Next-generation autotech semiconductor and software solutions provider

Indie Semiconductor NASDAQ: INDI stock has been selling off since its reverse merger IPO as a publicly listed company. The maker of system on a chip (SoC) platforms enables

automobiles to accommodate next-gen megatrends such as autonomous driving connectivity, user experience, and electrification applications. The Company is a play on

electric vehicles and autonomous driving. The

pandemic-induced global

chip shortage is also a tailwind in addition to the recovery of the

supply chain in the automotive industry as sales spikes with rising demand amidst dwindling supply. There is a perfect storm in place for shares to rebound. On the flip side, it is a reverse merged SPAC, which carries with it the risk of further dilution especially as shares trade under its $10 PIPE offering price. Prudent investors with an appetite for risk can monitor shares for opportunistic pullbacks to gain exposure on this multiple tailwinds autotech

chip play.

About Indi Semiconductor

The merger with Thunder Bridge II SPAC helps it capitalize $2 billion of strategy backlog and an addition $2.5 billion in identified pipeline opportunities driven by deep relationships with Tier 1 automotive suppliers. The Company went public on June 11, 2021, peaking at a high of $11.90 before selling off. Indie “is at the forefront of the disruptive automotive megatrends spanning ADAS/Autonomous, Connectivity, User Experience and Vehicle Electrification. Today, Indie’s automotive semiconductor portfolio addresses a $16 billion market, according to HIS, which is expected to exceed $38 billion by 2025 driven by strong demand for silicon and software content in automobiles. Indie’s best-in-class, mixed signal SoC solutions are currently on 12 Tier 1 approved vendor lists, contributing to a strategic backlog position of more than $2 billion, defined as projected revenues based on existing contracts, design and pricing terms and historic production trends.”

Already Best-in-Class SOC

According to their Summer 2021 presentation, Indie is in pursuit of the uncrashable car and is both standard and partner agnostic. The Company’s SOC platforms can be found in most of the top tier vehicle makers including General Motors NYSE: GM, Ford Motors NYSE: FORD, Porsche (OTCMKTS: POAHY), Ferrari NYSE: RACE, Fiat Chrysler NYSE: STLA, Hyundai, and Tesla NASDAQ: TSLA. The Company has already shipped over 100 million devices in automotive Tier 1 companies. Indie platform supports the “Park Assist” feature on a Hyundai Sonata aired in the Feb. 2, 2020, Super Bowl LIV ad.

Four Megatrends

Indie address the four megatrends: Autonomous, User experience, Connectivity and Electrification. With autonomous, it reduces power by 10X and cost by 20X for LIDAR integration. With connectivity, it focuses on wireless charging, telematics, driver monitoring and cloud access. With user experience, it enhances Apple NASDAQ: AAPL CarPlay solutions, infotainment, and LED lightening. In referring to electrification, it has charging controllers and diagnostic solutions. Currently, the content per vehicle (CPV) opportunity is around $310 per vehicle, to rise to $975 per vehicle moving forward and up to $4,000 per vehicle in the future. This little known chip company is an under the radar long-term play for investors willing to take the risk of own a post-reverse merged SPAC.

INDI Opportunistic Pullback Levels

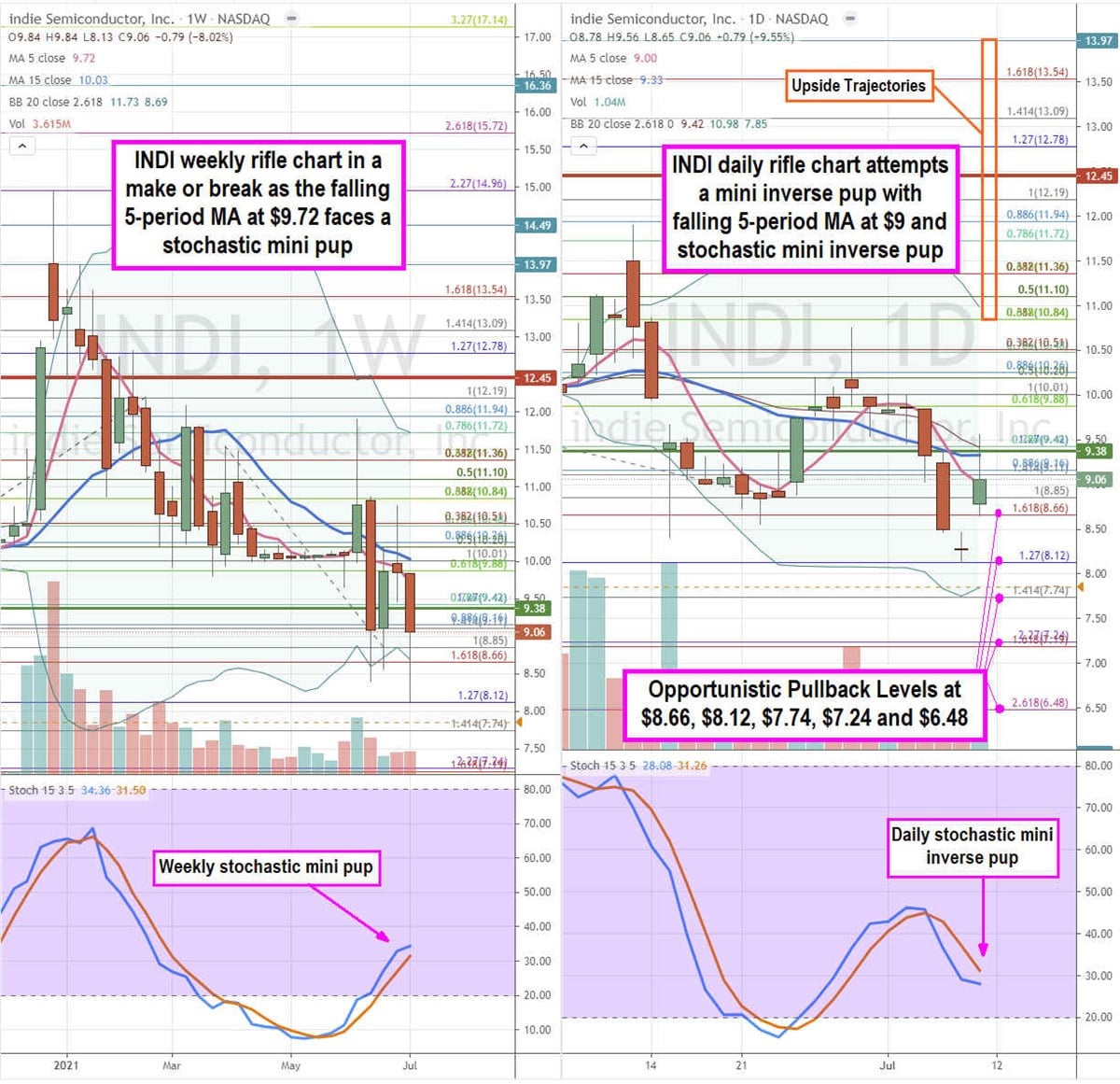

Using the rifle charts on the weekly and daily time frames provides a precision view of the playing field for INDI shares. The weekly rifle chart has a downtrend with a falling 5-period moving average (MA) at $9.72 and 15-period MA at the $10.01 Fibonacci (fib) level. The stochastic has a mini pup attempt setting up for a make or break where the MAs can breakout if the 5-period MA crosses up through the 15-period MA. If the weekly stochastic crosses back down then the downtrend can continue towards the weekly lower Bollinger Bands (BBs) at the $8.66 fib, which may also start the BB expansion. The weekly market structure high (MSH) sell triggered on the breakdown under $12.45. The daily market structure low (MSL) buy triggers above $9.38. The daily rifle chart has been in a downtrend with a falling 5-period MA at $9.00 with 15-period MA at $9.33. The daily lower BBs are at $7.85. The daily stochastic is forming a potential mini inverse pup. Prudent investors can monitor for opportunistic pullback levels at the $8.66 fib, $8.12 fib, $7.74 fib, $7.24 fib, and the $6.48 fib. The upside trajectories range from the $10.84 fib up towards the $13.97 level.

Before you consider indie Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and indie Semiconductor wasn't on the list.

While indie Semiconductor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.