One of the essential tools the SEC utilizes to monitor and regulate insider trading is Form 4 filings. But what is a Form 4 filing? SEC Form 4 filings are used as a critical disclosure mechanism, providing vital insights into the changes in beneficial ownership of securities by corporate insiders. Understanding Form 4 and its significance in finance is crucial in navigating the intricate landscape of insider trading and its implications.

But what is a Form 4 SEC filing, exactly?

We'll investigate the intricacies of Form 4 filings, shedding light on what they are, why they matter and how they contribute to maintaining a level playing field for all market participants. Whether you are an investor, financial professional or simply curious about the inner workings of the stock market, this comprehensive overview will equip you with the knowledge needed to decipher the hidden patterns behind Form 4 filings.

The Securities and Exchange Commission (SEC) is crucial in maintaining fair and transparent financial markets. One key tool the SEC employs is the SEC Form 4, also known as the "Statement of Changes in Beneficial Ownership."

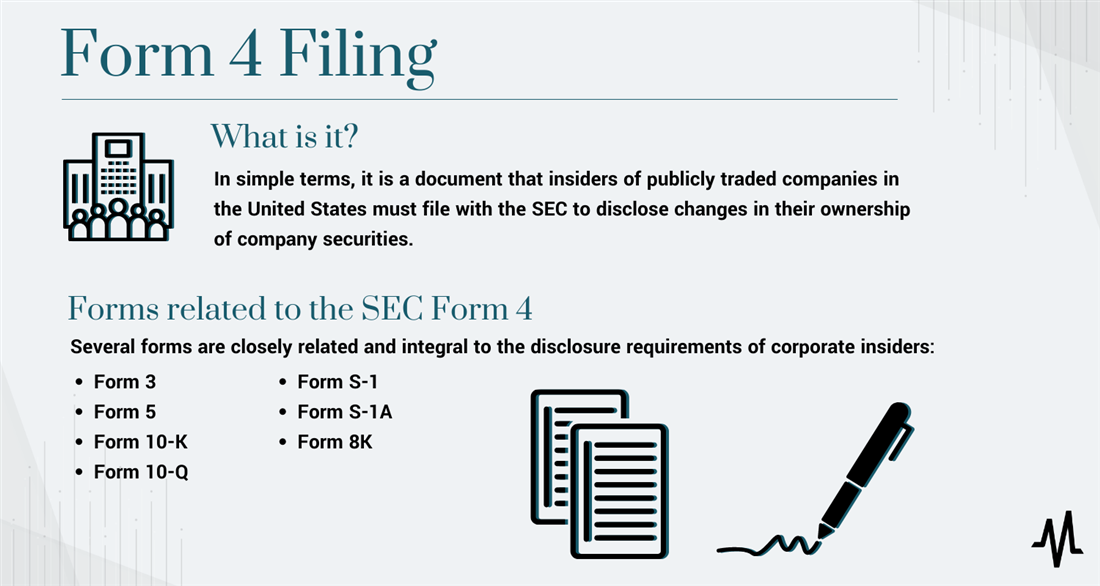

So, what is an SEC Form 4? In simple terms, it is a document that insiders of publicly traded companies in the United States must file with the SEC to disclose changes in their ownership of company securities. These insiders, including directors, officers and significant shareholders, are legally obligated to report any transactions involving their company's stock or other securities they hold.

What is a SEC Form 4 filings purpose? The SEC Form 4 serves multiple purposes. First and foremost, it provides transparency by allowing investors and the general public to gain insight into corporate insiders' buying and selling activities. This information can be invaluable in understanding the sentiment and confidence of those with intimate knowledge of the company.

The Form 4 filing requirements ensure insiders cannot exploit their privileged information by trading securities without disclosing their transactions. By mandating timely and accurate disclosures, the SEC aims to prevent illicit insider trading and maintain the integrity of the financial markets.

The contents of an SEC Form 4 include detailed information about the insider, such as their name, position within the company and relationship to the issuer of the securities. The form also specifies the type of transaction (e.g., purchase, sale, gift) and the number of securities involved. Additionally, it provides the transaction date, the price at which the transaction occurred and any related financial instruments or derivative securities.

Understanding the information in an SEC Form 4 is crucial for investors and market analysts. By examining the reported transactions, one can gauge the sentiment of insiders toward their company's prospects. Large purchases by insiders may indicate confidence in future performance, while significant sales could suggest concerns or impending organizational changes.

Regulatory bodies, financial institutions and market participants closely monitor SEC Form 4 filings. Unusual or significant transactions can attract attention and potentially trigger further investigations or legal actions to ensure compliance with insider trading regulations.

The SEC Form 4 is a vital disclosure document central to promoting transparency and curbing insider trading in the financial markets. By requiring corporate insiders to report their transactions, the SEC aims to safeguard the interests of investors, foster market integrity and maintain a level playing field for all participants.

Individuals often wonder, "What is Form 4 SEC and how does it work?" when seeking to understand the specific filing requirements that insiders must adhere to when engaging in purchasing or selling securities within their own company.

It is essential also to learn that in addition to the SEC Form 4, several other forms are closely related and integral to the disclosure requirements of corporate insiders. These forms provide additional insights into beneficial ownership and insider trading activities. Understanding the purpose and significance of these related forms is essential for comprehensively understanding the regulatory landscape.

While our focus thus far has been on the SEC Form 4 and its role in disclosing changes in beneficial ownership, other forms serve complementary purposes. These forms work with Form 4 to provide a more holistic picture of insider transactions and ownership patterns. By examining these forms in conjunction with Form 4, investors and market participants can understand corporate insiders' actions and intentions.

Let's explore the various forms related to the SEC Form 4, shedding light on their specific functions and how they contribute to the overall framework of insider trading disclosures.

The SEC Form 3 serves as the initial filing for individuals who become insiders of a publicly traded company. When an individual assumes a significant role within a company, such as a director or officer, they must file a Form 3 to report their holdings of company securities. This form includes information on the insider's identity, relationship with the issuer and initial holdings. While Form 3 does not directly pertain to changes in ownership, it establishes a foundation for subsequent filings, including the SEC Form 4.

Insiders file the SEC Form 5 to report any transactions not reported on time through Form 4. This form captures transactions made by insiders that may have been inadvertently omitted or qualified for a delayed reporting exemption. While individuals use Form 4 to regularly report transactions, Form 5 ensures that any outstanding transactions provide a more complete picture of an insider's beneficial ownership activities.

The SEC Form 10-K is an annual report filed by publicly traded companies to provide a comprehensive overview of their financial performance and operations. While it does not directly relate to individual insider transactions, it is an essential filing for investors seeking a holistic understanding of a company's business, risks and financial condition.

The Form 10-K includes information on the company's subsidiaries, executive compensation, audited financial statements and legal proceedings. Investors can refer to this form to gain insights into a company's overall governance and financial health, which can indirectly influence their analysis of insider transactions reported on the SEC Form 4.

The SEC Form 10-Q is a quarterly report that provides a snapshot of a company's financial position and results of operations. Similar to Form 10-K, it does not focus on individual insider transactions but offers investors periodic updates on a company's performance. Reviewing Form 10-Q allows investors to gather relevant information about a company's ongoing operations, industry trends and potential risks. This broader context can help contextualize the transactions reported on the SEC Form 4.

The SEC Form S-1 is a registration statement filed by companies planning to offer securities to the public through an initial public offering (IPO). This form does not directly relate to insider transactions or beneficial ownership reporting. However, it plays a crucial role in the overall regulatory framework by providing detailed information about the company's business, financials and risks to potential investors. Investors interested in the insider transactions of a newly public company can refer to the subsequent Form 4 filings once the IPO has been completed.

The SEC Form S-1A is an amendment to the Form S-1, typically filed when additional information or updates are necessary. While it does not directly connect to insider transactions, it can provide supplemental details that may indirectly impact the analysis of insider activities reported on the SEC Form 4. Investors should consider any material changes or updates disclosed through Form S-1A when evaluating the broader context of a company's securities offerings and the subsequent insider transactions.

The SEC Form 8K is a report filed by companies to disclose significant events deemed important to shareholders and the investing public. This includes acquisitions or disposals of assets, changes in executive leadership, material impairments and other significant corporate developments. While the Form 8K does not directly pertain to insider transactions, it provides investors with timely information about events that may influence a company's overall operations and potentially impact the analysis of insider activities reported on the SEC Form 4.

While the SEC Form 4 is our primary focus, it is vital to recognize the relationships and connections between this form and other filings within the regulatory landscape. Form 3 establishes the initial holdings of insiders, while Form 5 captures any outstanding transactions not previously reported on a timely basis. Forms 10-K and 10-Q provide a broader understanding of a company's financial performance, which can indirectly impact the analysis of insider transactions. Forms S-1 and S-1A are related to the registration of securities offerings, while Form 8K discloses significant corporate events.

By comprehending the purposes and interdependencies of these forms, investors can enhance their understanding of the broader regulatory framework and gain deeper insights into the beneficial ownership reporting landscape. This knowledge empowers investors to analyze insider transactions more informedly, considering the context of these related forms.

Two Examples of Insider Trading

When learning about insider trading, it is essential to understand that this practice can be legal and illegal, depending on the circumstances and compliance with regulatory frameworks. In its simplest form, insider trading refers to buying or selling securities based on material nonpublic information. However, the legality of such actions hinges on adherence to specific laws and regulations governing the fair and transparent operation of financial markets.

Insider trading can be illegal when individuals exploit confidential, nonpublic information to buy, sell or sometimes short-sell securities, thus compromising the market's integrity and fairness. This unlawful form of insider trading gives insiders an unfair advantage over other investors who do not possess the same nonpublic information. It erodes trust in the financial system, undermines investor confidence and impairs the principles of fairness and equal opportunity in trading. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, are tasked with monitoring and prosecuting illegal insider trading activities to maintain market integrity.

On the other hand, legal insider trading occurs when corporate insiders, such as executives, directors, or employees, engage in buying or selling shares of their own company but strictly in compliance with regulatory requirements. These types of transactions happen all the time by insiders in companies ranging from blue-chip companies to penny stock companies. These insiders may possess material nonpublic information about their company. However, they can still trade securities legally if they follow proper procedures and disclose their transactions as mandated by securities laws. Legal insider trading promotes transparency and allows insiders to diversify their investments, align their interests with shareholders and facilitate liquidity in the market. However, even legal insider trading is subject to regulatory oversight to prevent abuse or the misuse of nonpublic information.

It is crucial to differentiate between these two forms of insider trading — illegal and legal — to grasp the ethical and legal implications associated with each. While illegal insider trading involves exploiting nonpublic information for personal gain, legal insider trading allows insiders to trade based on public information and proper disclosure when conducted within the confines of regulations.

Let's break down two instances of insider trading, one that showcases its legality and another that highlights its illegal nature. By examining these examples, we can gain further insight into the consequences and distinctions between legal and illegal insider trading practices.

Mark Zuckerberg and Facebook

In 2020 Mark Zuckerberg, the founder, CEO and a major shareholder of Facebook, now called Meta Platforms Inc. (NASDAQ: META), engaged in a series of transactions that exemplify legal insider trading practices. This period was characterized by fluctuations and uncertainties in Facebook's stock due to global economic conditions and investors' desires to invest in social media stocks. However, Zuckerberg's trades were conducted following established rules and regulations, showcasing the legality of his actions.

Zuckerberg utilized a pre-established trading plan called a 10b5-1 plan to ensure compliance with securities laws and regulations. Insiders set up these plans to facilitate the buying or selling of securities at predetermined times or prices without the ability to alter or influence the trades based on subsequent nonpublic information. These plans aim to prevent insiders from engaging in improper trading activities and maintain market fairness.

Zuckerberg's trades occurred in accordance with his 10b5-1 plan, which had been established in advance and made public. This allowed him to sell a predetermined number of Facebook shares periodically, regardless of any nonpublic information he might possess during each transaction. Notably, the transactions were disclosed correctly to regulatory authorities, ensuring transparency in the market. Investors researching Facebook's stock chart would have also been interested in any insider trading in the company. They would have seen Facebook's SEC filings and that Mark Zuckerberg had sold shares which might have brought them concern. Correlating the predetermined sales information with Facebook's news headlines would have helped the investor understand that this stock sale by the company's founder was a preplanned sale and nothing to cause alarm.

This example of legal insider trading highlights the importance of adhering to established rules and regulations. By implementing a prearranged trading plan, Zuckerberg acted responsibly and mitigated the risk of improperly using nonpublic information for personal gain. Properly disclosing his trades further reinforces transparency and compliance with legal requirements.

The case of Mark Zuckerberg's legal insider trading is a noteworthy example that demonstrates how insiders can engage in trading activities within the confines of the law by following established rules and disclosing their transactions.

Steven Cohen and SAC Capital Advisors

SAC Capital Advisors, founded by Steven A. Cohen in 1992, was a group of hedge funds that employed approximately 800 people in 2010 across its offices in Stamford, Connecticut, New York City and other locations. The firm faced numerous investigations by the Securities and Exchange Commission (SEC) for manipulating stock prices across multiple stock market sectors. In 2010, the SEC initiated an insider trading investigation of SAC, leading to indictments against several former employees by the U.S. Department of Justice in 2013. SAC Capital itself pleaded guilty to insider trading charges in November 2013 and paid $1.2 billion in penalties, in addition to $616 million already paid to the SEC.

SAC Capital had a significant history as a high-performing hedge fund. It began trading large-cap stocks with $25 million in 1992 and grew its assets under management to $16 billion when it started trading small-cap stocks and mid-cap stocks. This massive amount of trading earned SAC Capital a reputation as the world's highest-returning hedge fund. SAC Capital played a significant role in daily trading activities, with its trading activity accounting for up to 3% of the New York Stock Exchange's daily trading and 1% of the NASDAQ's daily trades.

In November 2010, the SEC conducted raids at the offices of former SAC traders' investment companies. Subsequently, SAC received broad subpoenas, and in February 2011, two former employees were charged with insider trading. More charges were levied against additional former SAC Capital traders in November 2012. In July 2013, the SEC filed a civil suit against SAC for failing to supervise its traders properly. Simultaneously, the U.S. Department of Justice filed a five-count criminal indictment, including securities fraud and wire fraud charges.

In November 2013, the firm decided to plead guilty to all counts of the indictment, halt the management of funds for external investors and pay a $1.2 billion fine. This was in addition to the $616 million already paid in fines and penalties, bringing the total to $1.8 billion. The fines were split between a $900 million criminal fine and a $900 million civil money laundering and forfeiture judgment.

Following the guilty plea, SAC Capital's change in media sentiment caused the company to reduce in size significantly, and it returned the majority of its external investor capital. In 2014, Point72 Asset Management was established as a separate family office, while SAC ceased to exist as a distinct entity in 2016.

Insider trading encompasses legal and illegal practices, with the distinction in adherence to regulatory frameworks. Legal insider trading occurs when corporate insiders trade securities in compliance with regulations, promoting transparency and aligning interests with shareholders. On the other hand, illegal insider trading involves exploiting nonpublic information for personal gain, compromising market integrity and fairness. Understanding the differences between these two forms is crucial for comprehending the ethical and legal implications associated with insider trading. Upholding regulatory frameworks is vital in preventing the misuse of nonpublic information and maintaining the integrity of financial markets.

Filing SEC Form 4 is a crucial requirement for individuals who hold positions as corporate insiders, such as directors, officers and beneficial owners, in publicly traded companies in the United States. Form 4 is used to report their transactions in company securities, including purchases, sales, grants and exercises of stock options. Filing this form helps promote transparency and provides investors with information about the trading activities of insiders.

To file SEC Form 4, individuals can access the form on the U.S. Securities and Exchange Commission's official website through the Electronic Data Gathering, Analysis and Retrieval (EDGAR) system. The form requires detailed information about the reporting person (insider), the company's name and ticker symbol and the details of the reported transaction.

When filling out the form, individuals must provide accurate information about the transaction, including the transaction date, type (purchase, sale, grant), number of shares involved, price per share and any applicable transaction codes or footnotes. The form also requires identification details of the reporting person, such as their name, address, relationship to the company and role within the company.

It is essential to be aware of the specific transaction codes used to indicate the nature of the transaction. For example, "P" represents a purchase, "S" represents a sale, "M" represents the exercise of options and "G" represents the grant or award of securities. These codes help categorize and clarify the type of transaction reported.

Form 4 has specific filing deadlines that must be adhered to. Generally, transactions must be reported within two business days of the transaction date. If the transaction involves a derivative security, the deadline extends to within 10 days of the end of the month in which the transaction occurred.

After completing the form, it must be filed electronically through the SEC's EDGAR system. This involves creating an EDGAR account, obtaining the necessary codes and passwords and uploading the completed form in the required format, usually in XML or HTML. Once the form is submitted, it'll generate a confirmation receipt, proving that the SEC has accepted the filing.

Corporate insiders are required to file Form 4 for subsequent transactions as long as they hold their positions as insiders. This ensures compliance with SEC regulations and provides timely information to investors regarding insider trading activities.

Conditions that Must Be Met for Insider Trading

Insider trading involves buying or selling securities based on material nonpublic information about a company. Certain conditions determine whether an activity qualifies as insider trading.

First, the information must be material, which could affect the securities' price if made public. Second, the person engaging in the trading must have insider status, typically as a director, officer, employee, or significant shareholder with access to nonpublic information. Engaging in insider trading is considered a breach of fiduciary duty, as insiders are expected to act in the company's and its shareholders' best interests. Lastly, intent and knowledge are crucial elements to establish in cases of illegal insider trading, requiring evidence of the insider knowingly and intentionally trading on nonpublic information.

Illegal insider trading raises significant legality issues and is prohibited under securities laws in most jurisdictions, including the United States. Violating securities laws, such as the Securities Exchange Act of 1934 and Rule 10b-5 in the U.S., can lead to criminal and civil penalties. Criminal penalties may include fines, imprisonment, or both, while civil penalties can involve disgorgement of profits, monetary fines and injunctions. Regulatory bodies like the U.S. Securities and Exchange Commission (SEC) actively monitor and investigate insider trading activities, bringing enforcement actions and imposing sanctions.

Engaging in illegal insider trading carries legal consequences and poses reputational risks. It undermines investor confidence, harms market integrity and creates an unfair playing field for participants. Various regulations exist to deter and prevent illegal insider trading, promoting market fairness and protecting investors. Market participants must familiarize themselves with these regulations to ensure compliance and avoid legal repercussions.

Insider trading involves trading securities based on material nonpublic information, breaching fiduciary duty and compromising market fairness. Illegal insider trading violates securities laws, leading to potential criminal and civil penalties, regulatory enforcement actions, reputational damage and harm to market integrity. Adhering to insider trading regulations is essential for maintaining trust and fairness in the financial markets.

Is Insider Trading Legal?

The issue of whether insider trading is illegal or not is a topic of debate in the financial world, especially in the digital age, where information spreads rapidly. The Securities and Exchange Commission (SEC) definition states that insider trading involves buying or selling securities while possessing material nonpublic information in breach of a fiduciary duty or a relationship of trust and confidence. This definition suggests that insider trading violations occur when someone acts on the information and when they "tip" inside information to others.

For insider trading to be considered illegal, three conditions generally include:

- The information must be passed along by an insider.

- The individuals receiving the information must trade based on that information.

- The trading activity must occur before the information becomes available to the general public. This last condition is crucial because it allows individuals with access to nonpublic information to potentially maximize their gains by trading before the information becomes widely known.

The term "insider" is broadly defined and includes officers, directors, major stockholders and employees of publicly traded entities. These individuals should prioritize the company's interests over their own. The SEC prohibits insiders from trading for personal gain if they possess material nonpublic information about the entity. Insiders are also prohibited from disclosing this information to others, including family, friends and business acquaintances, before it becomes public. However, insiders are generally allowed to trade or discuss the information once it has been made public.

It is important to distinguish between idle conversations and insider trading. The intent behind the communication of inside information plays a crucial role. The Supreme Court case of Dirks v. SEC established that merely disclosing material nonpublic information does not necessarily constitute a breach of fiduciary duties. If someone overhears a conversation where inside information is disclosed without being aware that it is confidential, they may act on it. However, if the information is intentionally relayed to someone, even if the communicator believes it won't be acted upon, it can be considered insider trading.

The legality of insider trading depends on various factors, including access to nonpublic information, intent and compliance with reporting requirements. Illegal insider trading breaches fiduciary duties, undermines market transparency and disadvantages other market participants. When appropriately disclosed, legal insider trading can provide supplementary information to investors. With the rise of information availability in the digital era, defining and regulating insider trading remains.

Walking the Line: Navigating Insider Trading

Insider trading remains a contentious issue in the financial world, particularly in the digital age, where access to information has become easier yet harder to define. The SEC's definition of insider trading encompasses the act of trading on material nonpublic information and tipping such information. Three conditions must be met to be considered illegal: information must come from an insider, acted upon by the recipient and traded before the information becomes public. Violating these conditions can lead to severe legal consequences, as seen in high-profile cases.

Insider trading is deemed illegal due to its harmful implications. It undermines the fiduciary duty of insiders to prioritize the company's interests over their own, and it violates the principle of transparency in the market. Allowing some individuals to benefit from privileged information creates an unfair advantage, eroding trust in the market among retail investors and institutional participants alike. However, it is worth noting that under restrictive conditions, insider trading can be legal when properly disclosed to the SEC and reported in public filings.

Defining insider trading ultimately comes down to access and intent. While retail investors now have access to abundant information, distinguishing between idle speculation and credible inside information is crucial. The distinction between public domain information and nonpublic material information is also essential in determining the legality of trades. Striking a balance between regulatory measures, investor protection and facilitating legitimate information dissemination will continue to be challenging as the digital landscape evolves. By maintaining transparency, upholding ethical standards and adhering to the regulatory framework, the financial industry can work towards fostering a fair and level playing field for all market participants.

FAQs

We'll review some frequently asked questions about SEC Form 4 and insider trading regulations. Understanding the requirements and processes involved in filing SEC Form 4 is crucial for individuals holding positions as corporate insiders in publicly traded companies. This FAQ aims to clarify common questions about the SEC Form 4.

SEC Form 4 is a filing required by the U.S. Securities and Exchange Commission (SEC) for individuals who hold positions as corporate insiders in publicly traded companies. It reports their transactions in company securities, such as purchases, sales, grants and exercises of stock options. Form 4 plays a crucial role in promoting transparency and providing investors with information about the trading activities of insiders.

You must provide accurate and comprehensive data. The form requires details about the reporting person (insider), including identification, relationship to the company and role (director, officer, beneficial owner, etc.).

Additionally, the form requires information about the company, such as its name, ticker symbol and the transaction details reported, including the transaction date, type of transaction, number of shares involved and price per share.

It is crucial to adhere to the specific transaction codes used to categorize the nature of the transaction (e.g., purchase, sale, exercise of options, grant). Form 4 has specific filing deadlines, and once completed, it needs to be filed electronically through the SEC's EDGAR system.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...