Maplebear Inc. NASDAQ: CART is best known as Instacart, the world’s largest online grocery marketplace with a network exceeding 80,000 stores. While you may have believed it was just a food delivery app like DoorDash Inc. NASDAQ: DASH or Uber Eats (owned by Uber Technologies Inc. NYSE: UBER), it’s evolved into much more. The company now offers a suite of enterprise solutions for retailers, including in-store electronic shelf labels, personalized advertising, and expanded delivery partnerships with non-grocery retailers.

Despite firmly beating consensus estimates, the retail/wholesale sector company's shares took a 12% tumble after reporting its third-quarter 2024 earnings due to conservative guidance for the upcoming quarter. Investors might consider the sell-off an early Christmas present and buy shares on the pullbacks.

Transcending the Digital Shopping Experience

Maplebear Today

$41.17 +2.57 (+6.66%) As of 04/11/2025 04:00 PM Eastern

- 52-Week Range

- $29.84

▼

$53.44 - P/E Ratio

- 27.63

- Price Target

- $50.61

The Instacart app enables users to select items from their local grocery stores and have them delivered or scheduled for pick up. It also lets users use digitized local weekly flyers with coupons and loyalty programs to earn points and discounts that they would normally receive in-store.

The company has expanded its network of retailers to include more than just grocery stores, including Best Buy Co. Inc. NYSE: BBY, Costco Wholesale Co. NASDAQ: COST, Walgreens Boots Alliance Inc. NASDAQ: WBA, Walmart Inc. NYSE: WMT, Home Depot Inc. NYSE: HD and Sephora.

Instacart is enhancing the in-store shopping experience with the tactical rollout out of their Caper Carts. These are AI-powered smart carts that identify, weigh and scan items in your shopping cart while automatically charging your payment method on the way out without having to wait in the store’s checkout lines.

Q3 Earnings Were Solid; Guidance Disappointed the Markets

Instacart reported solid third-quarter earnings, beating EPS consensus estimates by 20 cents to earn 42 cents. Revenues grew 11.5% year-over-year (YoY) to $852 million, firmly beating $844.03 consensus estimates. Gross transaction volume (GTV) rose 11% YoY to $8.303 billion with 72.9 million orders, up 10% YoY. Adjusted EBITDA rose 39% YoY to $227 million, which represents 2.7% of the GTV and 27% of total revenue. Average order value (AOV) edged up 1% YoY, illustrating that consumers are still trying to keep a lip on spending. Advertising revenue rose 11% YoY to $246 million, powered by strength in emerging brands as larger consumer brands faced some softness.

Maplebear Stock Forecast Today

12-Month Stock Price Forecast:$50.6122.93% UpsideModerate BuyBased on 28 Analyst Ratings | Current Price | $41.17 |

|---|

| High Forecast | $60.00 |

|---|

| Average Forecast | $50.61 |

|---|

| Low Forecast | $37.00 |

|---|

Maplebear Stock Forecast DetailsWhile these were solid results, the disappointment came from the perceived growth slowdown based on its Q4 guidance. Instacart expects GTV to be around $8.5 billion to $8.6 billion range, with adjusted EBITDA of $230 million to $240 million. The GTV forecast projects 8% to 11% YoY growth, which was a sequential drop from its Q3 GTV of 11% YoY growth. The disappointing adjusted EBITDA range, which barely hovered above the Q3 range, was due to the reinvestments in marketing incentives and reinvestment in affordable service options.

Could Instacart Be Lowballing Estimates?

While GTV indicates a potential slowdown in Q4, its also possible the company is lowballing estimates to be on the safe side. For proof of this, we have to look at the Q3 estimates of 8% to 10% YoY GTV growth, which the company beat, coming in at 11% YoY. Adjusted EBITDA also came in at the high end of its forecasted range. This could be a case of déjà vu, again, as in under-promise and over-deliver.

Instacart Still Dominates the Grocery Delivery Market

Maplebear MarketRank™ Stock Analysis

- Overall MarketRank™

- 74th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 22.9% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- N/A

- News Sentiment

- 1.17

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 12.59%

See Full AnalysisWhile Instacart is also offering restaurant food delivery through its partnership with DoorDash, DoorDash and Uber Eats have also started to offer grocery delivery. However, Instacart’s app is much more seamless and sophisticated with the addition of its digital flyers, Snap EBT acceptance and inclusion of loyalty programs. Instacart also offers a subscription membership, which can include free deliveries. Its app uses machine learning models and streaming data to provide real-time inventory tracking when possible. Instacart's network represents 85% of the U.S. grocery marketplace.

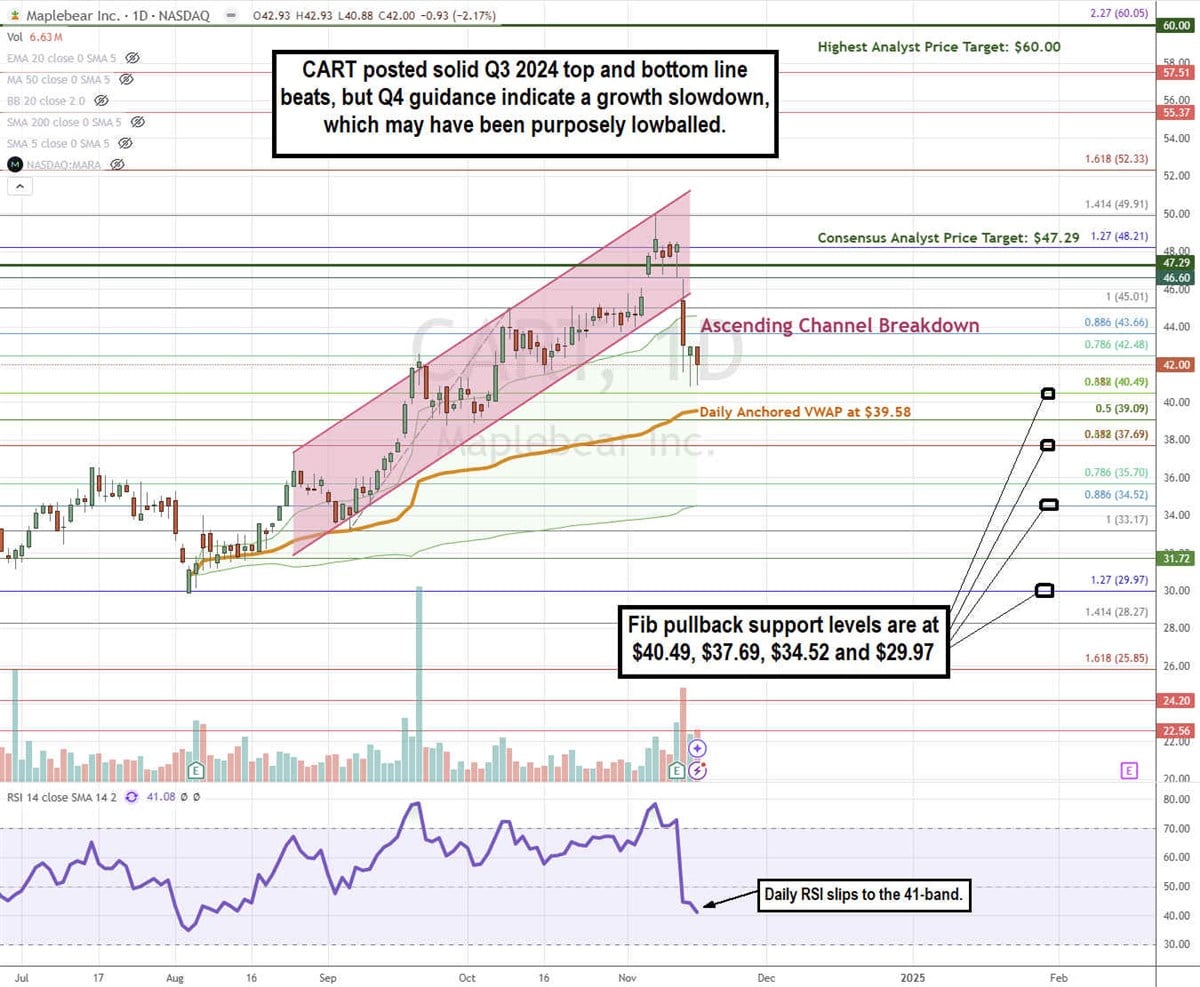

CART Triggers an Ascending Channel Breakdown

An ascending channel describes an uptrend comprised of an ascending (rising) upper trendline resistance and ascending lower trendline support representing higher highs and higher lows. This indicates that demand continues to grow as supply continues to thin out. However, a breakdown occurs if the stock completely falls under the lower trendline support.

CART formed an ascending trading channel that peaked around the $49.91 Fib. The Q3 earnings reaction caused an 11% sell-off firmly sending CART below the lower trendline support at $45.50. The daily anchored VWAP support is at $39.58. The daily RSI fell to the 41-band. Fibonacci (Fib) pullback support levels are at $40.49, $37.69, $34.52 and $29.97.

CART’s average consensus price target is $47.29 implying a 12.6% upside, and its highest analyst price target sits at $60.00. It has 13 analysts' Buy ratings and 12 Hold ratings. The stock has a 7.06% short interest.

Actionable Options Strategies: Bullish options investors can buy CART stock on a pullback using cash-secured puts at the Fib pullback support levels or consider a bullish call debit spread for a cheaper cost to limit the downside while the upside gets capped.

Before you consider Maplebear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Maplebear wasn't on the list.

While Maplebear currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.