Because of the current state of Chinese versus American counterpart affairs within the chip and semiconductor manufacturing industry, many operators in the space have been pinned to choose between the two nations as to which will receive support through manufacturing licenses and equipment.

The U.S. has pushed more considerable sanctions lately, limiting China's ability to compete in the chip war or the friendlier-sounding chip race.

Intel NASDAQ: INTC has been one of the firms affected by the two leading economies conflicting interests in developing and owning the most advanced chip manufacturing machinery and licenses to build. The latest evidence of Chinese officials taking a stake in the personal computer chip and data center giant from the West comes as Chinese vice president Han Zheng sets talks of a possible Intel base set up in the East Asia nation.

As a result, Intel CEO Pat Gelsinger now has to battle geopolitical tilts and deliver on his IDM 2.0 turnaround plans to bring Intel back to the global chip podium.

Roadmap to Expansion

CEO Pat Gelsinger has laid out a plan to turn things around at Intel, which may cause lower cash flow generation power in the short term to get things done. Cash flow compression directly affects shareholders as the company reduces its ability to pay dividends and exercise share repurchases.

However, this reduction has been offset by management's decision to reduce compensation and lay off employees as the company prepares for what comes next.

Starting with what IDM 2.0 is, Gelsinger sums it up as a strategy for manufacturing innovation and product leadership. The plan is to expand around USD 20 billion by building two fabs (foundries) in Arizona, allowing Intel to kickstart its new "Foundry Services" unit. Foundry Services would effectively allow Intel to develop chips for other companies, much like Taiwan Semiconductor Manufacturing NYSE: TSM operates. However, Intel also brings revenue diversification through data centers and personal computer chips of their own making.

Expanding U.S.-based facilities will allow Intel to diversify geopolitical risk for companies that rely on Taiwan Semiconductor Manufacturing for their chip supply; concerns about a possible Chinese invasion have added value to location alternatives such as the one Intel is planning to provide.

In addition, while the new unit in foundry services only represents around 1.4% of Intel's revenue, the firm has made some headway into expanding this unit by approaching U.K.-based manufacturer Arm.

Outsourced Production Begins

Intel has announced a new partnership with ARM, a U.K.-based chip designer and developer. This collaboration agreement would allow mobile-phone chip designers to utilize Intel's "18A" manufacturing process for these chips. This announcement is the latest step from CEO Gelsinger to open Intel's factories to rivals to take back some of the market share lost to Taiwan Semiconductor Manufacturing and Samsung Electronics OTCMKTS: SSNLF throughout the years.

Even though the initial collaboration will be focused on mobile chips, it is expected that with due time and quality testing in the open market, the two firms will be moving into automotive components, data centers, aerospace, and other areas. Shares of Intel stock reacted by rising near 1.05% in the first hour of trading on April 12th.

However, upon FED announcements of a possible rate pause, alongside CPI showcasing still elevated inflation levels, markets turned mixed signals into a decline in the stock price for Intel, which closed the day down 1.02%.

A successful partnership with ARM may start a new wave of client adoption to use Intel as the chip manufacturer of choice. However, some investors are skeptical about the implication of the input costs since labor costs in the U.S.-based foundries will be significantly higher than those incurred in Taiwan or China; perhaps Gelsinger will consider the Chinese vice president's offer after all.

A Slice of Industry at a Discount

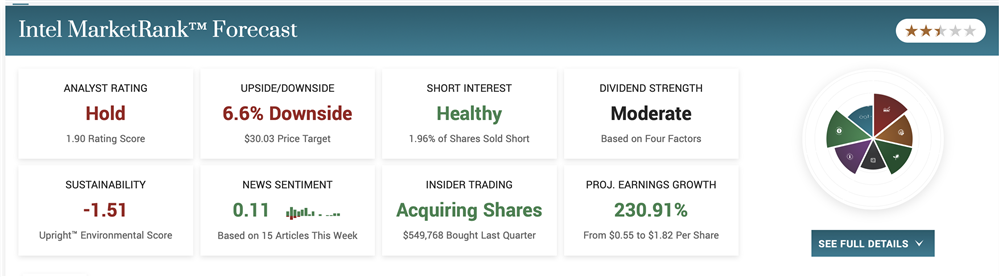

When comparing Intel's price action in the open market to peers like NVIDIA NASDAQ: NVDA, Micron Technology NASDAQ: MU, and Advanced Micro Devices NASDAQ: AMD, investors can notice that Intel stock trades currently at 66% of its 52-week high prices while its peers are trading at 82% and above from their 52-week highs.

Additionally, Intel stock has found a bottom range between $25 and $30 per share as there is currently exceedingly high trading volume compared to historical average volumes. This support range comes paired with bullish divergences in weekly indicators such as RSI and stochastics.

With an earnings announcement expected later in April, investors could await further foundry services segment results to start handing out blank checks for the stock.

Before you consider Intel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intel wasn't on the list.

While Intel currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.