Charles Schwab NYSE: SCHW is a behemoth in the retail stock brokerage business. Still, the company found itself in traders' crosshairs amid the banking crisis spurred by the Silicon Valley Bank failure.

However, its peer in the brokerage business, Interactive Brokers NASDAQ: IBKR walked away from the worst of the crisis with mere dents compared to Charles Schwab.

Given the similarities in the business, why did the market spare Interactive Brokers? And does the ongoing banking crisis make Interactive Brokers the more attractive play in the brokerage industry?

Why Schwab and Interactive Brokers Are Very Different

Charles Schwab stock is down 27% this month, compared to the modest 9% decline in competitor Interactive Brokers. Given Schwab’s status as a blue chip, why the significant decline?

It comes down to the fundamental differences in strategy between Schwab and Interactive Brokers. Schwab operates far more like a bank than your typical fee-based stock broker, while IBKR relies heavily on trading fees.

Given Schwab's retail-oriented clientele, it saw the writing on the wall about trading commissions when it saw Robinhood steal market share by offering zero-commission trading. The company boldly moved to slash trading fees to zero in October 2019, catching its commission-reliant competitors like TD Ameritrade, which it eventually acquired, flat-footed.

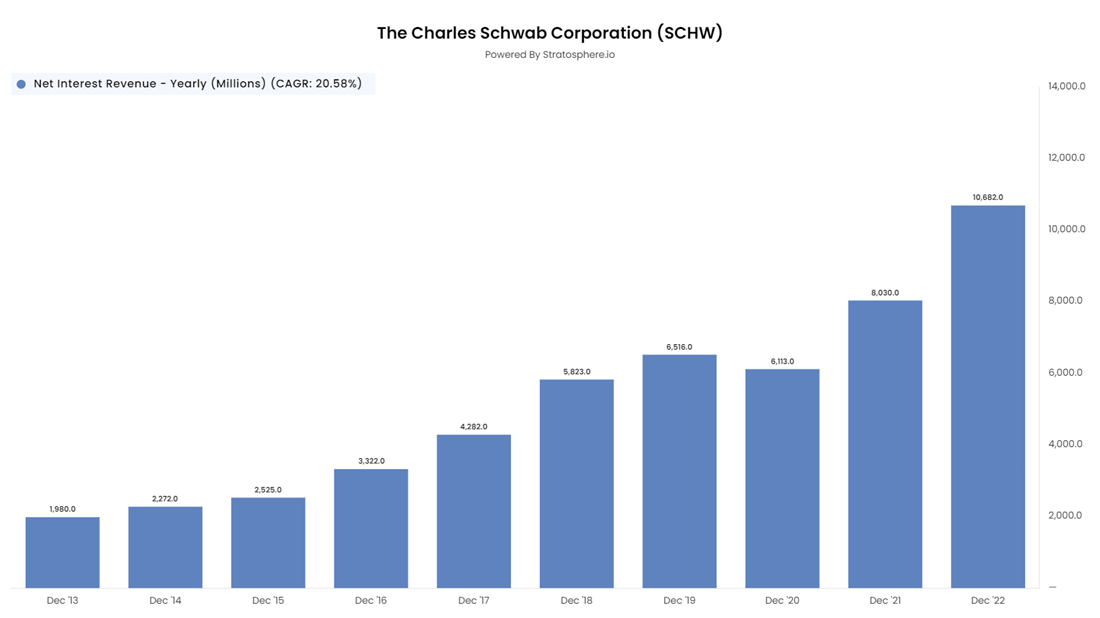

So instead of churning as many trading commissions as possible, Schwab focuses on net interest income. In other words, most of its profits result from paying clients a low rate on deposits while investing those deposits at higher interest rates.

This is primarily how banks make money, and this segment makes up more than half of Schwab's revenue nowadays.

This is why Schwab offers premium services like trading, research, software tools, and even banking for little or no fee. The more client funds come into Schwab, the more interest income it makes.

See the chart below to see how Schwab’s net interest income has evolved over time:

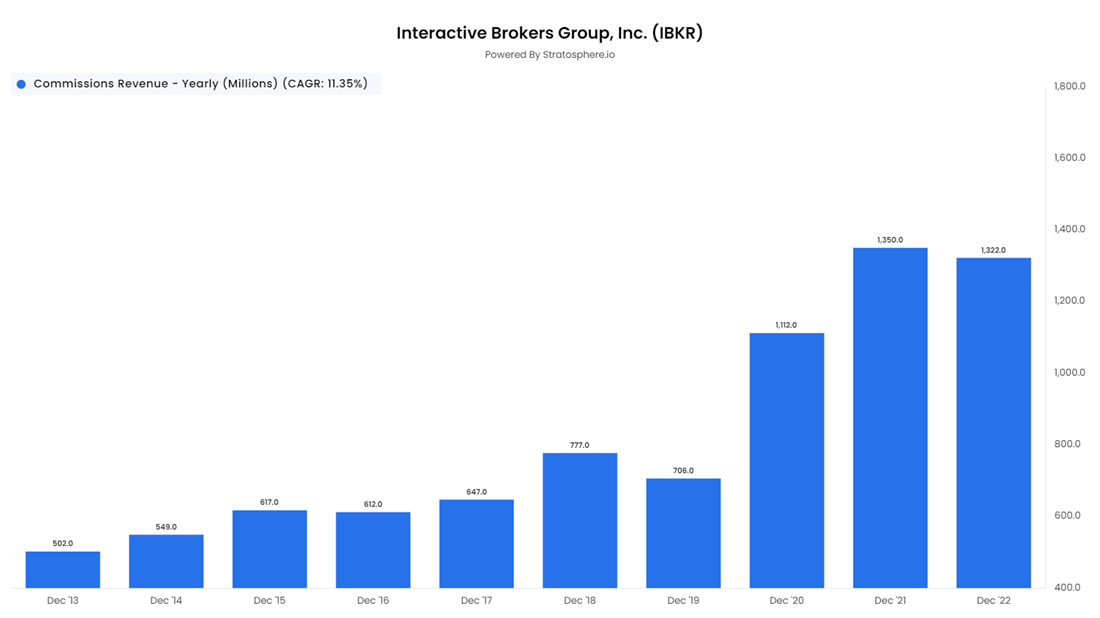

While Schwab only made 8% of its revenue from trading fees in 2018 (the year before slashing commissions), Interactive Brokers continues making roughly half of its revenue from trading commissions.

This is because Interactive Brokers services the high-end market, counting hedge funds, financial advisories, and other large institutions as clients. Additionally, the firm performs many back-office functions for smaller funds without the proper staff.

A retail client buying 50 shares of Apple stock for his retirement account doesn’t care about execution quality or payment for order flow. Many of IBKR’s clients painstakingly measure execution quality, attempting to optimize it down to the penny, for which IBKR offers advanced trading algorithms to reduce transaction costs for large traders.

While Schwab only made 8% of its revenue from trading fees in 2018 (the year before slashing commissions), Interactive Brokers continues making roughly half of its revenue from trading commissions.

This is because Interactive Brokers services the high-end market, counting hedge funds, financial advisories, and other large institutions as clients. Additionally, the firm performs many back-office functions for smaller funds without the proper staff.

A retail client buying 50 shares of Apple stock for his retirement account doesn’t care about execution quality or payment for order flow. Many of IBKR’s clients painstakingly measure execution quality, attempting to optimize it down to the penny, for which IBKR offers advanced trading algorithms to reduce transaction costs for large traders.

Charles Schwab’s Interest Rate Exposure

Schwab makes most of its money from interest on bonds it buys with its customers' uninvested deposits. Schwab's growing and sticky deposit base has delivered significant interest income growth, enabling the company to consistently post a return of equity (ROE) north of 10% for several years.

This has earned the company a premium valuation of around 3x book value, compared to the roughly 1x historical average that money center banks like JPMorgan and Bank of America trade at.

So Schwab is priced for the growth to continue. However, new threats to the company are leading investors to aggressively sell its shares.

For one, Charles Schwab has significant unrealized losses in its securities portfolio, which is a similar problem plaguing many regional banks and ultimately what led to the bank runs on Silicon Valley Bank and Signature Bank.

However, Schwab's comparatively modest 27% decline from an already steep valuation signals that while investors guess there's a rocky road ahead, there are no significant worries about its liquidity.

Furthermore, Schwab received net capital inflows the week after Silicon Valley Bank's failure, to the tune of $16.5 billion, roughly double the company's average weekly inflows in the prior weeks.

So even though the company isn’t under any significant threat of collapse, investors are clearly worried about Schwab’s considerable losses in its investment portfolio.

The thinking from Charles Schwab bears is that the company could be forced to sell some of its securities at a loss in the event of further bank runs. However, the company did prove to be a flight to safety for depositors, evidenced by the company's inflows following the SVB collapse.

Is Interactive Brokers The Better Pick?

While the rest of the brokerage industry went all-in on zero commissions and now struggles with differentiation, Interactive Brokers NASDAQ: IBKR doubled down on its premium service offerings for its professional client base of hedge funds and financial institutions.

Interactive Brokers' primary business model is to charge its clients fees for trade execution, market data, and other services that fast money hedge fund traders need. It's counterintuitive, but the industry's shift to an ultra-discount asset-gathering model might've been the best thing for IBKR's business.

It seems intuitive that commissions going to zero would be terrible for Interactive Brokers. After all, trading fees are its core business. However, the opposite occurred. Zero commissions meant the Schwabs of the world couldn’t provide a professional level of service to more advanced traders.

Interactive Brokers became the only game in town. While they still compete with large prime brokers like Goldman Sachs and Morgan Stanley, they target a sweet spot in the industry. Professional traders are too small for the world's Goldmans to care about but are too advanced for the Schwabs of the world.

And as such, Interactive Brokers becomes an attractive play on the growth of transaction volume in financial markets, as evidenced by its trading fee revenue.

And while financial firms with significant interest rate exposure took a bath in 2022 as the Federal Reserve embarked on its fastest rate hike campaign in history, Interactive Brokers sticks out as one of the few firms largely unaffected by the mess.

And it was all thanks to the company’s cash management strategy. In a July 2022 conference call, an analyst asked Thomas Peterfy the following:

I just wanted to ask with the recent hike in interest rates and the prospect of more to come, how are you guys thinking about sort of the duration and the makeup of your investment portfolio and to kind of generate higher returns?

CEO Thomas Peterfy replied, simply:

No, we are not. That’s the kind of risk we do not want to take. We will continue to invest in T-bills and repos.

Bottom Line

As Schwab’s investment portfolio is under the microscope, Interactive Brokers is relatively unblemished, evidenced by its lack of reliance on interest rates and very conservative investment strategy.

This ratio chart of Interactive Brokers and Schwab says more than words ever could:

Before you consider Charles Schwab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles Schwab wasn't on the list.

While Charles Schwab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report