Financial management and business software developer

Intuit NASDAQ: INTU stock has started the new year on a downtrend mirroring the sell-off in the benchmark indexes. Shares are trading near the October 2021 levels. Intuit has come a long way from the days of just being a tax

software maker with its popular

Quickbooks and TurboTax applications into a

digitally transformed business and consumer one-stop shop. The Company has made five big bets utilizing its

artificial intelligence (AI) technically that will drive growth and profits moving forward as outlined in its fiscal Q1 2022 earnings conference call. The Company completed a secondary offering at $668.95 per share at the end of November 2021. Shares have fallen over (-100 points) since then, providing a

discount opportunity. Prudent investors seeking exposure in this high-quality profitable and well-entrenched software company can watch for opportunistic pullback levels to scale into a position.

Five Big Bets

CEO Sasan Goodzari commented on three of the Company’s five big bets moving forward on the fiscal Q1 2022 conference call, “Today, I'd like to highlight examples of our recent progress across 3 of these Big Bets. Our third Big Bet is to unlock smart money decisions. I am extremely proud of the momentum we are seeing with Credit Karma. Credit Karma is a data platform with powerful network effects, solving a two-sided problem. We are focused on our goal of creating a personal financial assistant that helps consumers find the right financial products, put more money in their pockets, and access financial experts and insights. Credit Karma achieved record high revenue again in Q1. We continue to deliver innovation across all verticals fueled by our proprietary Lightbox platform, enabling personalized experiences for our members, creating a network effect. Within the core, partners ' usage of Lightbox reached all-time highs across both credit cards and personal loans. Lightbox more than doubled the average approval rate for members who apply for credit cards on Credit Karma versus outside of Credit Karma. Within the growth verticals, we're solving a larger set of financial challenges for consumers. Karma Drive is giving U.S. members the opportunity to see if they can save money on auto insurance with usage-based pricing. We're actively exploring expansion opportunities with Lightbox in other verticals, including auto loans, building off of the success as we've seen in credit cards and personal loans. Within the emerging verticals, we remain focused on innovation with Credit Karma money. We integrated Credit Karma money into TurboTax last season and experimented with how we could best meet our customers ' needs and announced an integration with QuickBooks Online Payroll. Given our learnings, we are excited about launching our improved experiences in the upcoming tax season.”

CEO Goodzari continued, “We believe Credit Karma Money is the key to driving growth in frequency of visits over time, one of the many key drivers of average revenue per monthly active user. Zooming out, we continue to grow members and are focused on building trust by delivering personalized financial products right for members, helping members save money, pay down debt, and get faster access to their money while providing insight and advice. Over time, we're creating a virtual cycle, which we expect to increase the frequency of engagement, transaction, and monetization across our ecosystem. Our fourth Big Bet is to become the center of small business growth by helping our customers get customers, get paid fast, manage capital, pay employees with confidence, and grow in an omnichannel world. 60% of small businesses struggled with cash flow and we are continuing to innovate to create solutions for customers to overcome this challenge. In fiscal year 2021, total payments volume on our platform grew 40% year-over-year to over $90 billion. An online payment volume grew more than 60% driven by an increase in customer using our payments offering. As we continue to innovate for our customers and payments, those using QuickBooks cash of nearly 3 times higher engagement compared to customers who've just used QuickBooks Online. To accelerate engagement and usage of our platform, we recently introduced Get Paid Upfront, a game - changing innovation that will help qualified customers get paid soon after their invoice is set. Our fifth Big Bet is to disrupt the small business mid-market with QuickBooks Online Advance. We're seeing strong traction with QBO Advance, with customers growing to 118,000 in fiscal year 2021, up 57% year-over-year. As we continue to move up-market and serve these customers most critical needs, we're seeing a services ecosystem ARPC that is 4x higher than the ARPC for QBO customers. We're pleased with our results and remain confident in our game plans to win. Across all of our Big Bets, we're building momentum and accelerating innovation, which we believe positions us well for durable growth in the future. This will be further fueled the by Mailchimp. I'm delighted that we closed Mailchimp.”

CFO Commentary

Intuit CFO Mary Clatterbuck commented, “We continue to expect pent-up demand across the core verticals to taper sometime in the second half of fiscal 2022 after a strong year of investment by our partners. We remain excited about the opportunities ahead. Consumer Group revenue of $120 million in Q1 was in line with our expectations. Looking ahead to the upcoming tax season, we continue to focus on our strategy to expand our lead in DIY and transform the assisted segment with TurboTax Live. As to the ProConnect Group, revenue of $26 million in the quarter was also in line with our expectations. Turning to our financial principles, we remain committed to growing organic revenue double-digits and growing operating income dollars faster than revenue. As I've shared before, as we lean into our platform strategy, we see the opportunity for margin expansion over time. We take a disciplined approach to capital management, investing the cash we generate in opportunities that yield an expected return on investment greater than 15%. We continue to reallocate resources to top priorities with an emphasis on becoming an AI-driven expert platform. These principles guide our decisions and remain our long-term commitment. Our first priority for the cash we generate is investing in the business to drive customer and revenue growth. We consider acquisitions to accelerate our growth and fill out our product roadmap. We returned excess cash that we can't invest profitably in the business to shareholders via both share repurchases and dividends. We finished the quarter with approximately $3.3 billion in cash and investments on our balance sheet. On November 1st, we entered into a $4.7 billion term loan under our new credit arrangement at credit agreement to partially fund the Mailchimp acquisition. We repurchased $339 million during the first quarter. Depending on market conditions and other factors, our aim is to be in the market each quarter.”

INTU Opportunistic Pullback Levels

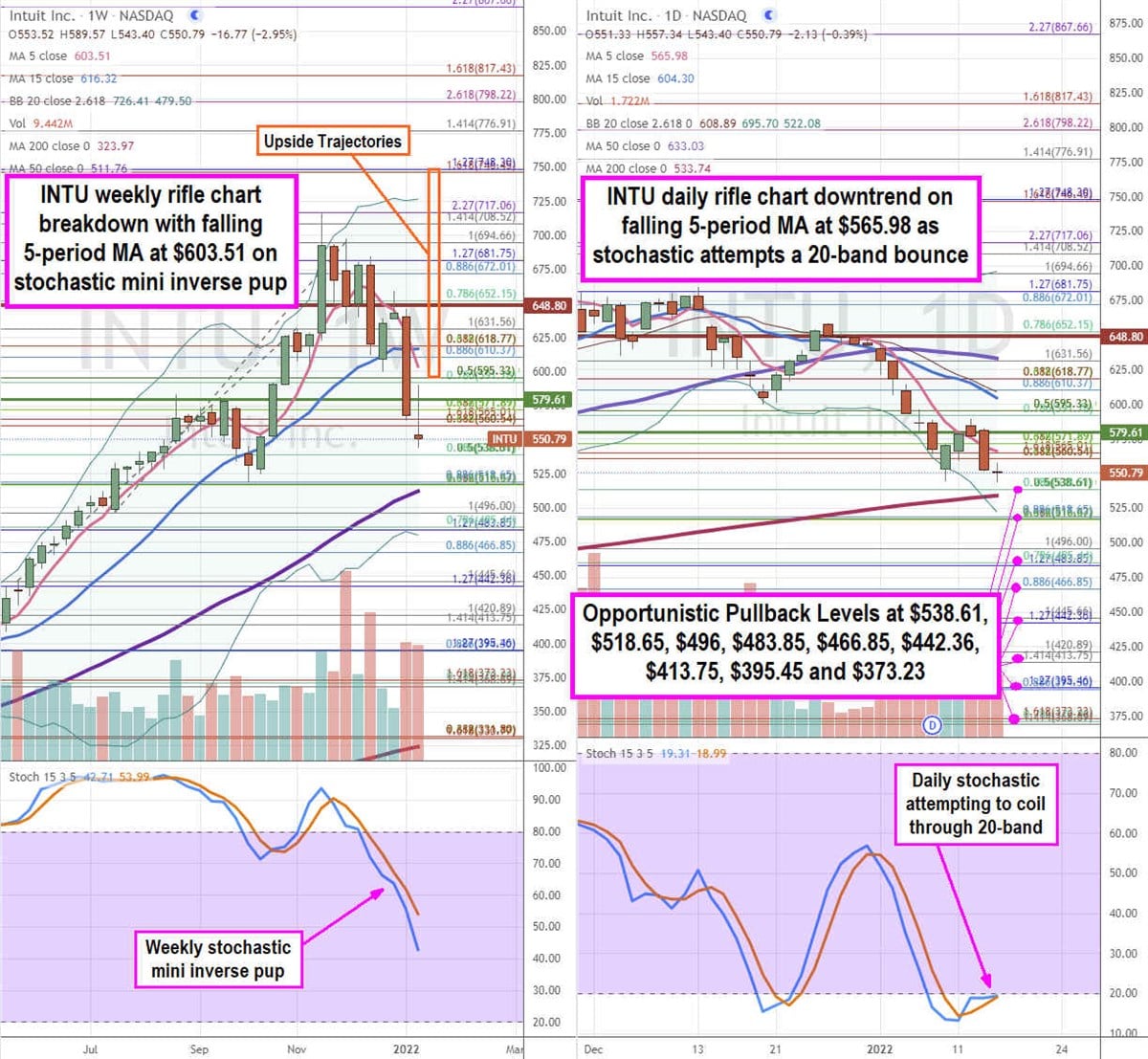

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for INTU stock. The weekly rifle chart peaked at the $717.06 Fibonacci (fib) level. The weekly stochastic formed stairstep mini inverse pups falling to the 40-band as the breakdown triggered as the 5-period moving average (MA) resistance crossed through the 15-period MA at $616.32. The weekly 50-period MA support sits at $511.76. The weekly market structure high (MSH) sell triggered on the breakdown below $648.80 level. The daily rifle chart has a downtrend with a falling 5-period MA at $565.98 followed by the 15-period MA at $604.30. The daily 50-period MA support was broken at $633.03. The daily 200 period MA support sits at $533.74 with daily lower Bollinger Bands (BBs) at $522.08. The daily market structure low (MSL) buy triggers on the breakout through $579.61 as the daily stochastic attempts to form a mini pup through the 20-band. Prudent investors can monitor for opportunistic pullback levels at the $538.61 fib, $518.65 fib, $496, $483.85 fib, $466.85 fib, $442.36 fib, $413.75 fib, $395.56 fib, and the $373.23 fib level. Upside trajectories range from the $595.33 fib level up towards the $748.30 fib level.

Before you consider Intuit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intuit wasn't on the list.

While Intuit currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.