Should you venture into the dynamic growth potential of an individual retirement account (IRA), park your money in the reliable corner of a certificate of deposit (CD) or perhaps find a middle ground with a money market account (MMA)?

Each option has its benefits, risks and return potential.

By the end of this article, you can make an informed investment decision on the best path to help you reach your financial goals — IRA vs CD vs money market account.

Understanding IRAs

An IRA is a tax-advantaged investment account designed to help you save for retirement. The tax benefits can come in the form of tax-deferred or tax-free growth, depending on the type of IRA you choose.

IRAs can hold many financial assets, including CDs, stocks, bonds, mutual funds, exchange-traded funds (ETFs), dividend ETFs and annuities. This flexibility allows you to create a well-rounded and diversified investment strategy, helping to mitigate risks and maximize potential returns over the long term.

Harnessing the power of time allows you to build a more substantial retirement nest egg: the younger you are when you invest in an IRA, the greater your potential for compound growth. You can have as many IRAs as you want, but the 2023 total yearly investment limit for individuals under 50 is $6,500 per year and $7,500 for those 50 and older (catch-up contribution).

Generally, you can withdraw money from an IRA without penalty at age 59½. Withdrawals made before this age may be subject to an early withdrawal penalty unless they meet certain exceptions, such as qualified education expenses, first-time home purchase (up to a limit), certain medical expenses, or if the account holder becomes disabled.

It is important to note that the FDIC insures IRA accounts up to $250,000, but this coverage only applies to cash and cash equivalents within the IRA, such as money market funds or CDs; assets like stocks, bonds, mutual funds and ETFs are not covered.

Traditional IRA vs Roth IRA: Decoding the differences

IRAs come in various types, including Traditional IRAs and Roth IRAs. When choosing between the two options, it’s important to consider both your current tax bracket and anticipated tax bracket in retirement.

Traditional IRA

In a traditional IRA:

- Contributions are made with pre-tax dollars (although they are only fully tax-deductible if an employer-sponsored retirement plan doesn't cover you).

- Funds may be partially or not tax-deductible depending on your employer's retirement plan (and your spouse's employer retirement plan, if filing married).

- Investment gains grow tax-deferred and are then taxed as ordinary income when withdrawn during retirement.

- Early withdrawals (before age 59½) may incur a 10% penalty.

- The required minimum distribution (RMD) stipulates a yearly minimum payout after age 73.

- May take more effort to manage from researching, selecting, acquiring, tracking and evaluating your investments.

Roth IRA

In a Roth IRA:

- You can make contributions with after-tax dollars (they are not tax-deductible).

- Qualified withdrawals of earnings are tax-free.

- You can withdraw contributions tax-free at any time.

- There is no RMD during the account holder's lifetime.

- Early withdrawals of earnings (before age 59½) may be subject to taxes and penalties, with some exceptions.

- Only some are eligible to have or contribute if your modified adjusted gross income (AGI) is $218,000 or higher (filing married jointly) or $153,000 or higher (filing single or married filing separately), you can't make contributions to a Roth IRA.

Pros and cons of investing in an IRA

Incorporating IRAs into your investment portfolio presents significant advantages, primarily driven by the tax benefits and growth potential that can enhance long-term wealth accumulation. Compounding growth over time is a key advantage, as contributions can generate returns on a tax-deferred or tax-free basis, depending on the type of IRA. Additionally, IRAs offer diverse investment options, allowing for strategic portfolio diversification.

But there are notable disadvantages to consider. RMDs can potentially affect retirement income planning and tax liabilities, and early withdrawals may incur penalties, limiting liquidity. In addition, with market volatility comes investment risk, which can impact the performance of assets within IRAs.

Exploring certificates of deposit (CDs)

As a low-risk, low-maintenance way to watch your money grow, a CD is like a savings account with a time-based twist. Typically offered by banks and credit unions, CDs are renowned for their safety and predictability. When you invest in a CD, you agree to lock up your funds for a predetermined period, ranging from a few months to several years.

In return for your patience, you will receive a fixed interest rate that typically surpasses regular savings accounts on top of the return on your principal investment. The longer you're willing to stash your cash away, the higher the interest rate you usually receive.

The mechanics of CDs

There are many different types of CDs, each with its own set of advantages and trade-offs:

- Traditional CD: You deposit a lump sum for a predetermined period of time, and the bank pays you a fixed interest rate.

- High-yield CD: This type offers better interest rates than traditional CDs, but requires larger deposits and may have longer terms.

- Jumbo CD: This CD requires an even larger initial deposit than a high-yield CD – often exceeding $100,000 – but the payoff is an even higher interest rate.

- No-penalty CD or liquid CD: Should you want to withdraw before the maturity date, you can do so without penalty. However, the banks often require the entire balance to be withdrawn and the account closed. As a trade-off for this flexibility, the interest rates are typically lower than other CDs.

- Bump-up or raise-your-rate or bump-rate CD: If market rates increase during the CD's term, you can "bump up" the interest rate to a higher one (usually only once). This is useful during monetary tightening periods when the Federal Reserve raises interest rates to slow down the economy and combat inflation.

- Step-up CD: Similar to a bump-up CD, this type automatically raises the interest rate at specific, predetermined intervals regardless of the interest rate environment.

- Callable CD: The issuing bank has the right to "call back" the CD before maturity, potentially leaving you to reinvest at a different, less favorable rate. Because of this risk, the initial interest rates are typically higher.

- IRA CD: This traditional CD is held within your IRA and, as such, provides a tax-advantaged way to save for retirement. You can open either an IRA or Roth IRA CD, and you are permitted to open multiple CDs within the same IRA.

- Brokered CD: Since this type is offered through brokers (rather than banks or credit unions), you typically need a brokerage account to purchase one. This type of CD earns simple (non-compounding) interest paid out on a schedule. You cannot withdraw funds before maturity, even for a fee.

- Zero-coupon CD: Also available through brokers, this type is sold at a discount to face value, with interest accruing and paid at maturity. This CD generally features longer terms and higher interest rates, but you must pay taxes on interest earned annually even though you won’t receive the interest until maturity.

Analyzing the pros and cons of CDs

CDs offer a low-risk avenue for preserving capital and securing guaranteed returns, which is best suited for conservative investors with a short to intermediate investment horizon. The safety of CDs stems from their fixed-term structure, where the principal amount is protected, creating an investment environment insulated from market fluctuations. In addition, the fixed interest rates provide a level of certainty uncommon in more volatile investments. In short, you'll know exactly how much you'll receive at a CD's maturity.

However, there are sacrifices for this predictability — most notability, liquidity and high interest rates. Your money will be locked up for a predetermined period, and if you want to access those funds before the maturity date, you'll have to pay a penalty. In addition, the interest rates on CDs are typically much lower than those of more dynamic investment options like stocks.

Money market accounts unveiled

A MMA is a financial product that combines features of both savings and checking accounts, offering account holders a higher interest rate than traditional savings accounts while maintaining liquidity similar to a checking account.

MMAs are typically offered by banks and credit unions, who invest the funds in short-term, low-risk financial instruments like Treasury bills and CDs. MMAs are a great option for growth and accessibility within a secure financial environment.

Navigating money market accounts: What you need to know

MMAs share many similarities with IRAs and CDs, making them valuable components in the toolkit of conservative investors. All three financial instruments prioritize stability and low risk, offering a secure fund environment.

They also boast interest-earning potential — MMAs and CDs offer competitive rates, and CDs provide fixed rates over a specified term. They also have minimum balance requirements.

Their flexibility sets MMAs apart, striking a balance between accessibility and returns. MMAs allow for withdrawals and transfers, providing flexibility akin to a checking account.

While MMAs offer better returns than regular savings accounts, they also have limitations, such as a capped number of monthly transactions. Because traditional savings accounts usually have lower or no minimum balance requirements, they are more accessible for individuals with smaller amounts to save than MMAs. Traditional savings accounts are generally simpler in structure and do not have the check-writing capabilities often found in MMAs.

Pros and cons of money market accounts

When weighed against other low-risk options, such as savings accounts and government bonds, MMAs offer a middle ground that caters to risk-averse investors and those seeking modest investment growth.

Understanding the advantages and drawbacks of MMAs will help you make informed decisions about whether these accounts align with your financial goals and risk tolerance.

On the positive side, MMAs offer stability by maintaining a steady net asset value, ensuring that deposited funds are shielded from market volatility. Their liquidity nature provides easy access to funds through check-writing or electronic transfers. While potential returns are generally moderate, MMAs often outpace standard savings accounts.

However, their yields may lag behind riskier investments. Compared to low-risk options, such as traditional savings accounts or CDs, MMAs shine for their competitive interest rates and enhanced accessibility, making them a favorable choice for individuals seeking a prudent balance between safety and modest returns in their investment portfolio.

Key differences

While IRAs, CDs and MMAs are similar in many ways, there are important differences. One basic rule of thumb is that more benefits typically equate to more restrictions.

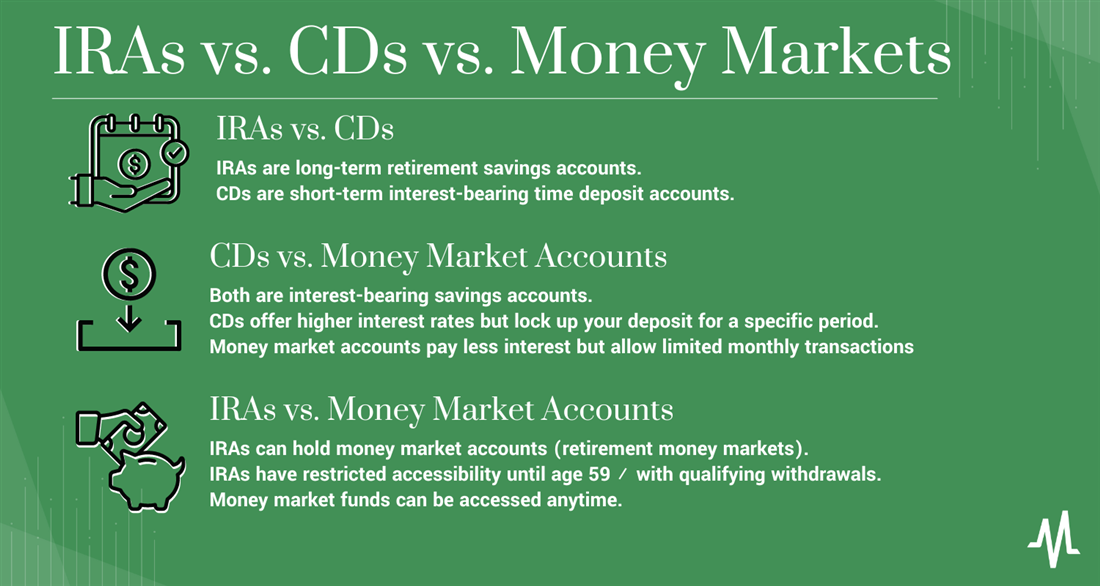

IRAs vs. CDs

So, what's better: IRA or CD? Comparing a CD account vs IRA is like comparing fruit baskets vs. oranges. An IRA is a long-term retirement savings account, whereas a CD is a short-term interest-bearing time deposit account. IRAs can take more time and effort to manage (evaluating stocks and performance), whereas CDs are simple transactions. Because an IRA comprises a portfolio of financial assets, including stocks, bonds, annuities and CDs, you can include a CD in your IRA or Roth IRA portfolio.

An important difference between an IRA and CD is the unlimited maximum you can put into a CD compared to the $6,500 or $7,500 (if you're 50 years or older) annual contribution limit for an IRA. If you have an amount that exceeds the annual contribution limit as a risk-free investment, then you could use some or all of that excess money to buy a CD, assuming you won't need to access the money anytime soon. Your funds are more accessible with a CD vs IRA if you aren't at least 59½ years old.

CDs vs. money market accounts

Both of these accounts are a form of interest-bearing savings accounts, but they serve different purposes. CDs offer higher interest rates because they lock up your deposit for the agreed-upon period.

You can't transact or withdraw funds from your CD until maturity. You can pull all or part of the money or roll it over for another term.

MMAs pay less interest than CDs but allow for a limited number of monthly financial transactions in the account. MMAs tend to have tiered interest rates that rise as the balance grows and minimum balance requirements. Both money markets and CDs can have maintenance and penalty fees.

IRAs vs. money market accounts

IRA accounts can also hold MMAs, called retirement money markets. Accessibility is the biggest benefit in the money market vs IRA discussion. IRA proceeds are only accessible after 59½ years of age with qualifying withdrawals, whereas you can access money market funds anytime.

Tax implications of each

When choosing a savings account, understanding the tax implications is crucial.

IRAs

Traditional IRAs are tax-deferred until withdrawals are made in retirement or after 59½. Qualified withdrawals are subject to ordinary income tax. Contributions are tax deductible unless you or your spouse has an employer-sponsored retirement plan. In that case, tax deductibility may be limited. Since Roth IRAs are funded with after-tax dollars, they are not tax deductible and no income tax or capital gains tax is applied when you make a qualified withdrawal.

CDs

The interest on CDs is taxed as ordinary income. Standard CDs are not tax deductible. Retirement CDs purchased in an IRA account are tax deductible and tax-deferred.

Money market accounts

Like CDs, the interest earned on money market accounts is taxed as ordinary income. MMAs in a traditional IRA are tax deductible and tax-deferred.

Make the right choice for your financial future

Aligning your investment choices with financial goals, risk tolerance and time horizon is essential for creating a well-rounded portfolio. IRAs are potent tools for long-term wealth accumulation, offering tax advantages tailored for retirement planning.

With their fixed returns, CDs are suitable for shorter-term goals, providing stability and predictability. MMAs balance accessibility and competitive returns, making them versatile for various financial goals. Assessing your risk tolerance is key; IRAs may involve market exposure, CDs offer low-risk stability and MMAs provide a middle ground. Diversification across these options is essential for a well-rounded portfolio. IRAs contribute to long-term growth, CDs stabilize with fixed returns and MMAs add flexibility and liquidity. Regularly reassess your portfolio to ensure it aligns with your evolving financial journey, seeking professional advice for a personalized investment strategy.

Add some savings power to boost your portfolio

Deciding between an IRA, CD and MMA involves understanding the intricacies of each option's tax advantages, stability and flexibility. It’s important to take stock of your financial goals, risk appetite and time horizon to determine whether the dynamic growth potential of an IRA, the secure predictability of a CD or the versatile balance of an MMA is the right fit for you.

FAQs

Here are answers to some of your frequently asked questions.

Is an IRA better than a money market account?

An IRA account can be better than a money market account if you are planning long-term toward retirement and seek to add different asset classes. Remember that IRAs have a limited annual contribution limit, which can significantly impede more significant gains from a larger investment. An IRA is a retirement account that can include money market accounts in its portfolio of assets.

As a retirement account, the proceeds can only be withdrawn once you are 59 ½ years old. A regular money market account provides immediate access to funds enabling depositors to withdraw funds up to the monthly limit for transactions. Money market accounts don't have a maximum limit. They pay more interest for higher balances. Note that you can have an IRA and money market account similar to a CD or IRA combo. It doesn’t have to be an either/or situation.

Which is better, CDs or money market accounts?

CDs are better if you seek higher interest rates and only need access to your cash on the maturity date. Money market accounts are better if you want the flexibility to access your money without penalties while earning interest.

Why would you choose a CD over a money market account?

CDs pay more than money market accounts because your money is locked in for the duration of time until maturity. The primary reason would be receiving a higher interest rate for the same deposit money. CDs also provide an incentive to save but limit access to your funds with the risk of paying a penalty.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...