Global satellite communication provider

Iridium NASDAQ: IRDM stock has been coming back down to earth since peaking at $54.65 a year ago. The provider of

mobile voice and data communications services to enterprises, governments, and consumers globally. The Company is a play on mobility which has been accelerated due to

COVID-19. As more workers work remotely utilizing Zoom meetings and mobile apps, Iridium benefits from more usage of its networks. That is the basic thinking for Iridium as a long-term play. They are the dominant player in the L band spectrum but are facing much competition from the K band satellites including Starlink, Elon Musk’s

network. The Company is seeing growth in most of their customer base and remarkably even growth in U.S. government business as subscribers grew to 149,000. Their Syntellis acquisition is acclimating well adding GPS and position navigation services. Prudent investors seeking exposure in the satellite

communications segment can watch for opportunistic pullback in shares of Iridium.

Q3 Fiscal 2021 Earnings Release

On Oct. 19, 2021, Iridium released its fiscal third-quarter 2021 results for the quarter ending September 2021. The Company reported an earnings-per-share (EPS) loss of (-$0.02), beating consensus analyst estimates for a loss of (-$0.03), by $0.01. Revenues rose 7.06% year-over-year (YoY) to $162.14 million. Total billable subscribers rose 18% YoY to 1.69 million. Iridium CEO Matt Desch commented, “We feel really good about the momentum we're seeing in our business. It's broad-based and a function of strong top line growth, good execution, and strong partner activity. Together, these factors provide Iridium a clear runway for long-term growth," said Matt Desch, CEO, Iridium. Desch continued, "With the flood of new capital making its way into the space industry, Iridium continues to distinguish itself as a leader in satellite communications by leveraging its unique network and spectrum position to connect people, vehicles and assets on the move. We continue to generate stronger free cash flow as we attract new subscribers to our network, which sets us up well as we plan for 2022. In light of strong underlying demand and continued subscriber momentum, Iridium is raising its full-year guidance for 2021. We now expect total service revenue growth of between 5% and 6% and operational EBITDA of approximately $375 million this year."

Conference Call Takeaways

CEO Desch set the tone, “ In the third quarter, we saw broad-based demand for our many solutions and continued to witness the strength of our wholesale business model. The ecosystem of around 500 global partners that we built over the past two decades remains a real differentiator. It has shown us resilience during various economic cycles and market dislocations. Back in May, you will recall that Tom and I laid out the vectors for Iridium's five-year growth plan during our Investor Day. At that time, visibility for growth in 2021 was still a bit clouded by how fast some of our partners' markets might recover from the previous year. However, we still had a strong grasp of the underlying demand for our services, and we had confidence that a full schedule of new product rollouts and planned service introductions all supported by our substantial partner network would deliver new subscriber additions just as it has in prior years. This perspective supported our announcement in May of a return to average high single-digit service revenue growth from 2023 through 2025. We're definitely on schedule for that given our results this year. In light of the growth, we continue to see across our commercial business lines, we're taking up our full year outlook for service revenue growth to between 5% and 6% in 2021. This increase also supports a higher operational EBITDA, which we now expect to reach approximately $375 million this year, which would represent about 5.5% growth on a year-over-year basis. We feel really good about the momentum we're seeing in our business, and it's not just confined to our bottom line. It's a combination of top line growth, good execution on operations and strong partner activity; which are all providing a clear runway for years to come. I mentioned last quarter that global supply chains were affecting equipment production because of a shortfall of a key part in some of our IoT modules. I want to update you on this situation. As you saw in our results, we had a strong quarter of equipment sales as demand from our partners remains particularly strong, even more robust than we expected earlier in the year. To-date, our supply chain team has done a good job in managing the impact of this component shortage as much as possible. In fact, we now expect that the strong demand we continue to see will cause our equipment revenue in 2021 to exceed last year's level. Still, I wish we were less constrained by this shortage, especially as we see demand outstripping current supply allocations for the next several quarters.”

He added, “Now, an area we haven't seen the subscriber growth that we had from past years is the US government. While service revenues remain as expected, administrative issues created by the transition of our EMSS contract from DISA to the US Space Force has slowed US -- has slowed user activations. As we mentioned last quarter, this has not been a seamless hand-off and we continue to support the process they are going through together to ensure that the US Government can avail itself of all the benefits conferred by our contract. We still have a great relationship, and they highly value our network. The government had about 149,000 subscribers at the end of the third quarter and we continue to work with them on a number of dedicated engineering, development and gateway upgrade projects that are strategic to their needs going forward. Switching gears to Aireon. The company continues to see its business slowly improve as air traffic rebounds. Aireon expects to generate positive free cash flow for the year and remains very excited about its newest offering of data services which could become a substantial contributor to their revenues. They continue to provide a very high quality and valuable service to their ANSP customers including the FAA and have additional customers in the pipeline even though reduced air travel over the last 18 months has delayed customer decisions on new contracts. Still, they are in good shape for a company that's only been operational for 2.5 years.”

IRDM Opportunistic Pullback Levels

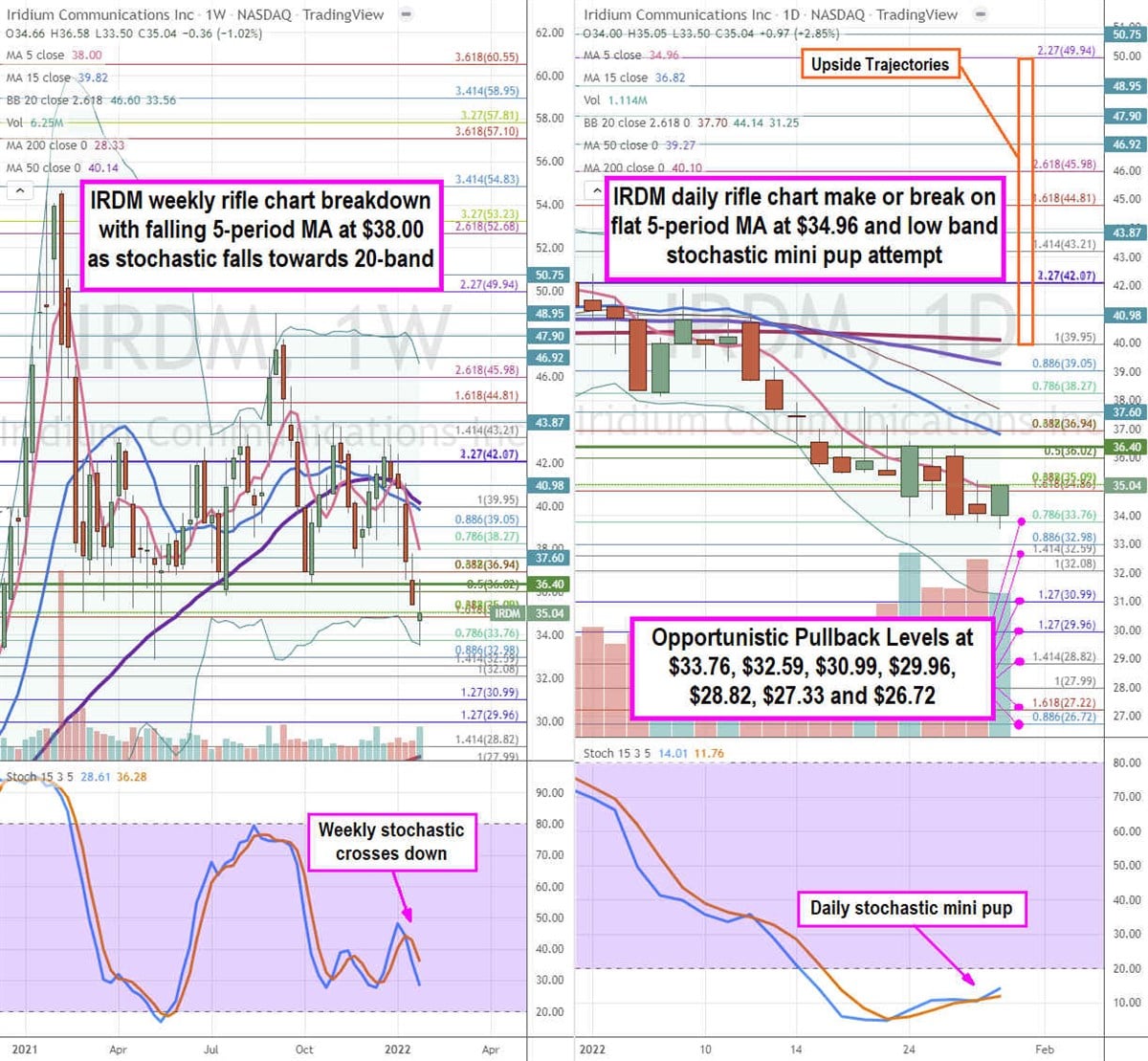

Using the rifle charts on the weekly and daily time frames enables a precision view of the playing field for IRDM stock. The weekly rifle chart breakdown has a falling 5-period moving average (MA) at $38.00 after peaking at the $43.21 Fibonacci (fib) level. The weekly lower Bollinger Bands (BBs) tested at $33.56. The weekly stochastic crossed back down through the 30-band. The daily rifle chart has been in a downtrend and is trying to rebound with a make or break as the stochastic forms a mini pup under the 20-band. The daily 5-period MA is flattening at the $35.09 fib, followed by a still falling 15-period MA at $36.82. The daily market structure low (MSL) buy triggers above $36.40. Prudent investors can watch for opportunistic pullback levels at the $33.76 fib, $32.59 fib, $30.99 fib, $29.96 fib, $28.82 fib, $27.33 fib, and the $26.72 fib level. Upside trajectories range from the $39.95 fib up towards the $49.94 fib level.

Before you consider Iridium Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iridium Communications wasn't on the list.

While Iridium Communications currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.