Year-to-date (YTD) shares of Groupon NASDAQ: GRPN have surprised many, particularly given the overwhelming bearish sentiment. The stock has surged around 65% higher.

Adding to its already impressive gains YTD, the stock recently broke out of consolidation and, despite pulling back over the previous two days, remains in a firm uptrend above key moving averages.

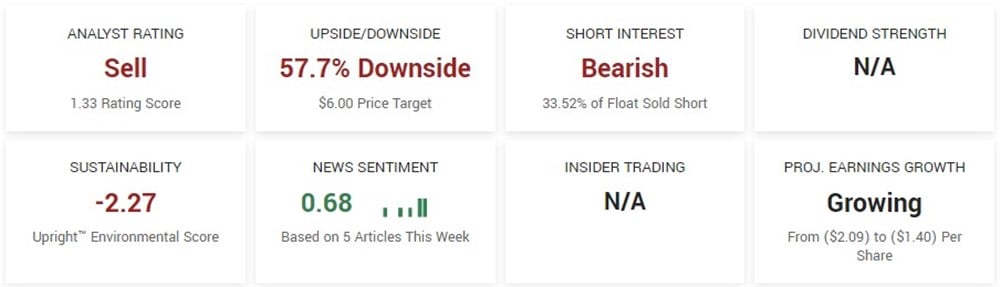

As mentioned, the sentiment on GRPN is bearish, with significant short interest and analysts predicting over 50% downside for the name based on the consensus price target.

Given the current market environment, might shares of GRPN have what it takes to continue higher, potentially leading to a short squeeze? Let's take a closer look.

Groupon NASDAQ: GRPN

Groupon runs a marketplace connecting consumers with merchants and operates with two main segments, one in North America and the other internationally. The company sells products and services from third-party merchants and its own inventory. Customers can access Groupon through mobile apps and websites.

GRPN currently has a market capitalization of $419.69 million, making it a relatively small-cap stock. Its 52-week range of $2.89 - $16.25 is a fair representation of that and also suggests that the stock has experienced significant volatility. GRPN has a float of about 20 million shares and an average daily volume of 1.22 million.

The stock's modest market capitalization, limited available shares, and average daily trading volume increase the potential for a short squeeze. This scenario arises when short sellers cover their positions, triggering a surge in buying and increasing demand for the stock, which can significantly exceed the typical supply on a regular trading day.

The Large Short Interest in GRPN

As of September 15, 33.52% of the float in GRPN is sold short, equating to about 5.3 million shares. While that amount has remained relatively unchanged over the previous month, GRPN's stock has risen almost 20% over the previous month, which is a worrying sign for those holding the stock short.

Another important factor to consider is that the amount of shares sold short, 5.3 million, is significantly higher than the stock's average daily volume. As a result of this, if GRPN continues to trade higher, the range and volatility could expand as shorts begin to cover. However, as things stand, that may not be a likely event.

Analysts See Significant Downside

Analysts seem to agree with the short sellers regarding the valuation of GRPN. Based on three analyst ratings, GRPN currently has a Sell rating and a consensus analyst price target of $6, predicting almost 56% downside for the stock. Most recently, on August 11, Goldman Sachs increased its target from $3 to $4. However, despite the increase, the price target still implies over 47% downside.

Can GRPN Squeeze Higher?

Regarding technical analysis for GRPN, it's crucial for the stock to maintain support above $13.40 to sustain its upward momentum. If it can firmly hold above this level and establish a higher low, the potential for an upward squeeze may rise, particularly if it surpasses its recent high of $16.25. However, monitoring the trading volume closely is essential, as a surge in both price and volume could indicate short sellers starting to cover their positions.

Before you consider Groupon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Groupon wasn't on the list.

While Groupon currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.