C3.ai NYSE: AI has been one of the standout artificial intelligence performers of the year. Year-to-date shares of AI are up 269%, significantly outperforming the overall market and competitors. As the stock shrugs off negative catalysts, continuing to trade higher and form attractive technical setups on the chart, the possibility of an outsized short squeeze event is likely.

C3.ai is a prominent enterprise software company founded by Thomas Siebel in 2009, based in Redwood City, California. They specialize in AI solutions catering to various industries. Led by Thomas Siebel as CEO, the company went public in December 2020, raising $651 million.

While experiencing flat revenue growth in recent years, C3.ai maintains a healthy profit margin and low debt-to-equity ratio, indicating positive market expectations.

The Bears Versus The Bulls

As the short interest implies, there has been an ongoing battle between the bulls and bears of C3.ai, with the bear case widely spoken about on popular media platforms. But what about the bulls' case?

The bulls have a firm case for the stock. After all, C3.ai is in the hottest market. C3.ai, according to D.A. Davidson senior software analyst Gil Luria, is a significant player in the enterprise AI space with an estimated revenue of $300 million this year.

The AI market's potential size is crucial to C3's growth, with CEO Thomas Siebel noting a multi-billion-dollar opportunity.

While C3's customer count may be limited due to long sales cycles and contracts, they excel with large complex industrial customers, positioning them well for significant opportunities.

Their growth has been successful in both the public and private sectors, gaining market share from competitors like Palantir and attracting forward-looking companies. Despite its evolving customer mix, C3.ai aims to provide accurate representations of its customer base.

The Short Interest

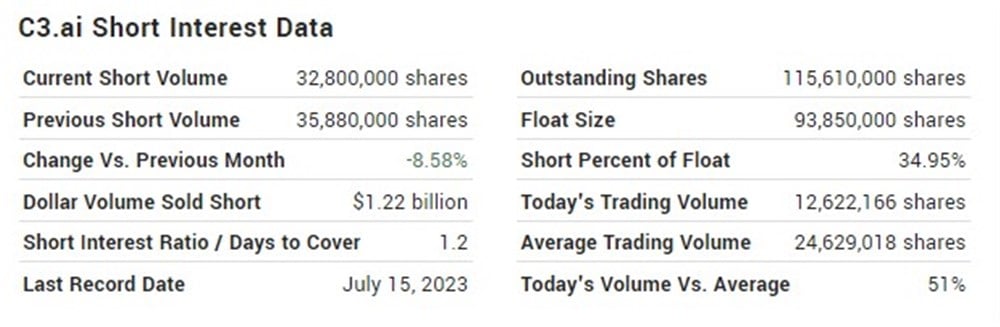

The substantial short interest in the stock has been a crucial driving force behind its remarkable surge. Since April, the short interest has flirted with 40% short of the float. As of July 15, the short interest was 34.95%, down from June 30, which was 38.55%. According to the latest short data, 32.8 million shares are short in AI.

C3.ai Nears A Breakout Level

From a technical analysis standpoint, the current setup in AI presents an ideal opportunity for bullish momentum traders and investors. Here's why: The stock exhibits a textbook-perfect pattern as it consolidates above prior resistance, with both the 50-day and 200-day SMAs showing an upward trend.

The decreasing range and volume also suggest a rubber band effect is imminent. With such a significant contraction in range and volume, a substantial expansion will likely happen in the short term, propelling the stock higher.

The bulls are eagerly anticipating a breakthrough above the $44 mark, coupled with an increase in trading volume, which could pave the way for new 52-week highs, surpassing the $49 level.

Before you consider C3.ai, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and C3.ai wasn't on the list.

While C3.ai currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.