Just like the crypto craze, the artificial intelligence (AI) craze has arrived in 2023. Any public company with AI in its name is being gobbled up. This usually ends up bad for investors who chase prices too high to get in on obscure lottery ticket names. Companies sometimes receive much-needed attention to bring them to the forefront with new investors. Could BigBear.ai Holdings Inc. NASDAQ: BBAI stock be one of those hidden-in-plain-sight gems?

Three months ago, on Dec. 22, 2022, the Company received a non-compliance notice from the New York Stock Exchange (NYSE) as it failed to maintain a $1.00 price over 30 consecutive days. While the stock has risen 610% in 2023 from $0.69 to a high of $5.92, it’s worth noting that its 52-week high was $16.12.

BigBear.ai the Company

BigBear.ai is a Columbia, MD-based company that provides AI and machine learning solutions for decision support. They offer various services from consulting, enterprise IT, systems engineering, and cybersecurity to predictive and prescriptive analytics. The Company services governments, healthcare, and manufacturing segments.

It competes with Palantir Technologies Inc. NYSE: PLTR, C3.ai Inc. NYSE: AI, and EPAM Systems Inc. NASDAQ: EPAM. The Company has slowly been growing its revenue base, with $150 million to $170 million projected for 2022. Earnings are still red as it closed Q3 2022 with (-$16.1 million) in net losses.

The Big News

BigBear.ai announced it had secured a 10-year $900 million Indefinite Delivery/Indefinite Quantity (IDIQ) contract with the U.S. Air Force. Shares were trading at $0.83 ahead of the news on Jan. 12, 2023. Volume skyrocketed from 63,000 shares the previous day to nearly 113 million shares on the day of the announcement.

The stock skyrocketed as high as $3.85 before a reversion back to $1.75 in the following days before staging a slow grinding rally to hit a high of $5.92 on 55 million shares of volume in the first week of February 2023.

The Reality of ID/IQ Contracts

At first glance, the press release sounds like BigBear.ai had won a $900 million contract from the U.S. Air Force. However, that's not the case. An ID/IQ contract puts a maximum cap on the products or services but doesn’t guarantee payment of $900 million. The $900 million figure is the maximum value of the contract. The Air Force can place task orders for up to $900 million over the contract's life, which is ten years.

BigBear.ai must still compete with over 20 other contractors to win as it says in the press release, “The contract vehicle allows BigBear.ai to compete for task orders delivering capabilities, systems, and synthetic environments to the Air Force as a prime contractor.”

They will compete for task orders supporting the Air Force Life Cycle Management Center Architectures and Integration Directorate (AFLCMC). It's also 10-year multiple awards meaning the Air Force can place task orders with any of the contract awardees of which tasks are to be completed by 2032.

An ID/IQ contract does not guarantee or obligate the Air Force to purchase products or services. It's a flexible procurement mechanism used by the Air Force to obtain a broader range of services or goods. The amount of business the contract generates is uncertain; only the maximum $900 million cap over ten years is.

$25 million Private Placement

Five days later, on Jan. 17, 2023, BigBear.ai announced and took the opportunity to execute a $25 million private placement for the issuance of 13.88 million shares with the option to purchase an additional 13.88 million shares at the offering price of $1.80 per share and accompanying warrant. While the private placement news initially tanked the shares, they have slowly crept back up through $5, indicating new investors are entering the stock. The offering closed on Jan. 19, 2023.

Task Wins Catalyst

Each new contract win can spike up shares based on recent stock price reactions. While the ID/IQ contract doesn't guarantee any tasks, each win may result in another press release, which could catalyze stock appreciation.

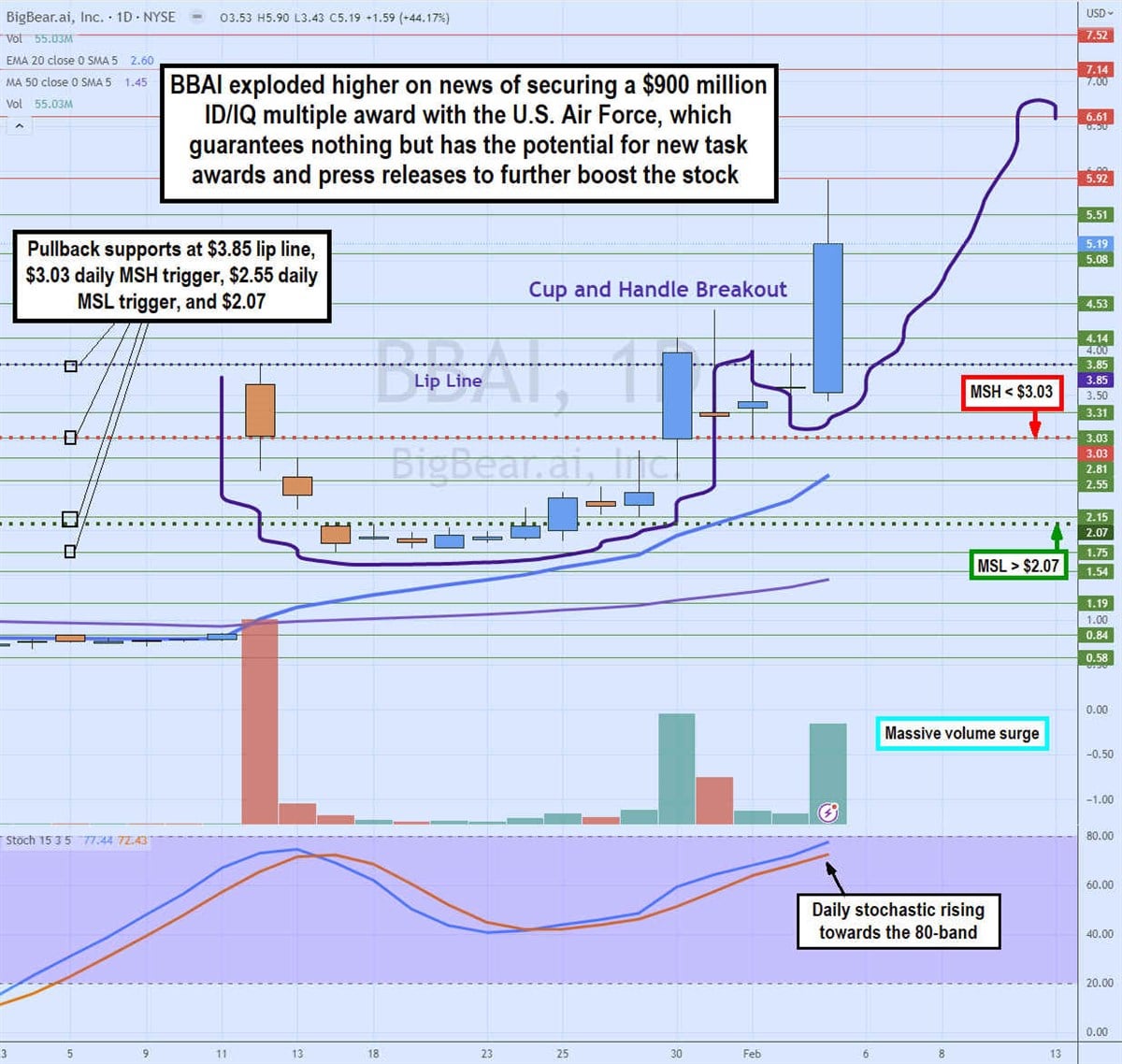

Daily Cup and Handle Breakout

BBAI was an obscure little-known engineering firm stock before the AI mania of 2023. The stock recently exploded to the upside on Jan. 12, 2023, to form the lip line at $3.85 before selling off on the private placement news for the next six trading days.

It made a swing low of $1.85 before triggering the daily market structure low (MSL) breakout through $2.07 as the daily stochastic crossed back towards the 80-band. Shares broke through the lip line initially before falling back under it to form the daily market structure high (MSH) sell trigger under $3.03 on Jan. 31, 2023.

This also completed the cup as the handle started to develop. Shares rallied with a breakout through the lip line to complete the cup and handle pattern as shares hit a new swing high at $5.92 on a substantial volume of 55 million shares. Pullback supports are at $3.85 lip line, $3.03 daily MSH trigger, $2.55, and $2.07 daily MSL trigger.

Before you consider EPAM Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EPAM Systems wasn't on the list.

While EPAM Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.