Shares of transportation and delivery company

FedEx (

NYSE: FDX) have been trading sideways since the Tennessee headquartered company reported their fiscal

Q3 earnings last week. That kind of action is usually indicative of a neutral report that neither disappoints or excites, which isn’t too far off the mark in this case. Revenue was just about ahead of what analysts had been expecting, while EPS was just below. This was a theme throughout the report, and you could almost hear the collective “meh” from Wall Street.

Unsurprisingly, the management team struck a much more positive tone with their comments. CFO Michael C. Lenz said that “we successfully executed during the holiday peak season, resulting in record December operating income. Our strong quarterly operating income increase was dampened by the surge of the Omicron variant which caused disruptions to our networks and diminished customer demand in January and into February. We remain focused on revenue quality and operational efficiency initiatives to mitigate inflationary pressures and drive earnings improvement.”

Looking at the key business units, it was pointed out that FedEx Express’ operating results increased, driven by higher yields, a net fuel benefit, and lower variable compensation expense. Unfortunately for management and investors however, Omicron looks to have held them back from what would have been a much better quarter otherwise. Its unexpected effects resulted in lower express freight revenue, as air capacity limitations drove a temporary suspension of key services during the quarter. The negative effects from Omicron on this quarter’s results fully offset the expected benefit that management had been looking for from less severe winter weather.

FedEx Ground operating results declined primarily due to increased rates for purchased transportation and employee wages, network inefficiencies, and expansion-related costs. The third key unit though, FedEx Freight, saw its third quarter operating income jumping nearly 300%, driven by a “continued focus on revenue quality and profitable growth”.

Looking Ahead

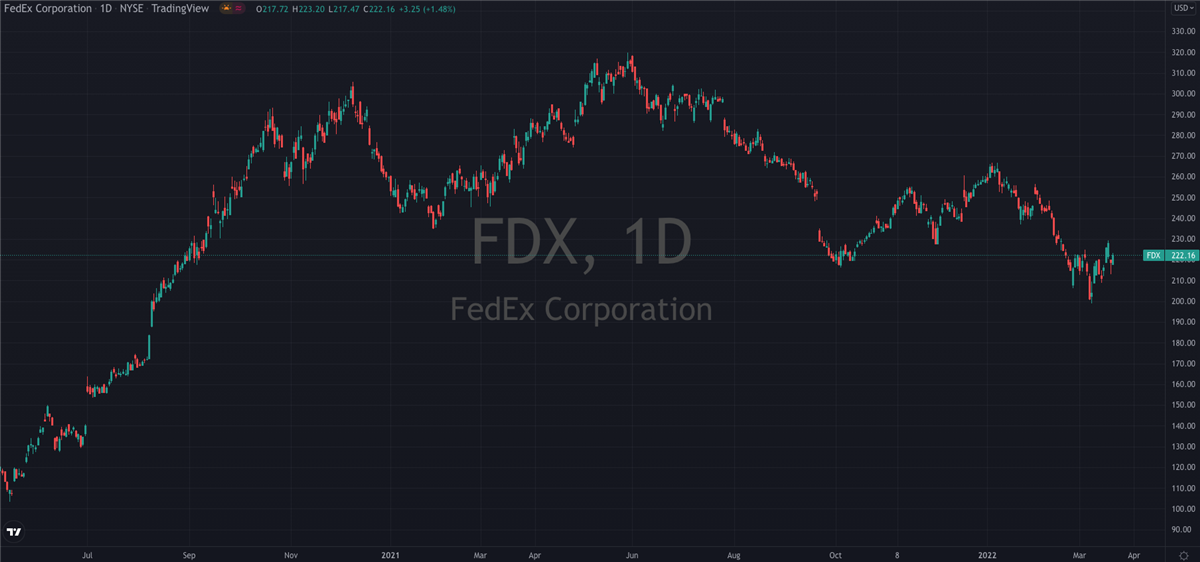

It’s interesting that shares have been so muted in the handful of sessions since. They’re currently trading down about 30% from last May’s all time high, having hit their lowest level since the start of COVID just two weeks ago. As an investor, it’s fair to think that the lack of selling pressure after what can only be described as a neutral report suggests that the bears are running out of steam and that momentum might be changing. Indeed, if this month’s low at $200 can be held, things could get interesting as we head into the summer.

Since last week’s report, a number of the sell-side heavyweights have reiterated their bullish ratings, albeit with some light warnings. Bank of America noted that “we reiterate our Buy given its historically low valuation, but lower our PO to $280 from $297, on a 12.0x target multiple (from 12.5x) on our F23e EPS, below its 12.5x-18.5x historical range given its reduced economic outlook." That $280 price target still suggests there’s upside of more than 25% to be had from where shares closed on Monday. Morgan Stanley also trimmed their price target to $250, which still implies there’s upside to be had from current levels.

Solid Upside Potential

Analyst Ravi Shanker made the current situation very easy for investors and potential investors to understand; “while FY22 is likely to be disappointing relative to expectations coming into the year, investor positioning has also reset lower and FY22 probably doesn’t matter much any more. All eyes will likely be on the Analyst Day on June 28. On the one hand, the disappointment of FY22 results relative to expectations means that the bar is lower, on the other, FDX will likely have to lay out an epic set of targets – and a crystal clear path to get there – for investors to believe in a $300+ price again."

The folks at Citi

reiterated their Buy rating, and went so far as to push their price target up to $300 which would have the stock trading back towards its all time high. So while last week’s report might not have been as much of a blowout as expected, the signs are there that FedEx is continuing to tick over nicely. This month’s past low makes an easy entry and exit point for investors to play around with, so you have to be thinking the risk/reward profile on this one is pretty clear.

Before you consider FedEx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FedEx wasn't on the list.

While FedEx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.