U.S. electric vehicle (EV) manufacturer Fisker Inc. NYSE: FSR stock has had its ups and downs in the past two-years. Shares peaked at $31.96 highs in March of 2021 and fell as low as $7.95 in June of 2022. Up until now, Fisker was a speculative pre-production electric vehicle (EV) play. However, the Company is officially scheduled to go into commercial production in November 2022. The Company plans on launching four Ocean models starting with the affordable Ocean Sport at $34,999 up to the luxury Ocean One starting at $68,999. The Company sold out on all 5,000 pre-launch limited orders for the Fisker Ocean One secured by $5,000 down payments in nine launch markets. The Fisker Ocean is designed to be the most sustainable SUV on Earth constructed of recycled and upcycled materials throughout. It also sports a solar roof call SolarSky which can produce over 2,000 emissions-free miles a year powered by sunshine. Its battery can also be used as emergency power sources for homes for up to seven days. It expects to finish final testing on 55 complete Fisker Ocean prototypes and go straight into production on Nov. 17, 2022. Shareholders have patiently and painfully waited for Fisker to go from prototype to production marking the second coming of the proverbial Tesla Killer.

Resurrection of the Tesla Killer

Henrik Fisker may sound familiar to sports car enthusiasts as he was the infamous designer behind acclaimed models like the James Bond BMW Z8 roadster, the best-selling Aston Martin V8, the Ford NYSE: F Shelby GR-1, the Artega GT, and the Tesla NASDAQ: TSLA Model S. Ironic that the man dubbed the Tesla Killer was formerly a designer at Tesla behind the team that designed the now iconic Tesla Model S. Fisker crashed and burned on his initial attempt at a flashy EV called the Karma which attracted much fanfare due to its celebrity list of customers including Leonardo DiCaprio, Justin Bieber, Colin Powell, and former U.S. vice president Al Gore. Unfortunately, the Company missed milestones causing a $528.7 million conditional loan by the U.S. Dept. of Energy to be frozen. Then Hurricane Sandy wiped out its initial Karma orders and the flooding caused production to shut down ultimately forcing the Company into bankruptcy in 2012. In 2016, Fisker Inc. was resurrected and ultimately reverse merged with a SPACE called Spartan Energy to gain a $1 billion war chest for a second chance to enter the EV market.

Asset Light and Design Focused Model

The Fisker brand is associated with brilliant, cutting edge, futuristic, award winning designs. This time around, Mr. Fisker sought to leverage his reputation for design and leave the manufacturing in the hands of highly experienced Magna International NYSE: MGA. By outsourcing the production, Fisker has an asset light and agile operating model that can focus on cutting edge design and an enhanced end user experience. Unlike competitors Tesla, Lucid NASDAQ: LCID, and Rivian NASDAQ: RIVN, Fisker doesn’t have to build plants to produce cars. They simple outsource, just like how Applied Materials NYSE: AMD outsources their semiconductor production to Taiwan Semiconductor NYSE: TSM rather than produce them in its own plants like Intel NASDAQ: INTC does.

D-Day is November 17, 2022

Mr. Fisker commented on its Q2 2022 conference call, “We look forward to taking our 5,000 Fisker Ocean One stakeholders on a once-in-a-lifetime journey with us as we approach the start of production on November 17, 2022. These 5,000 pre-orders for the Fisker Ocean One represent approximately $350 million of potential revenue for Fisker once all vehicles are delivered.” He continued, “I am proud of the seamless collaboration between Fisker and all of our partners and suppliers, ensuring our November 17, 2022, start-of-production,” Henrik continued. “After driving test cars on the high-speed track in Italy and on the roads in LA, I am excited about all the features we will offer in the Fisker Ocean and how superbly the Fisker Ocean will drive.”

Impact of the Inflation Reduction Act

The Inflation Reduction Act was signed into law by President Biden on Aug. 17, 2022. This law basically allocates $370 billion in the next decade towards decarbonization efforts. It renews the $7,500 EV tax credit from January 2023 through the end of 2032. While this may sound good for EV makers, it doesn’t benefit all of them. The tax credit only applies to EVs built in the U.S. and the battery materials must originate from the U.S. or a country that the U.S. has a free trade agreement with. Unfortunately, the Fisker Ocean is outsourced to Magna International which assembles the car in its Austria factory. The Company has used this to help boost pre-sales as the $7,500 credit can still apply if the $5,000 deposit for U.S. customers is converted to a binding sales agreement before the law takes effect.

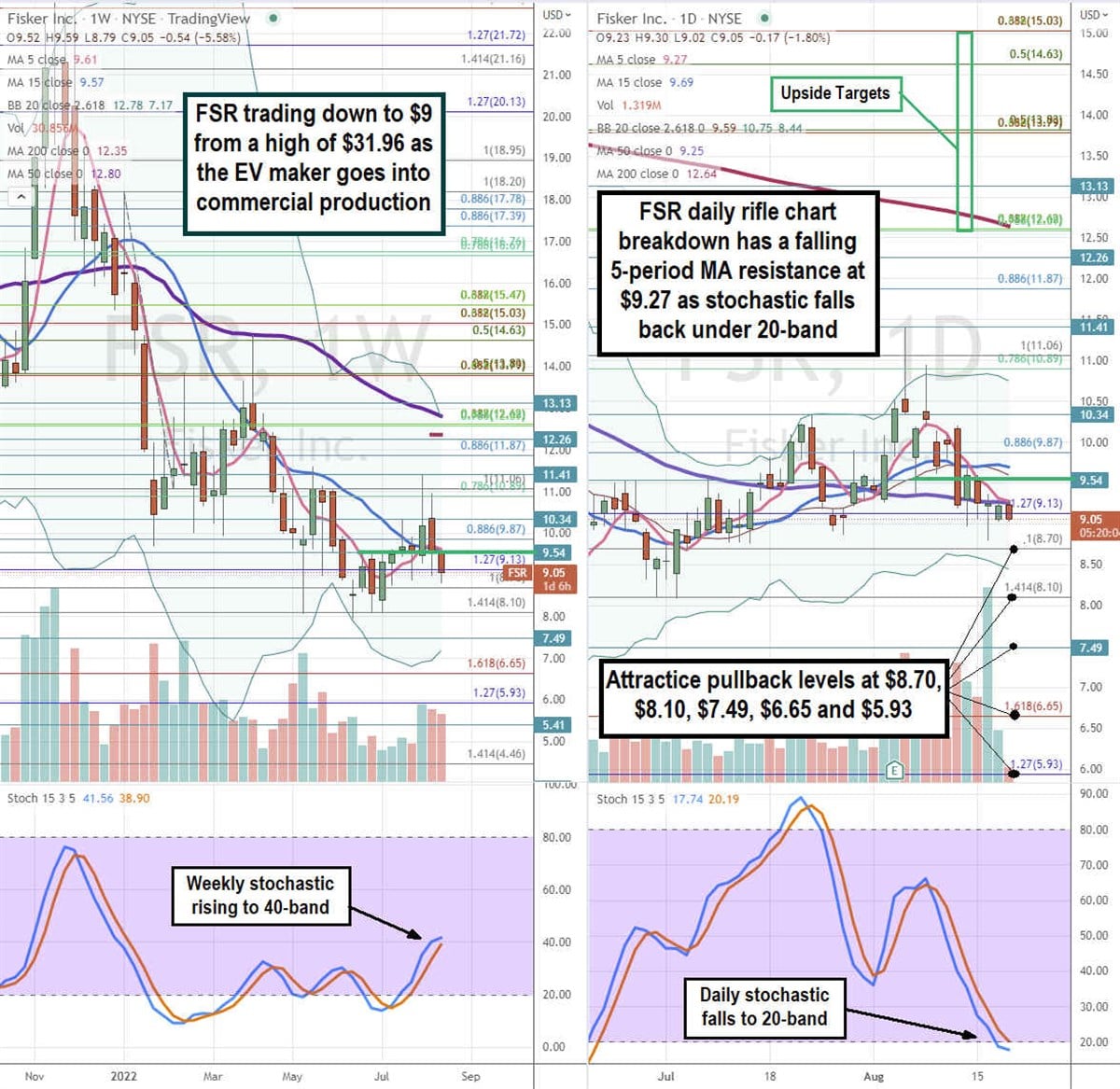

Here’s What the Chart Says

Using the rifle charts on the weekly and daily time frames provides a precision near-term view of the landscape for FSR stock. The weekly rifle chart found support near the $8.10 Fibonacci (fib) level. The weekly 5-period moving average (MA) at $9.61 is nearly overlapping the 15-period MA at $9.57. The weekly 50-period MA resistance at $12.80 overlaps the weekly upper Bollinger Bands (BBs) at $12.78. The weekly market structure low (MSL) buy triggers above $9.54. The daily rifle chart broke down in a downtrend with a falling 5-period MA resistance overlapping the daily 50-period MA at $9.27 followed by the 15-period MA resistance at $9.69. The daily lower BBs sit at $8.44 while the daily upper BBs sit at $10.75. The daily 200-period MA resistance sits up near the $12.62 fib. Attractive pullback levels are at the $8.70 fib, $8.10 fib, $7.49, $6.65 fib, and the $5.93 fib level. Upside targets range from the $12.62 fib up towards the $15.03 fib level.

Before you consider Fisker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fisker wasn't on the list.

While Fisker currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.