IonQ Today

$15.04 -1.83 (-10.84%) (As of 10/31/2024 ET)

- 52-Week Range

- $6.22

▼

$18.20 - Price Target

- $12.00

IonQ Inc. NYSE: IONQ is a leading developer in the field of quantum computing, focusing on the commercialization of computers based on trapped ion technology. As artificial intelligence (AI) becomes more mainstream, investors are always searching for the next cutting-edge technology. Quantum computing may be that cutting edge. However, it's still in the very early innings. Its applications and superiority over existing supercomputers have yet to be set in stone. There is more hype than reality at this stage in the game. With quantum computing, everything is still just a potential. On its website, IonQ states that quantum computing has "the potential to change the world."

IonQ operated in the computer and technology sector, competing with quantum computing divisions of Alphabet Inc. NASDAQ: GOOGL and International Business Machines Co. NYSE: IBM.

Quantum Computing: Hype or Reality?

In the simplest terms, quantum computing enables a third state called superposition, which is a simultaneous representation of one and zero, versus current supercomputers that still have just the two states of zero and one. Quantum computing can be used to solve particular problems with a massive number of variables and similar optimization needs, with a reduced number of computation processes, resulting in lower computation time.

Potential Applications for Quantum Computers

Drug discovery is an ideal application for quantum computers, as they simulate molecular behavior and their interactions with unprecedented accuracy. By modeling complex biological molecules and chemical reactions in every possible scenario with every possible effect and interaction, quantum computing could reduce the time to identify effective drug compounds from years to weeks or days.

Quantum computers could "supercharge" AI by leveraging superposition and entanglement, which would allow it to perform simultaneous calculations to speed up problem-solving and processing.

Maintaining a Quantum Computer

Trapped ion technology involves cooling atoms to near-zero kelvin and trapping them with electric fields. Zero kelvin is not zero degrees but negative 459 degrees Fahrenheit. At this temperature, all molecules stop moving, and particles have no kinetic energy and stand perfectly still.

Quantum computers must be maintained near zero kelvin for efficient operations with minimal thermal noise. The slightest heat or vibration can cause errors, which means they are usually housed inside refrigerators with cryogenic cooling systems that maintain temperatures near zero kelvin. Absolute zero is the theoretical lowest temperature possible, which can not be achieved perfectly.

For this reason, providing access to quantum computers through the cloud is the ideal access, or quantum computing as a service (QaaS), as the quantum computer is stored in a stable, near absolute zero environment. IonQ offers QaaS subscriptions through cloud providers like Amazon.com Inc. NASDAQ: AMZN AWS, Google Cloud and Microsoft Co. NASDAQ: MSFT Azure to researchers and developers.

Does IonQ Generate Any Revenues Yet?

Yes, IonQ does generate revenue. Although it reported a loss of 18 cents per share in its second quarter of 2024, revenues climbed 1086.4% YoY to $11.38 million, beating $8.66 million consensus estimates. IonQ generated revenues from QaaS subscriptions and research contracts. The company achieved $9 million in new bookings. Although its net loss was $37.6 million, it has $402 million in cash and cash equivalents.

The company expects Q3 2024 revenue between $9 million and $12 million, versus $10.26 million consensus estimates. For the full year 2024, IonQ forecasts revenue between $38 million and $42 million, versus $39.42 million consensus estimates.

IonQ CEO Peter Chapman commented, “This was also a major quarter for IonQ’s commercialization, including our win of a system design project with ARLIS (the Applied Research Laboratory for Intelligence and Security) via a competitive bidding process and an extension of our system access contract with AWS.”

More Contract Signings

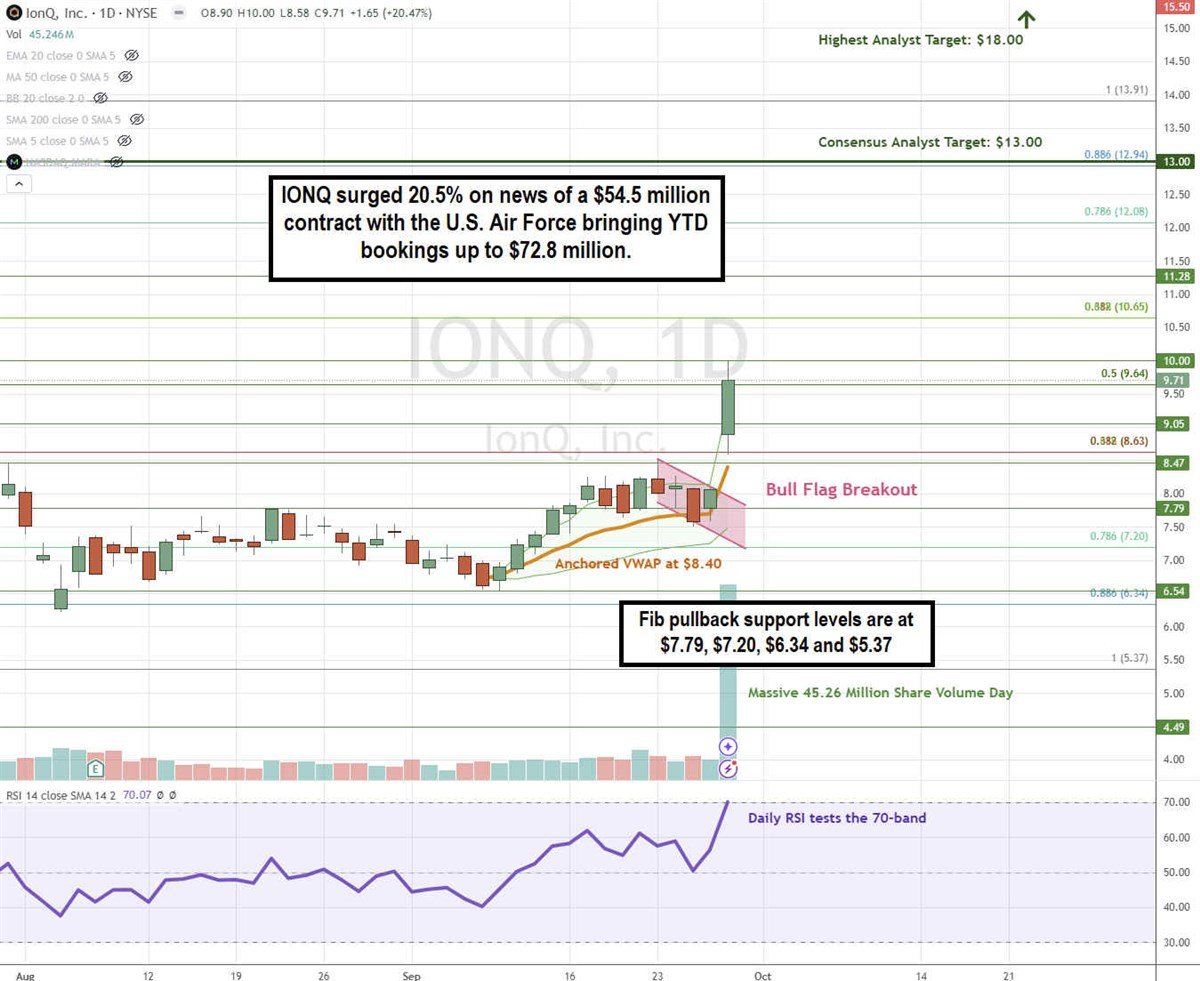

On Sept. 9, 2024, IonQ announced a $9 million agreement with the University of Maryland to provide state-of-the-art quantum computing access to the National Quantum Lab in Maryland. On Sept. 27, 2024, IonQ announced the largest 2024 U.S. quantum contract award of $54.5 million with the United States Air Force Research Lab (AFRL). This brings year-to-date (YTD) bookings of $72.8 million and reiterates its guidance of $75 million to $95 million for the full year 2024.

IONQ Stock Triggers a Bull Flag Breakout

A bull flag triggers when the stock surges through its upper descending trendline resistance.

IONQ triggered the bull flag breakout on the Sept. 27, 2024, announcement of the $54.5 million US Air Force contract. The news caused shares to surge 20.5% on 45.26 million shares of volume, triggering the breakout. The daily anchored VWAP support is at $8.40.The daily relative strength index (RSI) rose to the 70-band. Fibonacci (Fib) pullback support levels are at $7.79, $7.20, $6.34, and $5.37.

IONQ’s average consensus price target is $13.80, and its highest analyst price target sits at $18.00. It has three analyst Buy ratings and two Hold ratings.

Actionable Options Strategies: IONQ surged on news and big volume. Bullish investors can buy on pullbacks using cash-secured puts to take advantage of the elevated premiums at the fib pullback support levels to buy the dip. Be careful with the wide spreads since liquidity is usually thin.

Bullish investors with a longer time frame who want to spend less capital can consider buying out-of-the-money (OTM) directional LEAPS call options on this highly speculative stock.

Before you consider IonQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IonQ wasn't on the list.

While IonQ currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.