Google Smashes Consensus And FAANG Moves Higher

Google (GOOG) reported earnings this morning and smashed the consensus for revenue. Because of this, the stock is up 8% in the premarket and the entire FAANG complex is moving higher. Considering Netflix (NFLX) also smashed earnings and gave favorable outlook for the year, it’s beginning to look like a good time to buy some FAANG. The rest of the complex, Apple, Amazon, and Facebook all report earnings on Thursday after the close so we could see some other big moves very soon.

To begin with, there are two reasons to like FAANG as a group. The first is that secular tailwinds supporting the entire tech sector are accelerating because of the coronavirus pandemic. These tailwinds include the shift to digitization, the growth of the IoT, the coming age of 5G, and the remote worker/work from home model.

The second is that, in today’s environment, blue-chip dividend-paying stocks whose businesses can thrive during the pandemic are what you want to own. Within FAANG you will find a diversified group of blue-chip tech including streaming/media, web-services/cloud/search, consumer/retail, and tech-related infrastructure.

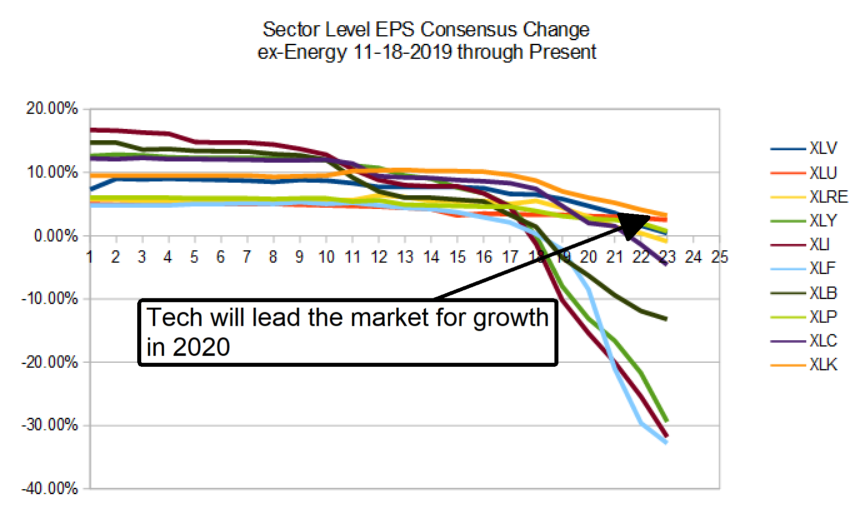

Now, FAANG is not a great dividend-paying group, far from it, but they are a solid bunch of blue-chip tech stocks. Apple is the only one to pay a dividend and that a small 1%. What mitigates the dividend factor is growth. Much of Tech, with FAANG in the lead, is going to see its EPS growth sustained in 2020 where most other sectors will not.

Google Beats But Growth Is Slowing

Google reported blowout revenue in its report but the news isn’t all good. The good news is the reported $41.16 billion is nearly $1 billion above consensus, a beat worth 250 basis points of growth, and up 13.3% from the previous year. The bad news is that sequentially, revenue fell from the previous quarter due to pandemic-related impact. On a sequential basis, revenue fell more than 10%. On the EPS end, both GAAP and adjusted EPS missed consensus and by substantial margins, mid-single-digits.

Ad-revenue on Youtube is a leading cause of the Q1 miss. Although the first two months of the year were strong ad revenues saw a sharp decline in March. The decline in ad-revenue facilitated a sharp decline in margins, 400 basis points, that cut deeply into profits. The silver lining is that, although segment revenue saw a 14% sequential quarterly drop, Youtube ad revenue is up 35% from the previous year and consumer trends are beginning to normalize.

Despite the miss, Google is still on track to hit the analyst’s targets for full-year revenue. Looking to next year, the analysts are expecting growth to continue in the range of 20%. Regarding the analysts, 40 of the 45 covering the stocks are bullish or very bullish with a consensus price target about15% above today’s prices.

The Technical Outlook Is Good, A Laggard Is Breaking Out

The technical outlook for Google is good. This first chart is the relative performance of the five FAANG stocks relative to the S&P. While no FAANG stock is lagging the broad market it is clear that Netflix and Amazon on the market favorites. No surprise there, Amazon (AMZN) is the leading consumer stock for the pandemic while Netflix is the leading entertainment stock. This leaves Google, FB (FB) and Apple (AAPL) trailing by a fair margin and in position to their shares begin to advance.

This second chart is one of Google. Google’s Q1 report has price action up by 8% in the premarket and trading above resistance. This move is very significant because it confirms support at the short-term 30-day EMA and a reversal in Google in stock that could lead to higher prices over the next few quarters.

Is It Time To Buy FAANG?

To answer the question, is it time to buy FAANG, it may not be time to buy the entire group but it looks like a good time to buy Google. This company still growing and able to produce growth despite the pandemic. Growth is both organic and through acquisition, acquisitions like the proposed purchase of D2iQ intended to solidify its position in the cloud. Longer-term, Google remains the leader in search and video, as well as a leader in cloud and other web services that it will be able to monetize over the coming years. It's probably a good time to buy Apple and Facebook too, before they report earnings.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.