Pfizer, Another Contender In The Fight Against COVID-19

Pfizer (PFE) made headlines a few weeks ago when it announced the development of a potential vaccine against COVID-19. The project is a joint venture between Pfizer and BioNTech (BNTX) and already underway. The first trial, an accelerated Phase 1 / 2 trial, began in Germany in late May. Since then, progress has advanced quickly and expanded to the U.S.

The news has helped drive shares of Pfizer higher, mostly on hype, and comments from Pfizer CEO Albert Bourla have helped fuel media hype. He said the company could make millions of doses this year with the first available by late Q3 early Q4, assuming, of course, the medicine proves effective. At least with remdesivir, Gilead has approval to use it to treat COVID-19.

In today’s news, Pfizer announced the first U.S.-based study of its vaccine BNT-192. The trial is underway at four sites and will help determine the optimal dose level of four mRNA vaccine candidates. The news sparked renewed interest in the stock, shares are up more than 3.0% in premarket trading, and it looks like this rally isn’t over. The question for me is this. Is Pfizer investible on this news, or is it just a trade?

Pfizer, Treading Water In 2020

Pfizer reported first-quarter results last week and the results are good. The company beat on the top and bottom lines due to strength in its existing businesses, a good sign in today’s times. Looking forward, the company is not expecting a material impact to its 2020 operations and reaffirmed the guidance.

Sales of Eliquis, Pfizer’s key growth-driving product, are up 29% from last year and not expected to slow soon. There are Eliquis generics ready to market but they won’t hit the shelves for years. The patent for Eliquis runs out in 2023 but litigation will keep the generics under wraps until 2025 or later. Other key drugs Ibrance (+10%) and Prevnar (-2%) also performed well in light of the pandemic.

The bad news is that guidance for the year is flat revenue and flat earnings, what’s worse is the analysts are not so sanguine. Despite the strong Q1 results and reaffirmed guidance, the consensus is for revenue and earnings to fall in 2020. Beyond that, revenue and EPS growth are expected to return in 2021 to the tune of 5% to 7%.

The Dividend Makes The Deal A Little Sweeter

While the outlook for growth is tepid and BNT-192 fueled growth speculation, the dividend at Pfizer is sound. The yield at today’s share prices is an attractive 4% and comes with a certain amount of growth expectation. Pfizer has been increasing the payout for ten years and the payout ratio is reasonably low at 56%.

Pfizer announced its latest distribution about two weeks ago. This payment is in-line with the previous and payable to shareholders of record May 8th which means Pfizer stock goes ex-dividend in two days. Regarding future increases, based on past history the next increase can be expected during the 2020 4th quarter earnings reporting cycle (calendar Q1 2021).

The Technical Outlook: Is Pfizer A Trade Or An Investment

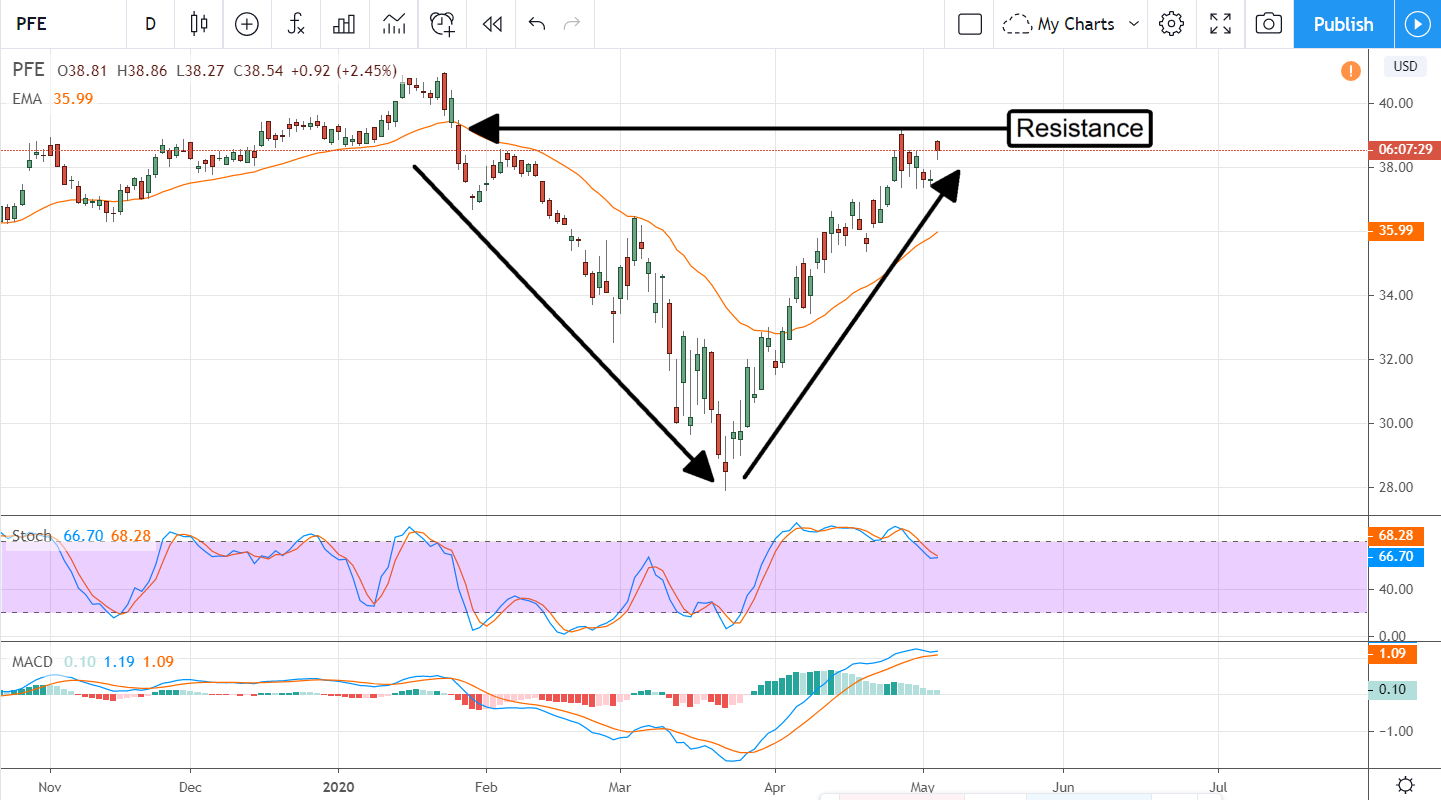

A look at the Pfizer chart will show you another stock in the process of a Vee-shaped recovery. This stock hit bottom along with the rest of the broad market and has since made a strong rebound. Share prices appear to be in a bullish consolidation and forming a bull flag, a pattern confirmed by today’s early market action. Pre-market trading has Pfizer up more than 3.25% on the BNT-192 news and probably heading higher.

I say probably because the early action failed to break above the $39.00 resistance level. The indicators are also iffy in that neither is strongly bullish or even showing a bullish crossover. With that said, if today’s price action can surpass and sustain a move above $39 I would be a buyer of this chart. At that point, targets emerge at $41, $44 and $46. The risk for investors is that BNT-192 could be a failure. Pfizer could be making big plans for nothing. That’s why I think this news makes Pfizer more of a trade than an investment, at least until the results are in.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.