Digital streaming service

Netflix NASDAQ: NFLX stock has been raging to new all-time highs on the heels of its Q3 2021 earnings results. Shares originally sold off in the after hours due to the mixed guidance but rallied in the following days as investors digested the news. The Company is coming off the success of its all-time best

streaming TV show Squid Game with over 140 million member households watching the series in the first month of release. Investors are mainly concerned with a slowdown in membership growth; however, the Company assures a slowdown in some demographics is a good thing. With the

return to work from the acceleration of

COVID vaccinations, it would seem logical to expect a reversion in growth. Netflix is planning on releasing video games but is still in the early stages with a vision of interactive gaming options. The Company noted that 2022 will see a normalization of its content slate with

COVID-19 behind them with the

reopening and content production returning. Prudent investors looking for exposure in this streaming leader can watch for opportunistic pullbacks instead of chasing entries.

Q3 Fiscal 2021 Earnings Release

On Oct. 19, 2021, Netflix reported its fiscal Q3 2021 results for the quarter ending September 2021. The Company reported earnings-per-share (EPS) profit of $3.19 versus consensus analyst estimates for a profit of $2.56. Revenues grew 16.3% year-over-year (YoY) to $7.48 billion, matching consensus analyst estimates. Global streaming paid net adds for the quarter was +4.38 million versus +3.50 million prior guidance. Q3 operating margins were 23.5% versus prior guidance of 20.7%. Netflix expects a more normalized content slate in 2022 with a greater number of originals. Squid Game has become the biggest TV show ever with 142 million member households watching in the first four weeks of release. The Company is testing video games in select countries. The Company is still in the early stages, but video games will be included in the fixed monthly fee and won’t have in-game advertisements or in-app purchases.

Mixed Forward Guidance

Netflix provided mixed guidance for Q4 2021 with EPS lowered to $0.80 versus $1.13 consensus analyst estimates. However, the Company sees Q4 revenues coming in higher at $7.712 billion versus $7.68 billion analyst estimates. Q4 global streaming adds will be +8.50 million. Operating margin guidance for Q4 was 6.5% compared to 14.4% in Q4 2020. Full-year 2021 will see operating margin of 20% versus 18% in prior year.

Conference Call Takeaways

The Netflix conference call was mainly a question and answering session. Netflix CFO Spence Newman addressed Q3 performance, “So throughout the quarter, the business remained healthy as it had been throughout the year with churn at low levels down prior to the comparable periods, both in 2020 and 2 years ago, pre - COVID in 2019. So retention was very healthy and viewing was up. Viewing per member is slightly down compared to the very COVID distorted 2020 Q3, but up a healthy compared to 2019, comparable period. And then what we saw as the quarter continued into September, we saw acceleration in our growth, which is what we had been hoping for and expecting, but it was good to see as we got into the strength of our schedule, we had a couple big hits. As you mentioned, one was squid game, la casa de papel.” He continued, “For Latin America, we saw that growth was a little bit soft in the quarter. It was primarily we took some price increases in Brazil in Q3. And as not unexpected, that tends to when we do those things slow down growth a little bit for the short-term. The good news is we only take pricing like that as Greg speaks to a lot when we believe we're increasing the value to our members and we believe we've done that. So, this is sort of a short-term slowdown in growth, but good for our business. And we're already continuing to grow through it, but this slowed us down a little bit in Latin America in Q3. And we also talked about in the letter for Latin America and UCAN, both of those markets are a bit more mature, more tenured, more penetrated than some of our other markets. So we would expect growth to be just a little bit harder work for, but still a lot of runway for growth in both of those regions.”

Forward Net Adds

Addressing forward guidance, Co-Founder Ted Sarandos commented,” So the guide is at 8.5 million paid net adds is essentially in line with the past few years, even pre - COVID where we were in that 8 million to 8.8 million-ish range. Right. And then you mentioned 2022. As the world starts to normalize next year, we'll see what that looks like, but how do you feel about your ability to get back to that 27 million, 28 million annual sub-addition level? And I hesitate to even ask the question because we're anchoring to this 27 million, which it would be helpful to understand actually why it fell into that consistent range over the last few years. And are we wrong to anchor on that recent history to begin with? I'm going to take it.” He added, “And if we deliver our guidance through Q4 over a trailing 24 month period, that's about 55 million paid net adds or about 27.5 million on average, which is kind of where we've been the last few years. But to Reed’s point, we can't predict with certainty, but those secular growth trends are pretty strong so long as we continue to improve our service.”

NFLX Opportunistic Pullback Levels

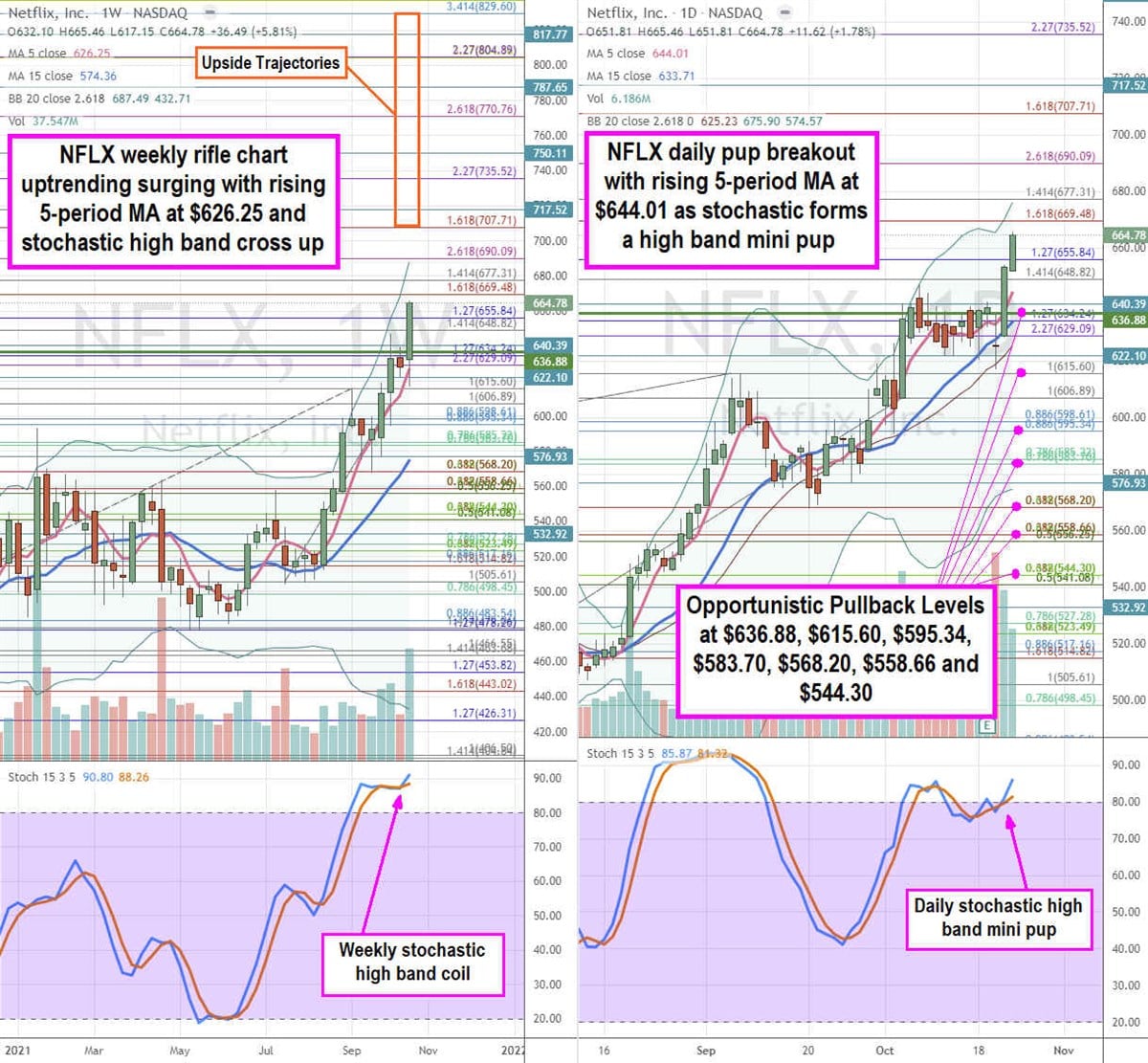

Using the rifle charts on the weekly and daily time frames provide a precision view of the landscape for NFLX stock. The weekly rifle chart has a strong uptrend with a rising 5-period moving average near the $629.09 Fibonacci (fib) level. The weekly upper Bollinger Bands (BBs) sit near the $690.09 fib level. The stochastic coiled back up through the 90-band as shares surged on its earnings reaction. The daily rifle chart formed a pup breakout with a rising 5-period MA at $644.01 with 15-period MA rising at $633.71. The stochastic formed a mini pup through the 80-band on the daily market structure low (MSL) buy trigger breakout above $636.88. Rather than chasing, prudent risk-tolerant investors can watch for opportunistic pullback levels at the $636.88 daily MSL trigger, $615.60 fib, $595.34 fib, $583.70 fib, $568.20 fib, $558.66 fib, and the $544.30 fib level. Upside trajectories range from the $707.71 fib upwards to the $829.60 level fib.

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.