Burlington Stores NYSE: BURL, an off-price clothing retailer, reported outstanding fiscal Q4 2020 earnings (the period ending January 30, 2021) on March 4.

Revenue increased 3.5% yoy to $2.28 billion, beating analyst estimates of $2.1 billion. Burlington’s adjusted earnings, which exclude one-time items, were $2.44 a share, above the consensus of $2.12 a share.

Same-store sales were flat for quarter, and improved as the quarter progressed. They were down 10% in November, flat in December, and then increased by 17% in January.

Off-price retailers have been hit very hard by the pandemic; they are typically not classified as essential businesses and many of them do not have strong online presences. That makes Burlington’s results even more impressive.

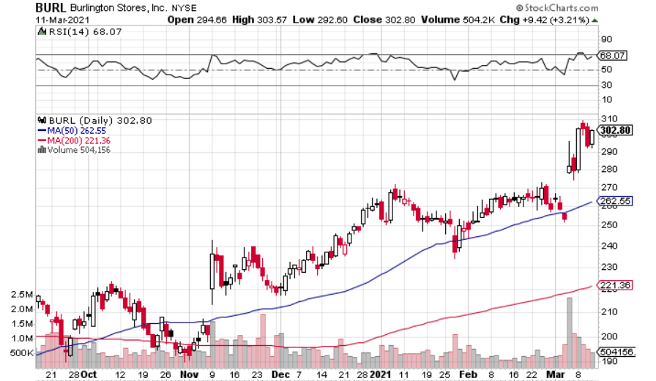

Investors took notice, and shares jumped by more than 11% following the report. Yesterday, BMO Capital Markets analyst Simeon Siegel reiterated his outperform rating and boosted his price target from $264 to $332. BURL shares increased by more than 3% on the news, pushing them to nearly 20% above March 3 levels.

It may seem like you’ve missed the bulk of the upside, but Burlington is still just getting started. The company has strong 2021 prospects and a bright long-term future.

Don’t Fear Lack of 2021 Guidance

Burlington management declined to provide specific sales or earnings guidance for fiscal 2021 due to “the uncertainty surrounding the pace of the recovery of consumer demand and the ongoing COVID-19 pandemic.”

It would be a mistake, however, to assume that a lack of guidance equals a lack of confidence. Burlington entered fiscal Q1 with comps trending in the right direction. That trend is unlikely to reverse for two reasons:

- Millions of Americans are getting vaccinated every week and at the same time, COVID cases are coming down. People are started to get more comfortable shopping at brick-and-mortar stores.

- The federal government just approved another COVID-relief package; it includes more stimulus checks.

The stimulus checks could be a nice tailwind for Burlington over the next few months. The company attributed its January comp growth to better weather and federal stimulus payments. But the January stimulus payments were for only $600. The new checks will be for $1,400. The cash infusion into Americans’ accounts could be a game-changer for Burlington’s fiscal Q1 2021 results.

The lack of guidance is actually a blessing in disguise for prospective investors. If management had issued guidance, it likely would have been on the high-end, which would have pushed the share price even higher.

Burlington Doubled Its Long-Term Store Target

Management may have been shy about its short to intermediate-term predictions, but it was bold about its long-term outlook. The company doubled its long-term store count goal from 1,000 to 2,000; it had 761 stores at the end of the fourth quarter.

In 2021, Burlington “expects to open 100 new stores, while relocating or closing 25 stores, for a total of 75 net new stores in fiscal 2021.”

At that rate, it may take Burlington a long time to get up to 2,000 stores. But it increases the chances that the new locations will be successful. Slow and steady wins the race

The Valuation is Reasonable

Burlington is trading at 43.9x projected 2021 earnings and 32.9x projected 2022 earnings. At first glance, those ratios look a little too high. Burlington closed out fiscal 2020 on a high note, but struggled for long stretches of the year.

But it appears that post-pandemic comp growth will be solid. Couple that with the expansion plans, and the current share price could look like an absolute bargain in a few years.

How Should You Play Burlington

Burlington shares have been flirting with overbought territory over the last few days. On top of that, the stock’s volume on the last two up-days has been lower than the previous day’s volume.

Burlington shares are an excellent long-term play, but there is a decent chance we’ll see a 5-10% pullback in the next couple of weeks. Consider picking up some shares if that happens.

Before you consider Burlington Stores, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Burlington Stores wasn't on the list.

While Burlington Stores currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.