Electric vehicle (EV) maker and hydrogen energy solutions firm Nikola NASDAQ: NKLA stock has seen a resurgence in recent events. Shares of the former SPAC took a dramatic sell-off on the ouster of its former CEO Trevor Milton and fraud allegations. However, the Company is rebuilding its reputation as it nears deliveries on its Nikola Tre BEV trucks. It is also in the process of settling civil fraud charges with the U.S. Securities and Enforcement Commission (SEC) for $125 million, which is 20% of cash on hand. Recently, Nikola announced deals for battery electric vehicles (BEVs) including the deal with USA Truck for 10 vehicles and with SAIA for 100 BEVs. The Company expects to deliver 25 vehicles in 2022 and up to 100 production vehicles by 2024. The Company expects profitability by 2025. Prudent investors seeking a potential turnaround play in clean energy and EVs can watch for opportunistic pullbacks in shares of Nikola.

Q3 2021 Earnings Release

On Nov. 3, 2021, NKLA released its fiscal third-quarter 2021 results for the quarter ending September 2021. The Company reported an EPS loss of (-$0.22) versus a loss of (-$0.38) consensus analyst estimates, a $0.16 beat. The Company is pre-revenues but managed to continue to grow its infrastructure building out a sales and service network of dealers in 28 states and over 130 locations. Nikola CEO Mark Russell commented, "Validation of the Nikola Tre BEV is progressing, with trucks now being test-driven and tested on public roads. We also formally inaugurated our joint venture manufacturing facility in Ulm, Germany, and entered into additional strategic partnerships to advance our hydrogen refueling ecosystem with TC Energy and OPAL Fuels." CEO Russell added, "with prospects of an SEC settlement, we're looking forward to resolving the outstanding issues relating to our founder and bringing that chapter to a close and maintaining our focus on delivering trucks to our customers, and building the energy, service, and support infrastructure our customers need."

Conference Call Takeaways

CEO Russell set the tone, “As you know, we've been engaged in discussions in cooperation with the SEC for some time regarding their investigation. We believe now that we have a potential settlement with them on the horizon, which is why we have reserved this amount. It reflects our best estimate of the civil penalty at this time. We expect it will be paid in installments over a 2-year period. We're looking forward to bringing this chapter to a close with this potential settlement and to focusing with renewed determination on building our future. Additionally, we intend to seek reimbursement from Mr. Milton for costs and damages arising from the actions that are the subject of the government investigations.” He continued, “Moving on to the latest on our Coolidge manufacturing facility. We've completed and are building trucks in what we call Phase 0.5 of the facility. And at the same time, we're building out the assembly expansion area, which will mark the end of Phase 1. That work should be done in the first quarter of next year, and then we'll move directly to Phase II, which should be completed in early 2023. And at that point, the facility will be capable of building up to 20,000 Nikola Tre BEVs and FCEVs on the same line and also of assembling Bosch fuel-cell modules. And from there, it will be a matter of ramping up over time towards our total nameplate capacity of 50,000 units in Coolidge. Next, we're very excited about the inauguration of our joint venture manufacturing facility in Ulm, Germany. The facility is complete. And as I mentioned previously, we're currently building 10 Tre BEV pre-series trucks. The facility has a production capacity of up to 2,000 units per year on 2 shifts. And we have the option to expand the line up to 10,000 vehicles per year as the Eurozone demand for Nikola BEVs and FCEVs ramps up. In addition, over the last few months, we made some important customer announcements, including a joint MOU between Nikola and IVECO, which we announced at the Ulm opening with the Hamburg Port Authority to deliver up to 25 Nikola Tre BEVs through 2022, a collaboration with PGT Trucking that includes an LOI to lease a 100 Nikola Tre FCEVs. The bundled leases include the Nikola Tre FCEV, hydrogen fuel, and service and maintenance in support of PGT. The first truck order was announced through our dealer network with the agreement with Tri-Eagle sales to lease 10 Nikola Tre BEVs from Ring Power Corporation, one of our dealers. We expect the Nikola dealer network to continue to play an integral role in delivering zero-emissions products to our customers. In addition to providing the trucks, in parts and service, Ring Power, in this case, will also provide the charging infrastructure for Tri-Eagle. We've made strong progress in the expansion of our sales and service network. We announced the additions of Alta Equipment Group and Quinn Company. Alta Equipment will provide coverage in the Northeast, including New York, New Jersey, and Eastern Pennsylvania in select areas in the New England region. Quinn company will provide sales and service coverage throughout Central and Southern California. We'll continue to make announcements as we enter into agreements and expand our sales and service footprint, which is a mission-critical item for us as we begin to deliver vehicles to customers.”

NKLA Opportunistic Pullback Levels

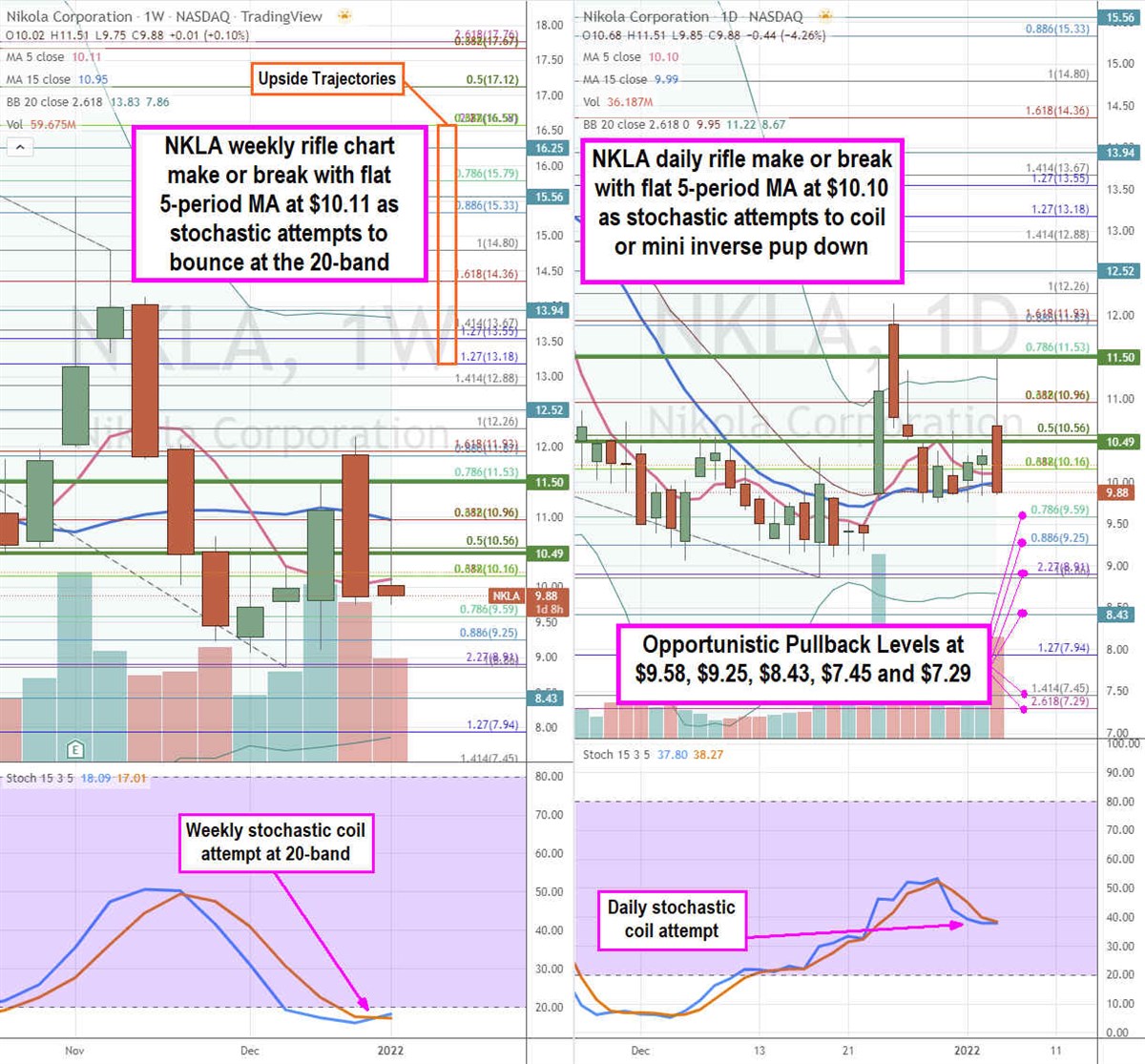

Using the rifle charts on the weekly and daily time frame provides a broad view of the landscape for NKLA stock. The weekly rifle chart recently peaked near the $12.26 Fibonacci (fib) level. Shares plunged as the weekly stochastic formed a mini inverse pup through the 20-band. The weekly rifle chart has a flat 5-period moving average (MA) at $10.11 followed by the 15-period MA at the $10.96 fib. The weekly stochastic is attempting to cross back up nearing the 20-band. Incidentally, there are two weekly market structure low (MSL) buy triggers on a breakout through $10.49 then $11.50. The daily rifle chart is also in a make or break with an uptrend pup attempt on the 5-period MA at $10.10 versus a stochastic mini inverse pup attempt at the 40-band as the Bollinger Bands (BBs) compress between the $11.22 upper BB and $9.99 lower daily BB. Prudent investors can watch for opportunistic pullback levels at the $9.58 fib, $9.25 fib, $8.43 fib, $7.45 fib, and the $7.29 fib level. Upside trajectories range from the $13.18 fib level up towards the $16.58 fib level.

Before you consider Nikola, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nikola wasn't on the list.

While Nikola currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.