Streaming video hardware and software platform operator Roku Inc. NASDAQ: ROKU shares plummeted over 35% following its Q4 2023 earnings report. The company generates most revenues from its legacy hardware sales, Roku TV sales, licensing the Roku operating system to Smart TV manufacturers and operating its namesake ad-supported streaming channel, the Roku Channel. Its stock had a parabolic run up to $108.84 on November 29, 2023.

The consumer discretionary sector company's shares were also hurt when Walmart Inc. NYSE: WMT announced the acquisition of smart TV maker Vizio Holding Co. (NYSE: VZIO) and its SmartCast operating system on February 20. This was the second gut punch after the earnings drop that further propelled shares lower.

It's all about the ARPU

Roku has benefitted from the cord-cutting trend, ad-supported channel growth and the migration to streaming TV and entertainment services, which has driven viewer engagement to a record high through 100 billion hours in 2023, which averages to 4.1 hours per day per account in Q4.

Roku's base of active accounts has grown larger than the customer base of the six largest pay-TV operators combined. Unfortunately, its average revenues per user (ARPU) declined in Q4 2023, sending shares tumbling more than 35%.

The ARPU riddle

The law of averages dictates that if more users join the platform on flat revenues, its ARPU naturally drops since the denominator grows. Therefore, revenue must rise proportionately to grow the ARPU.

However, Roku grew its user base by 14.3% year-over-year (YOY) to 80 million users. Streaming hours rose 21.8% YOY to 29.1 billion hours. Roku grew its revenues 14% YOY to $984 million. But ARPU fell 4.2% YOY to $39.92. While APRU has had its ups and downs, it hasn't been under $40 since Q2 2021, when Roku only had 55.1 million users.

Stay on top of the stock market sectors on MarketBeat.

ARPU drop causes

The cause of this drop in ARPU lies mainly in its growth in international users. Roku is growing but getting less money from international users, historically a much smaller ARPU.

The United States and Canada generate the most ARPU on streaming platforms and services compared to Netflix Inc. NASDAQ: NFLX and social media platforms Snap Inc. NYSE: SNAP, Pinterest Inc. NYSE: PINS and Meta Platforms Inc. NASDAQ: META

While international user growth can lift total user growth metrics, it also drags total ARPU metrics.

Strong user and revenue growth

On February 15, Roku reported a loss of 55 cents per share to match consensus analyst estimates. Roku achieved positive adjusted EBITDA and free cash flow for 2023, ahead of schedule. Revenues jumped 1% YOY to $984.4 million, beating analyst estimates of $967.72 million.

Raised revenue guidance

Roku raised Q1 2024 revenues to $850 million versus $829.5 million consensus analyst estimates. Total gross profit is expected to be around $370 million, with a net loss of about $90 million. Adjusted EBITDA is expected to be zero.

Get AI-powered insights on MarketBeat.

Roku CEO Anthony Wood saw 2023 as the year of operating expense reduction and internal operation improvements. Wood expects 2024 to be the year of platform growth and innovation. He did note that despite the recovery in the advertising market, the recovery is uneven and expects to face a difficult media and entertainment environment in 2024. Margins for its platform should compress soon and maintain a 13% growth rate in Q1 2024, less than the 18% platform growth seen in Q3 2023.

They will be a better programmer of its home screen to help monetize its 80 million active users. He noted, "We use this to grow ad reach, which correlates to add revenue, as well as to grow our streaming service distribution activities."

CEO Wood expects more demand for ad-supported streaming. Wood commented, "We expect strong demand for ad-supported tiers on Roku, as many users seek value price streaming options. With our platform advantages, love brand, first-party relationships with 80 million active accounts and deep user engagement, we're well positioned to accelerate revenue growth in future years."

Analyst downgrades

After Roku's earnings report, several analysts chimed in with downgrades and price cuts. Pivotal Research reiterated its "hold" rating but lowered its price target to $75 from $85. Citigroup reiterated its "neutral" rating but lowered its price target to $75 from $110.

Oppenheimer cuts its range to "perform" from "outperform." Analyst Jason Helfstein pointed out, "While we are positive on new management's strategy to embrace 3P programmatic demand and increase data integration to drive performance-based campaigns, a high percentage of Platform revenue is driven by SVOD advertising, SVOD price increases, and Media & Entertainment advertising. These areas are expected to struggle for most of 2024." They removed the $100 price target and see the stock price rangebound in 2024.

Check out Roku analyst ratings and price targets at MarketBeat. Look for peers and competitor stocks with the MarketBeat stock screener.

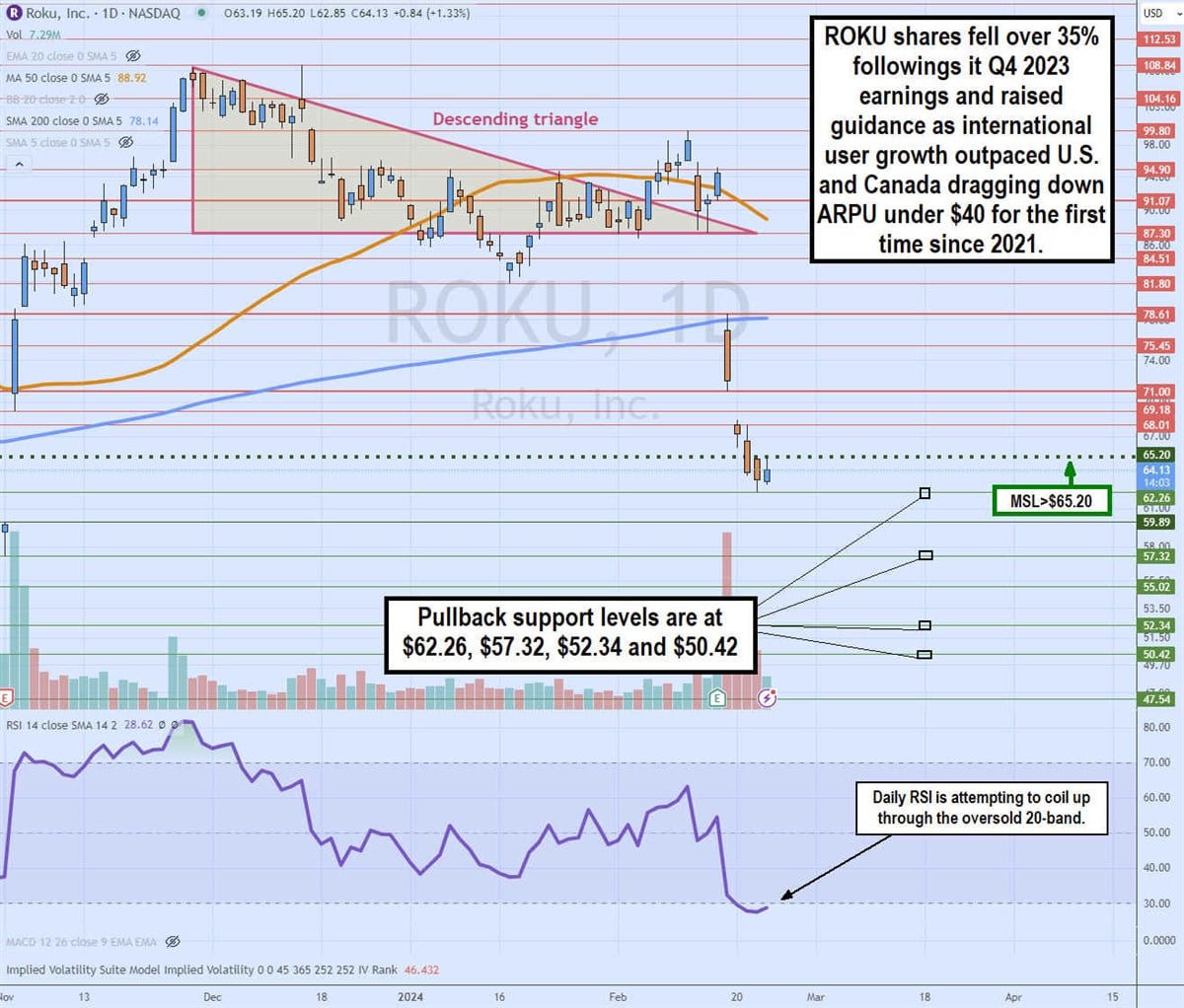

Daily descending triangle breakdown pattern

The daily candlestick chart on ROKU illustrates a descending triangle breakdown pattern. The descending trendline formed at the $108.24 swing high on November 29, 2023. The flat-bottom trendline formed at $87.03 after testing multiple times.

The daily 50-period moving average (MA) turned into a resistance heading into Q4 2023 earnings, setting up a breakdown through the flat-bottom trendline on the gap down to $78.61 and through the daily 200-period MA on February 16.

Shares continued to gap down again to sell off $68.38 on the announcement of WMT buying ROKU competitor VZIO, sending shares to a swing low of $62.26 on February 22. The daily market structure low (MSL) buys trigger formed at $65.20.

The daily relative strength index (RSI) fell under the 30-band but is attempting to coil. Pullback support levels are at $62.26, $57.32, $52.34 and $50.42.

Before you consider Meta Platforms, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Meta Platforms wasn't on the list.

While Meta Platforms currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report