Things aren’t always as they seem.

A stock can close up a bit for the day, and have a bearish performance. Alternatively, it can be bullish if a stock closes down a bit for the day. It’s all about the context.

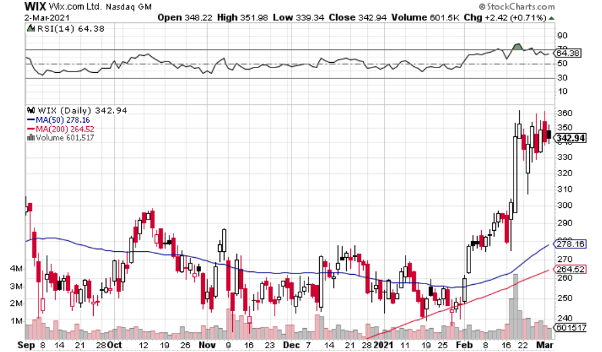

Take Wix.com NASDAQ: WIX for example:

Nearly a month ago, shares plunged by as much as 14.4% after reporting Q2 earnings. But WIX came roaring back and closed the day down 0.5%.

WIX shares found support in the mid $260s. So even though shares quickly traded back down to that level over the following three days, it shouldn’t come as much as a surprise that the decline again stopped in the mid $260s (which was also just above the 50-day moving average).

Shares have now bounced to nearly $300 a pop, and have spent the past two months range bound between $264 and $319. A breakout above $319 would give you the technical go-ahead.

Let’s take a look at the earnings report that led to WIX taking a stand in the mid $260s… And see if the cloud-based development platform provider has the juice for another leg-up.

WIX Has Fared Well in 2020… But Also Has History of Revenue Growth

In Q2, Wix’s revenue increased 27% yoy to $236.1 million. Its premium subscribers increased 17% yoy to 5 million, while its total registered user base went up 18% yoy to 182 million.

Note that WIX has a freemium business model, so the vast majority of its users aren’t generating much if any, revenue. The conversion rate pales in comparison to Spotify’s NYSE: SPOT nearly 1:1 ratio of free to paid users. On the other hand, Wix has a lot of upside if it can convert even a small fraction of its free users into paid subscribers.

Management is expecting sales to increase 26-27% yoy during the third quarter.

While the 2020 growth is impressive, Wix isn’t just a pandemic beneficiary:

Over the past five years, Wix has averaged 26% yoy revenue growth and 15% yoy registered user and subscription growth.

Earnings Missed… But There is a Silver Lining

In Q2 2020, Wix recorded an adjusted net loss of $0.26 per share, which fell short of analyst estimates for an adjusted profit of $0.24, and was less than the adjusted profit of $0.34 in Q2 2019.

Revenue beat expectations, so the earnings are likely what sent shares plunging after the report.

But again, it wasn’t as bad as it seemed:

The company lost money largely due to the investments it made in customer care and marketing. These are good uses of money for a growing company.

Furthermore, Wix’s operating and free cash flow increased 34% to $50 million and 52% to $46.7 million, respectively.

Once you consider the context, the quick post-earnings recovery makes sense.

Positioned for Post-COVID Prosperity

The 2020 shift to e-commerce has been an acceleration of an existing trend, so most of it will likely stick post-pandemic.

This bodes well for Wix, which benefits as more businesses prioritize their online operations.

The restaurant industry is one that offers Wix a lot of long-term upside. The industry has been slammed since the onset of the pandemic, with the few strong performers investing heavily into their online operations.

And more generally, subscription businesses are an excellent place to put your money because they are sticky.

Lofty Valuation, But Growth is Not Expected to Slow Down

WIX is trading at 16.3x forward sales, and its P/E ratio will not look attractive for at least the next couple of years.

But revenue is projected to increase around 26% in each of 2021 and 2022.

The fast revenue growth and potential for Wix to generate high margins down the road make the company an attractive risk/reward.

The Verdict

Wix is a pandemic winner that was winning pre-pandemic and should continue to win post-pandemic.

That said, the valuation is steep, and the path to solid earnings is unclear.

So even though the risk/reward is attractive, I’d wait for a convincing breakout before getting in – and then place a stop-order within 10% of your purchase price to limit your downside.

Before you consider Wix.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wix.com wasn't on the list.

While Wix.com currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report