Sleep, we all need it. But can you profit from it? While sleep is a staple of everyday life, retailers are feeling the pullback in consumer spending. Sleep products range from mattresses, frames and bases to bedding and accessories. The manufacturers and retailers that make these products fall under the consumer discretionary sector. Macroeconomic uncertainty and inflation have caused consumers to tighten their budgets, which has been impacting mattress stocks. However, value investors should look at these two mattress stocks, which have opposite price trajectories.

Tempur Sealy International Inc. NYSE: TPX

The merger of Tempur-Pedic and Sealy in 2013 created one of the world's largest bedding providers. Tempur-Pedic is well known for its body-forming supportive memory foam mattresses and adjustable foundations. The company operates three major brands: Sealy, Tempur-Pedic, and Stearns & Foster. They operate over 700 company-owned stores under the Tempur-Pedic, Sleep Outfitters, Sova, Sleep Solutions Outlet and Dreams brands. The company was ranked #1 in Customer Satisfaction for the Online Purchase segment in the J.D. Power 2023 U.S. Mattress Satisfaction Survey. The company expects the Mattress Firm acquisition to close in Q4 2023.

Profitable but slipping sales.

Tempur reported Q3 2023 earnings of 77 cents, missing estimates by 4 cents. Revenues fell 0.5% YoY to $1.28 billion, missing $1,28 billion analyst estimates. North American revenues fell 3.2%, but International revenues surged 12.3%. Adjusted operating income rose 3.9% to $214.7 million YoY. Adjusted net income fell 0.7% to $136.8 million.

Improving margins

Gross margins improved 270 bps to 44.9%, compared to 42.2% in the year-ago period. Adjusted gross margins were 45.9% compared to 42.5% YoY. North American adjusted gross margins improved 300 bps due to normalizing commodity costs and operational efficiencies. International gross margins improved by 320 bps to 56.6%

Lowering guidance

Tempur Sealy lowered its full-year 2023 forecasts for EPS of $2.30 to $2.50, down from $2.50 to $2.70 versus $2.60 consensus analyst estimates. Full-year revenues are expected between $4.92 billion to $5.02 billion versus $5.02 billion analyst estimates. Check out the sector heatmap on MarketBeat.

CEO Insights

Tempur Sealy CEO Scott Thompson commented, "Improvements in operations and supply contracts, combined with the impact of consumer-specific strategies, drove significant gross margin expansion, positioning the Company well for the future." He noted that the U.S. bedding market continues to be challenging and softer than anticipated as macroeconomic pressures continue to impact consumer behavior. The international market helped it to outperform the broader bedding market.

Tempur Sealy analyst ratings and price targets are at MarketBeat. Tempur Sealy's peers and competitor stocks can be found with the MarketBeat stock screener.

Inverse daily cup pattern

The daily candlestick chart on TPX illustrates an inverse cup pattern that commenced at $35.28 on June 6, 2023. Shares rose to a high of $47.57 on September 1, 2023, before plunging to $36.02 on November 10, 2023. Shares jumped 10% on November 14, 2023, to peak at $41.33, but with no news. There was heavy Nov. 40 call action after D1 Capital disclosed it maintained its 9.46 million share position. The daily 200-period moving average resistance is at $40.41. The daily market structure low (MSL) buy trigger is at $37.40. The daily relative strength index (RSI) is flat near the 50-band. Pullback support levels are at $37.40, $36.02, $34.80 and $33.14.

Formerly known as the Select Comfort Co, the company changed its name to Sleep Number in 2017. The company applies science and technology to its Climate 360 adjustable smart bed air mattresses and Flexfit adjustable bases for a personalized experience. Users can select a "Sleep Number" to customize the firmness and support of the bed as its air chamber technology makes the adjustments.

Many beds have built-in sleep-tracking (SleepIQ) technology that tracks various aspects of a user's sleep, including heart rate, sleep duration, movements and sleep patterns. The SleepIQ technology captures billions of data points nightly. The company sells its products through stores found in high-traffic areas like malls and strip centers, direct-to-consumers, direct marketing and online. Sleep Number is rolling out its next-gen smart beds with a starting price of $1,066.

Nightmare results

Sleep Number reported a Q3 2023 loss of 10 cents per share, missing consensus analyst estimates for a profit of 16 cents, a 26-cent miss. Revenues fell 13% YoY to $473 million, missing analyst estimates of $508.56 million. The company initiated $50 million of additional operating expense reductions on top of the $80 million for 2023. Gross margins improved by 130 bps due to easing commodity prices.

More cost reduction actions and lowered full-year 2023 EPS guidance

Cost reduction actions include a 10% headcount reduction of 500 workers and the closure of 40 to 50 stores by the end of 2024. Sleep Number lowered its full-year 2023 EPS outlook for a loss of 70 cents, which includes 35 cents in restructuring charges. SNBR has a 12% short interest.

Abrupt consumer demand drop

Sleep Number CEO Shelly Ibach commented, "The third quarter was challenging for Sleep Number and the bedding industry as the consumer demand trajectory changed abruptly midway through the quarter." August and September were the months that experienced an abrupt drop in demand. Industry demand is estimated to be down double-digits in the quarter, down 20% from 2019, below 25 million units and the lowest level since 2015. The bedding industry has been in a recession for the past two years. The first seven months looked strong, but August and September saw a dramatic drop as consumer purchasing power moved to the lowest on record.

Ibach noted that the company moved fast to adjust and cut costs, recalibrate sales and marketing approach, and amend its credit agreement to provide additional flexibility through 2024. Ibach concluded, "We expect these actions and broad-based restructuring initiatives to result in a more durable operating model with improved profitability and cash flows in a range of economic environments."

Sleep Number analyst ratings and price targets are at MarketBeat.

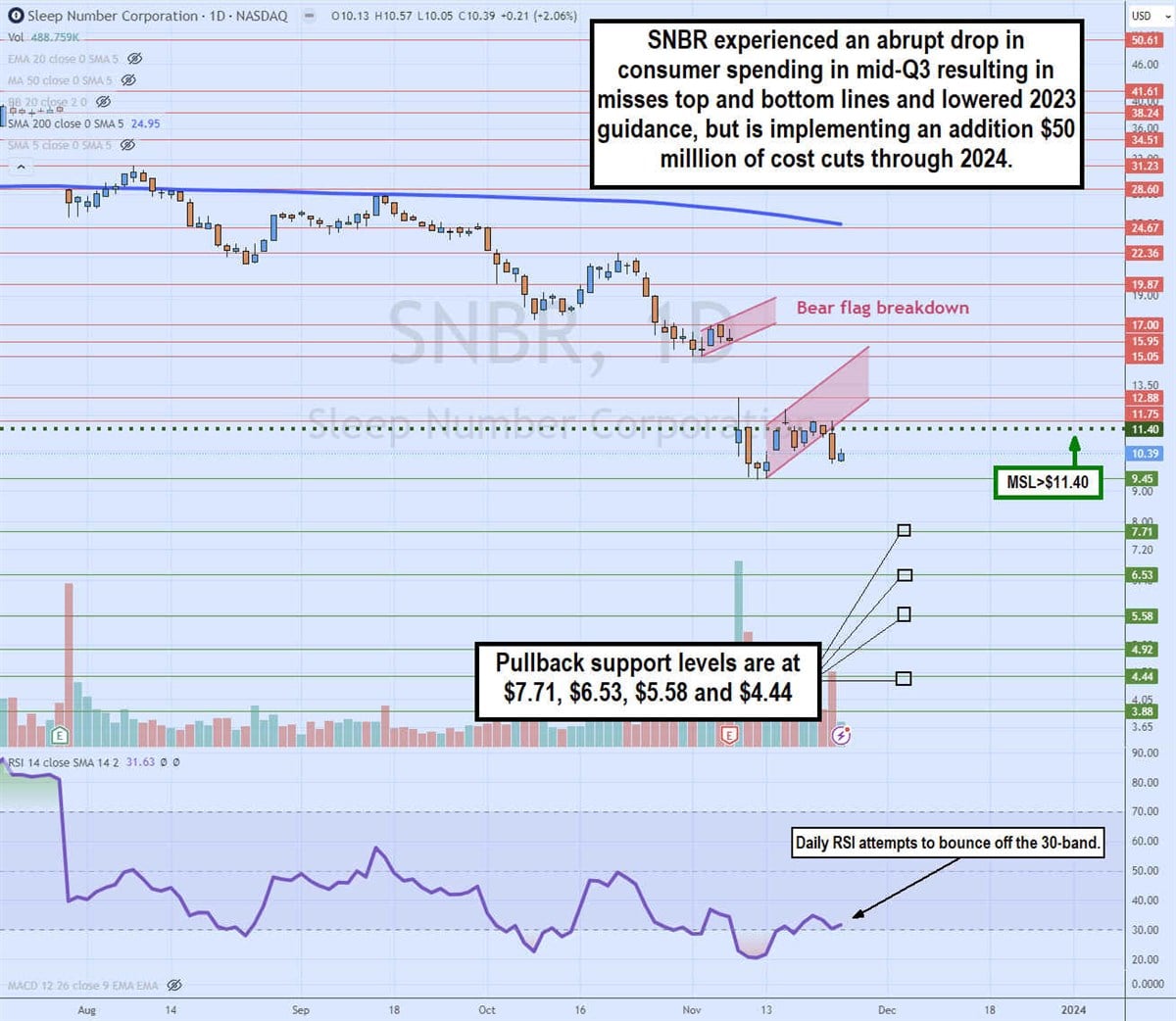

Daily bear flag breakdowns

The daily candlestick chart on SNBR illustrates the bear flags that triggered its Q3 2023 earnings release. The first bear flag triggered the $15.95 break to form a 29% price drop on earnings results on November 8, 2023. Shares continued to plummet to $9.45. The daily MSL trigger formed at $11.40 as the rally attempt failed again. Shares fell back under the lower flag trendline at $11.40 with a $9.45 break as the bear flag breakdown trigger. The daily RSI has been trying to bounce off the oversold 30-band. Pullback supports are at $7.71, $6.53, $5.58 and $4.44.

Before you consider Tempur Sealy International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tempur Sealy International wasn't on the list.

While Tempur Sealy International currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report