Tire and automobile service provider

Goodyear Tire and Rubber Company NYSE: GT shares have been recovering along with the global

automotive recovery after being hit hard during the

pandemic as an

epicenter industry. The Company completed its merger with Cooper Tire and Rubber in June 2021 as commuters and travelers hit the roads. The Company has also invested in

electric vehicle (EV) projects and partners with autonomous technology players to have a piece of next-gen technology. The recovery in the automotive sector remains “robust”. While global

supply chain problems and

chip shortages impact automobile production, the consumer business remains favorable as dealers and repair shops continue to restock inventory with the

reopening trend in addition to shifts in electronic powertrains. The Company is a one-stop-shop for vehicle maintenance as economies of scale help to improve margins. Prudent investors expecting a continued recovery in the automotive sector can look for opportunistic pullbacks in shares of Goodyear.

Q2 FY2021 Earnings Release

On Aug. 6, 2021, Goodyear released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported an earnings-per-share (EPS) profits of $0.32 versus consensus analyst estimates for $0.17, a $0.15 beat. Revenues rose 85% year-over-year (YoY) to $3.98 billion beating analyst estimates for $3.95 billion. Tire unit volumes rose 84% YoY to 37.5 million. Replacement tires grew 78% and Original equipment unit volume grew 109% driven by higher vehicle production. This volume growth is also due to the merger with Cooper Time completed on June 7, 2021. Goodyear CEO Richard Kramer commented, “We delivered merger-adjusted segment operating income significantly above last year and nearly 60 percent higher than second quarter 2019. Our strong results reflect a continued recovery in demand, including above-market growth across many of our businesses. In addition, the execution of our strategies helped deliver the highest quarterly contribution of price/mix in nine years. Broad economic recovery remains robust, particularly in the U.S. and China," continued Kramer. Our second-quarter results demonstrate our ability to capture value in the marketplace with innovative products and services while overcoming inflationary cost pressure. The addition of Cooper Tire in early June also contributed to our strong merger-adjusted earnings growth, and we welcome all of our new colleagues to the Goodyear family. Our teams are now focused on integrating our businesses and leveraging the combination to provide enhanced service for our customers and consumers.”

Conference Call Takeaways

CEO Kramer set the tone, “For the second quarter, we delivered $349 million of merger adjusted segment operating income, which is over one and a half times what we earned in the second quarter of 2019. These strong results reflect a continued recovery in demand, and we outperformed industry growth across many of our businesses. At the same time, we delivered the highest quarterly contribution of price mix that we've seen in our business in nine years and we continue to have good momentum. As I look at the global consumer replacement industry during the quarter, we continue to see a sustained path toward recovery. As you would expect, this general theme is largely carried by mature markets. We continue to experience pandemic-related weakness in several of our emerging market countries. More broadly, however, economic recovery remains robust, particularly in the US and China. Given these markets play to our strengths, we saw global consumer replacement market share rise nearly one point. In our OE business, the global shortage of semiconductors resulted in weaker and more volatile demand than we expected. The auto industry produced approximately two million fewer vehicles than initially expected at the beginning of the quarter. Despite the weaker than expected backdrop, we continue to recover share globally, including the benefit of our strong position on SUV's and light trucks. We're also continuing to see the benefits of our strong cost management.”

Commercial Business

CEO Kramer continued, “Turning to commercial, volume was more than 10% above 2019 levels despite lower freight volume. We benefited from exceptionally strong results in the on-road segment, driven by our growth portfolio fleet customers. During the quarter, for example, we added Tesco's fleet of 6,800 trucks and trailers to our customer portfolio. Tires alone are no longer enough to win over fleet customers. Today's fleets demand innovative solutions that will help them maximize uptime and reduce costs. We recently unveiled Goodyear drive point, the latest productivity tool in our total mobility offering. Drive point combines valves sensors, battery-powered receivers, and mobile apps to deliver fleets a cost-effective way to monitor tire performance. These technology solutions strengthen our position as a preferred provider of monitoring and predictive maintenance, making Goodyear more valuable to our customers and preference over other mobility solution providers.”

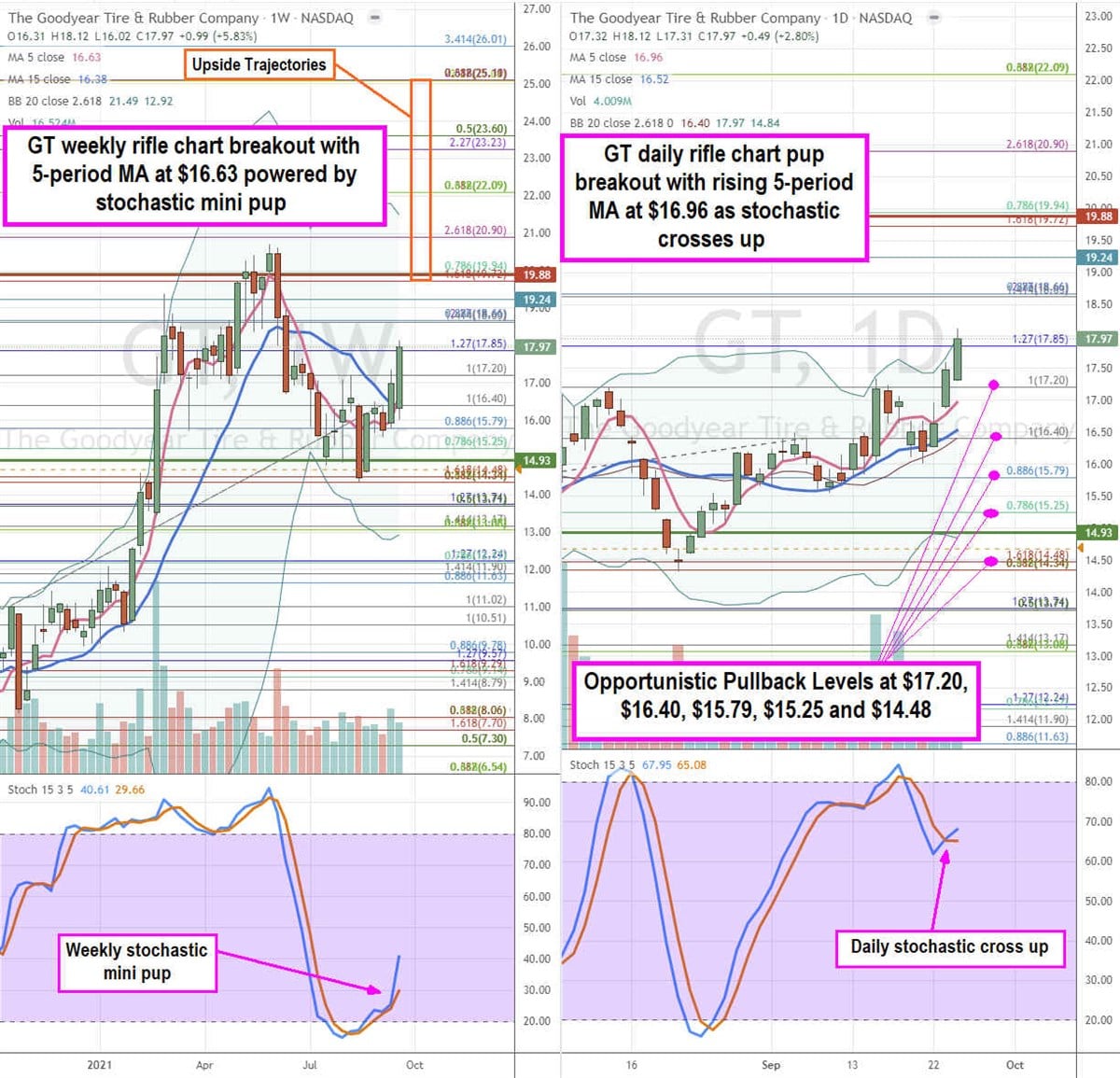

GT Price Trajectories

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for GT stock. The weekly rifle chart formed a breakout as the 5-period moving average (MA) crossed the 15-period MA at $16.63 as shares charged up towards the $17.85 Fibonacci (fib) level. The weekly stochastic formed a mini pup through the 40-band. The weekly upper Bollinger Bands (BBs) sit at $21.49. The daily rifle chart formed a pup breakout with a rising 5-period MA at $16.96 as it peaks at the $17.97 daily upper BBs. The daily stochastic crossed up again around the 70-band. The daily formed a breakout on the daily market structure low (MSL) buy trigger above $14.93. Prudent investors can watch for opportunistic pullback entry levels at the $17.20 fib, $16.40 fib, $15.79 fib, $15.25 fib, and the $14.48 fib level. Upside trajectories range from $19.72 fib up to the $25.18 fib level.

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.