Cybersecurity firm

CyberArk Software NASDAQ: CYBR shares have awoken but still trading below its pre-COVID levels in February. Shares are underperforming the benchmark

S&P 500 index NYSEARCA: SPY and momentum peers in the

cybersecurity space. Rather than chase the newcomers, prudent investors can look for value opportunities in the lagging leaders in the space. The acceleration of remote and work-from-anywhere endpoints has driven the need for enterprise level privilege access management (PAM) products which falls right into the Company’s sweet spot of products. The continued migration to cloud is a major headwind that was accelerated by the pandemic as companies realize the cost benefits of SaaS platforms. Investors looking for exposure in a post-pandemic cybersecurity recovery play should monitor opportunistic pullback entry levels while shares are starting to gain traction.

Q2 FY 2020 Earnings Release

On Aug. 2, 2020, CyberArk released its fiscal second-quarter 2020 results for the quarter ending June 2020. The Company reported an earnings-per-share (EPS) profit of $0.42 excluding non-recurring items versus consensus analyst estimates for a profit of $0.27, beating estimates by $0.15. Revenues grew 6.3% year-over-year (YoY) to $106.5 million meeting analyst estimates of $101.24 million. Licensing revenues continue to improve with 9% YoY SaaS subscription booking growth. Recurring license revenue grow to 25% of license revenues at $12 million, up from 5% YoY. Combined maintenance and professional services revenues rose 22.7% YoY to $58.6 million for the Q. The top growth came from insurance, pharmaceuticals, telecom and healthcare in Q2 while travel, retail and transportation books declined directly due to the pandemic. CyberArk lowered forecasts for Q3 2020 with EPS estimates in the range of $0.19 to $0.33 versus $0.38 consensus analyst estimates. The Company sees Q3 2020 revenues in the range of $107 to $115 million versus $111.11 consensus estimates.

Q2 2020 Conference Call Takeaways

CyberArk CEO Udi Mokady noted that identity security and PAM were at the top of CIO’s priority lists in light of growing IT threats in the backdrop of a pandemic. “The Maze, Twitter and recent COVID-19 vaccine attacks demonstrate that privilege pathway is the attack vector of choice, putting PAM as a top priority”, stated Mokady. The Company experienced a revenue headwind driven by SaaS and subscription business with over 170 logos in the Q. While the pandemic served to speed up onboarding of new clients, it also prolonged the deal process as budgets were more scrutinized. Mokady described some of the deal wins including an insurance company integrating CyberArk SaaS security solutions to 130,000 endpoints to accommodate the work-from-home/anywhere imperative. This enabled the client to block ransomware threats. He reiterated the trend for identity security as access grows exponentially through mobile, digital, cloud, and remote workforces.

Synergy of Services

The accelerated need for cloud security products was only expedited from the pandemic. Enterprises are trending to “Zero Trust” access which plays into CyberArk’s strengths. Tactical acquisitions have enabled the Company to parlay synergistic services to complement its PAM core. Identity as a service (IDaaS) through its Idaptive acquisition enables CyberArk to integrate AI-powered lifecycle endpoint management transforming it into an identity and access management (IAM) player. Gartner estimates 90% of new access management purchases globally will favor the SaaS-delivery model by 2022. The Company noted existing customers drove 75% if license revenues for the Q as they move forward with mission-critical PAM programs and add-on business. Investors should watch for reversions to opportunistic pullback levels to gain exposure with the near-term uncertainties of COVID-19.

CYBR Opportunistic Pullback Levels

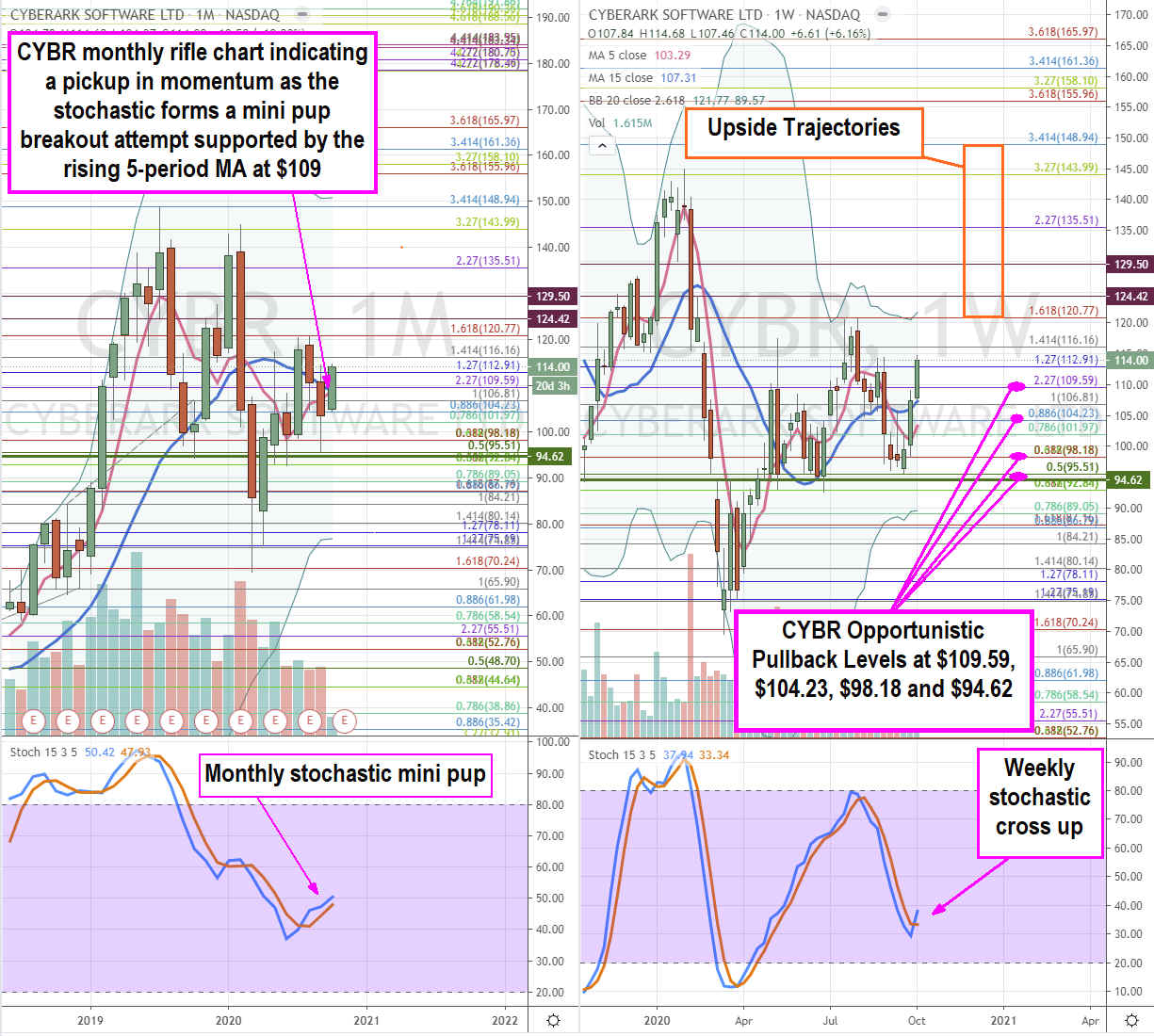

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for CYBR stock. The monthly rifle chart formed a bullish stochastic mini pup as the monthly 5-period moving average (MA) attempts to crossover the 15-period MA. The weekly rifle chart indicates a reversal attempt on the stochastic trying to cross back up. The weekly market structure low (MSL) buy triggered above the $94.62 as shares held pullbacks at both the $95.51 and $92.84 Fibonacci (fib) level. The daily chart shows a big grind to $114s double top resistance shortly after triggering the weekly MSL. It’s best to wait for pullbacks from this known resistance area for opportunistic pullback levels at the $109.59 fib, $104.23 fib, $98.18 fib and the $94.62 weekly MSL. The upside trajectories range from the weekly to monthly upper Bollinger Bands (BBs) from the $120.77 fib to $148.94 fib. For traders, keep an eye on the price action of peers like OKTA, Inc. (NASDAQ: OKTA), Palo Alto Networks, Inc. NASDAQ: PANW and Zscaler, Inc. NASDAQ: ZS to gauge industry sentiment.

Before you consider CyberArk Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CyberArk Software wasn't on the list.

While CyberArk Software currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.