KLA Corporation A Stock You Can Hold On To, And Like It

KLA Corporation (NASDAQ:KLAC) reported earnings on Monday and blew away the estimates. Before I get to that though, I want to talk a minute about the company itself. KLA Corporation makes and services the equipment used in the manufacture of semiconductors. While not specifically a maker of semiconductors, microprocessors, and their related wafer technologies it is fundamental to the entire technology industry. You can’t have today’s technology without semiconductor technology and you can’t make semiconductors without KLA Corporation.

Regarding the stock and its attraction as an investment, KLAC has many attractive features. To start, it is a growth company. The Age of Digital is upon us and trends driving use have only accelerated in the wake of the COVID-19 pandemic. At present, the consensus for revenue and EPS growth is in the high single to the low double-digit range but that could change. Once the 5G revolution takes hold demand for chips, and newer more advanced chips (and their equipment) will grow.

On top of that, KLAC is a dividend grower. The company has been increasing the payout each year since the distribution was initiated and there are some other impressive statistics. The payout ratio is a low 32% which implies the company will have no trouble paying the dividend and increasing it over the long-term. The balance sheet backs that up, there’s plenty of cash, manageable debt levels, and ample coverage. The yield itself is a little low but the 15% CAGR tells me future increases will be worthwhile.

KLA Corporation Besting The Consensus And Raising Guidance

The trendI’ve seen in the markets this earnings cycle is this; companies immune or resistant to the pandemic are not only beating consensus for Q2 EPS but they are also raising guidance or so obviously on track to beat FY consensus to make it meaningless. KLA Corporation is no different. The company posted a solid beat on the top and bottom line and raised guidance for the full year.

“KLA ended the June quarter with near-record total company backlog, demonstrating momentum in the marketplace across multiple product platforms in both the Semiconductor Process Control and EPC groups. Newly launched products such as the well-received eSL10 e-beam inspection platform, help drive our market leadership”

Revenue came in at $1.46 billion, up 15.9% and 270 basis points better than consensus. Revenue strength was driven by Specialty Semiconductor equipment and the PCB, Display, and Component Inspection segments. Specialty Semiconductor equipment, notably, saw its revenue increase 18% from the prior quarter and 50% on a YOY basis. The PCB, Display and Component Inspection segment saw its revenue grow 26% from the prior year’s 4th quarter.

On the bottom line, GAAP revenue of $2.63 beat by $0.40 while adjusted beat by $0.31. Looking forward, the company sees revenue and earnings for the 1st quarter of fiscal 2021 coming in well above consensus. Topping off the news, the board approved the company’s 11th consecutive dividend increase bringing the annual payment to $3.60 or 1.75%.

KLA Corporation Technical Outlook: The Time To Buy Is Now

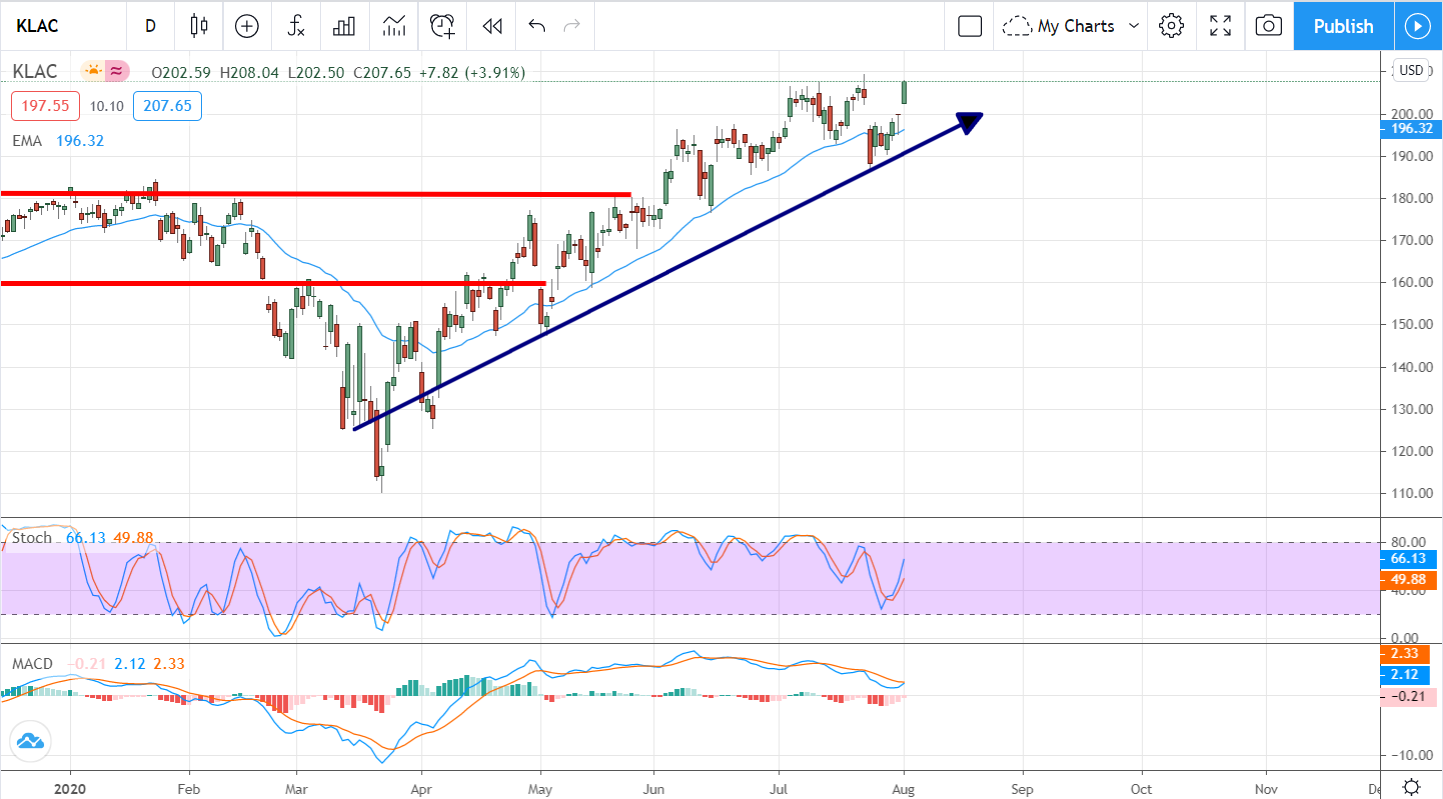

Shares of KLAC made their move well before the earnings news came out, rising nearly 4% to set a new all-time closing high just before the report was released. Today, price action has pulled back a bit but that is good news for those looking to buy more of this semiconductor stock. Price action over the past two to three weeks has been a bit choppy, the early price action should be viewed as backing-and-filling to close price gaps left by previous market action.

Long-term? This stock is trending strongly on outlook, now that results confirm what the market suspected a move to new highs is likely. From the technical perspective, price action has made a strong steady rally from the March low and is now forming a consolidation/continuation pattern. When price action breaks to new highs shares of KLAC could gain another $90 or 42% over the following 12 months.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.