U.S. major automobile manufacturer

Ford Motor Company NYSE: F stock has recently pulled back on the global

semiconductor shortage which is providing opportunistic to scale in shares. The Company has transformed itself into a more efficient player expanding into the

electric vehicle (EV) markets. The EV segment is seeing great demand despite the lead from

first movers like

Tesla (NASDAQ: TSLA) or

newcomers. The Company also has a stake in

Amazon NASDAQ: AMZN backed EV startup Rivian. The Company is fully onboard with electronification with plans to have most models operating electronically by 2030. The CEO stated that the Company is set for a springboard-like snap back in production once the global chip shortage stabilizes. The post-pandemic recovery has

bolstered demand for new and used vehicles as evidenced by Ford’s Q2 2021 blowout earnings. Prudent investors looking for an entry into a big three automaker onboard with the

EV movement can look to gain exposure on opportunistic pullbacks in shares of Ford.

Q2 FY 2021 Earnings Release

On July 28, 2021, Ford released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported an earnings-per-share (EPS) profit of $0.13 excluding non-recurring items versus consensus analyst estimates for $0.04, a 0.09 beat. Revenues rose 45.1% year-over-year (YoY) to $24.13 billion beating analyst estimates for $22.83 billion. Adjusted EBIT rose to $1.08 billion from (-$1.95 billion) in 2020 versus consensus of $86 million. The chip shortage is causing Ford to lost nearly 50% of its Q2 production. The Mustang Mach-E and other vehicles grew 7X larger customer retail order book than same period year ago. Business is spring-loaded for a rebound once the semiconductor shortage stabilizes. The Company raised outlook for full year 2021 adjusted EBIT guidance to $9 billion to $10 billion versus consensus analyst estimates for $6.83 billion.

Conference Call Takeaways

Ford CEO, Jim Farley set the tone. “We're committed to delivering a richer experience for our Ford and Lincoln customers, one that improves over time with things like our over-the-air software upgrades, data-driven experiences, productivity and uptime services for our critical commercial customers, charging software, and a lot more. Ford Plus also means introducing the industry's most compelling, high-volume, electric vehicle line-up and investing the capital and human resources required to design and build world-class batteries and electric powertrain components.” He continued, “And with Argo AI, we're well-positioned to launch an autonomous people and goods delivery business with significant future growth potential. But fundamental to transforming forward is to further strengthen our auto operations while we're also expanding our addressable market. Our commitment is to earn your confidence with strong execution quarter-after-quarter, year-after-year, delivering solid returns regardless of the challenges that we face with external environment like we did in the second quarter.

Despite the many headwinds from the semiconductor shortage, some of which were unique to Ford, our teams skillfully managed our business, and we generated a positive EBIT. And I can tell you that this outcome was far from certain at the beginning of the quarter. It required intense focus from our team, on cost, pricing, and mix. The primary advantage we have right now is the strength of our product portfolio. And it's about to get a lot stronger. We stopped making me too products in declining segments few years ago. And we unleashed our product development team to create emotional and distinctive products that only can come from Ford. The Mustang Mach-E, which is already the second best-selling electric SUV in the U.S., was recently named Car and Driver Electric Vehicle of the Year after rigorous testing against 10 other great EVs, including the Tesla Model Y Performance, the Porsche Taycan, and the Audi e-tron. The demand for our first round of high-volume EVs clearly has exceeded our most optimistic projections.”

Chip Shortage

CEO Farley addressed the global semiconductor shortage, “In April, we said we'd expect to lose about 50% of our planned volume in the second quarter, which then implied a loss in adjusted EBIT. In fact, we did better than expected. We leveraged the strong demand to optimize our revenue and profits. We're seeing signs of improvement in the flow of chips now in the third quarter, but the situation remains fluid, especially due to the delay in ramp-up of one of our key suppliers, Renesas, that Ford is uniquely exposed to in the first half. Overall, after effectively managing through the first half, we are now spring-loaded for growth in the second half and beyond because of those red-hot products, pent-up demand, and improving chip supply. Navigating these chip constraints has led us to make important permanent changes in our business model at Ford. We are modernizing our go-to-market strategy. What does that mean? We're placing greater emphasis on build-to-order sales bank, not just low stocks. We have learned that, yes, operating with fewer vehicles on lots is not only possible, but it's better for customers, dealers, and Ford. But we're also driving a significant increase in the number of customers configuring and ordering their vehicles online.”

He continued, We are now engaging directly, for example, with the fabs on semiconductors and key points in supply chain for critical components, electronic components. With closer relationships and more transparent exchange of information, such as technology roadmaps, we can integrate their know-how into our designs to better align supply and demand. Second, we're providing longer-term forecast to critical vendors so they can better understand and accommodate our requirements. And third, we are more comprehensively scanning for obstacles in our supply chain. Risk mitigation actions include stockpiling of critical parts like semis, dual sourcing, and design interchangeability in the case of single sources. These changes are all being applied to new technologies as well, including batteries, which are rapidly becoming a larger portion of our bill of material at Ford. Our pending joint venture with SK Innovation, called BlueOvalSK, will produce EV battery cells and arrays, helping us secure supplies of batteries at competitive cost and performance levels really critical given our demand for our new electric vehicles. And now I'd like to turn over to John to take us through the results for the quarter and our outlook.”

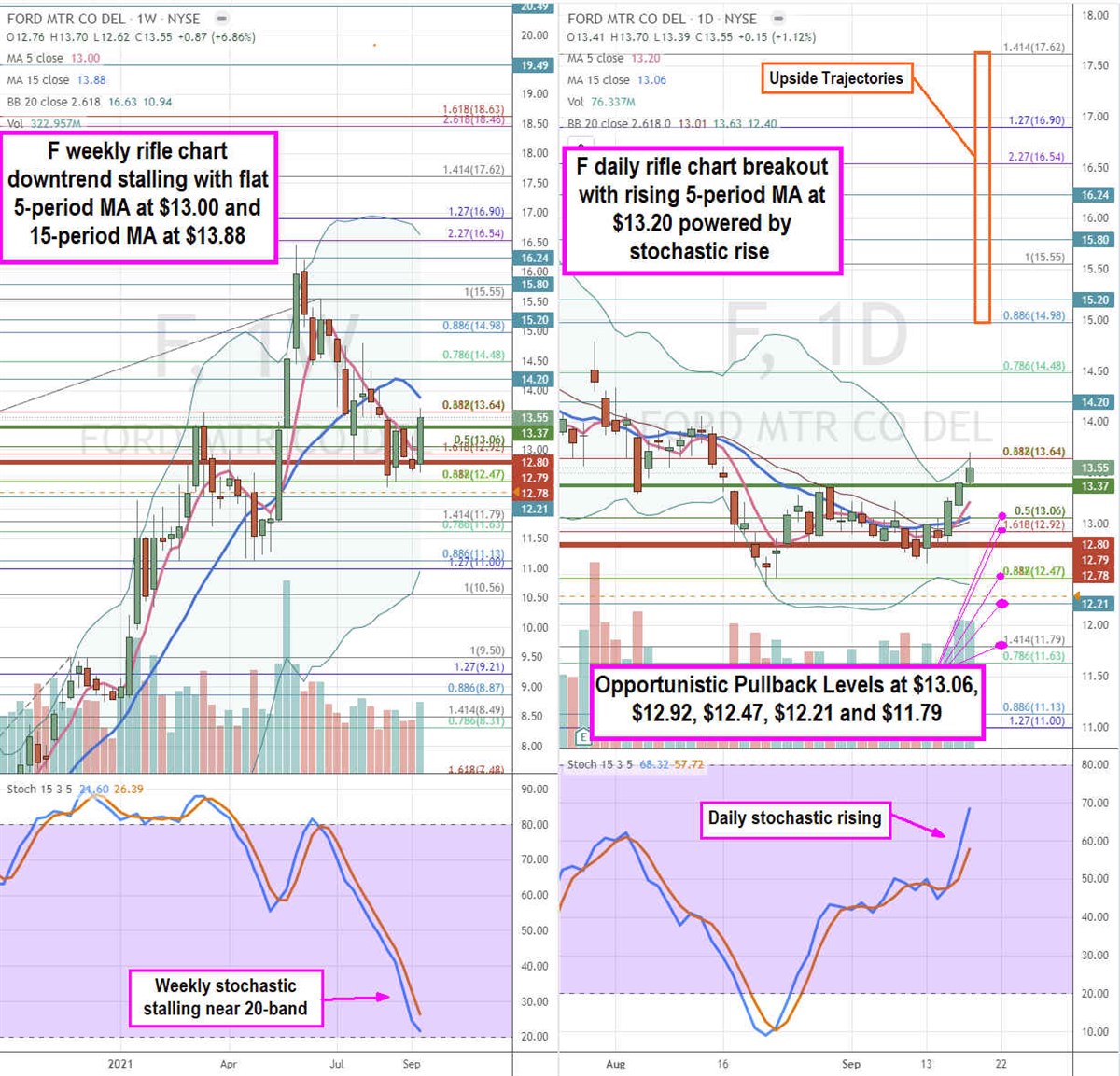

F Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provide a precise view of the price action playing field for F stock. The weekly rifle chart downtrend stalled as shares rallied off the monthly market structure high (MSH) sell trigger at $12.80. The weekly 5-period moving average (MA) support sits near the $13.06 Fibonacci (fib) level as it tries to channel tighten back to the weekly 15-period MA at $13.88. The weekly stochastic is also slowing its descent as it near the 20-band. The weekly market structure low (MSL) buy triggers above $13.55. The daily rifle chart has a breakout with rising 5-period MA at $13.20 and 15-period MA at the $13.06 fib. The daily Bollinger Band (BB) compression is starting to expand again with upper BBs at $13.63 and growing. The daily stochastic is rising towards the 80-band. Prudent investors can watch for opportunistic pullback levels at the $13.06 fib, $12.92 fib, $12.47 fib, $12.21 fib, and the $11.71 fib. The upside trajectories range from the $14.98 fib to the $17.62 fib level.

Before you consider Ford Motor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ford Motor wasn't on the list.

While Ford Motor currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report