Electronics manufacturer

Jabil Circuit NYSE: JBL stock has be relatively resilient amidst the

sell-off in the benchmark indexes. The Company manufactures electronics products various diversified industries including mobility, healthcare,

connected devices, automotive, digital print, retail industrial, 5G wireless, cloud and network storage. Jabil is a master in dealing with

supply chains and it continues to expand margins from consumer electronics components to circuit boards. Chances are your electronics, mobile devices, computers and home

appliances have components made by Jabil especially when it supplies to major brands including

Apple NASDAQ: AAPL,

Amazon NASDAQ: AMZN,

Johnson & Johnson NYSE: JNJ, and

Tesla NASDAQ: TSLA. Jabil

raised its fiscal full-year 2022 top and bottom lines all the while shares have fallen to a cheap 9.5X forward earnings. Prudent investors seeking a value play in the electronic components segment can watch for opportunistic pullbacks in shares of Jabil.

Q1 Fiscal 2022 Earnings Release

On Dec. 16, 2021, Jabil reported its Q1 fiscal 2022 results for the quarter ending November 2021. The Company reported earnings-per-share (EPS) of $1.92 versus consensus analyst estimates for $1.80, a $0.12 beat. Revenues grew 9.8% year-over-year (YoY) to $8.6 billion, beating analyst estimates for $8.28 billion. Diversified manufacturing services (DMS) revenues rose 11% YoY. Electronics manufacturing services (EMS) revenues grew 7% YoY.

Upside Guidance

The Company raised its fiscal Q2 2022 EPS guidance to a range of $1.35 to $1.55 versus $1.32 analyst estimates. Revenues are expected to come in between $7.1 billion to $7.7 billion compared to $7.36 billion consensus analyst estimates. Jabil raised full-year fiscal 2022 EPS guidance to $6.55 versus $6.35 analyst estimates and revenue guidance to $31.8 billion versus $31.54 billion analyst estimates.

Conference Call Takeaways

Jabil CEO Mark Mondello expressed the effort on expanding margins as the Company benefits from secular trends ingrained in customer sectors. He summed it up, “We believe these markets will drive our growth, with the overwhelming majority of such growth occurring organically, as we placed our attention on secular opportunities, opportunities such as 5G, electric vehicles, personalized health care, cloud computing, and clean energy. Furthermore, our commercial portfolio is intentional, and we think quite special. Each slice of this pie harbors domain expertise, affording us an essential collection of valuable capabilities. Although what's most impactful is the way in which we merge these capabilities with precision and speed as we serve our customers. Our approach is further enhanced by seamless collaboration across the organization combined with our unique Jabil structure. And when done correctly, we simplify the complex for many of the world's most remarkable brands. And we do so as we lean into a massive market where things need to be built, and supply chains need to be optimized.” CEO Mondello also pointed out that large scale diversification has enabled the Company to rely less on any single product or product family by the year. Jabil is committed to delivering over $700 million in free cash flow this year as it monetizes on multi-year secular trends in various end-markets.

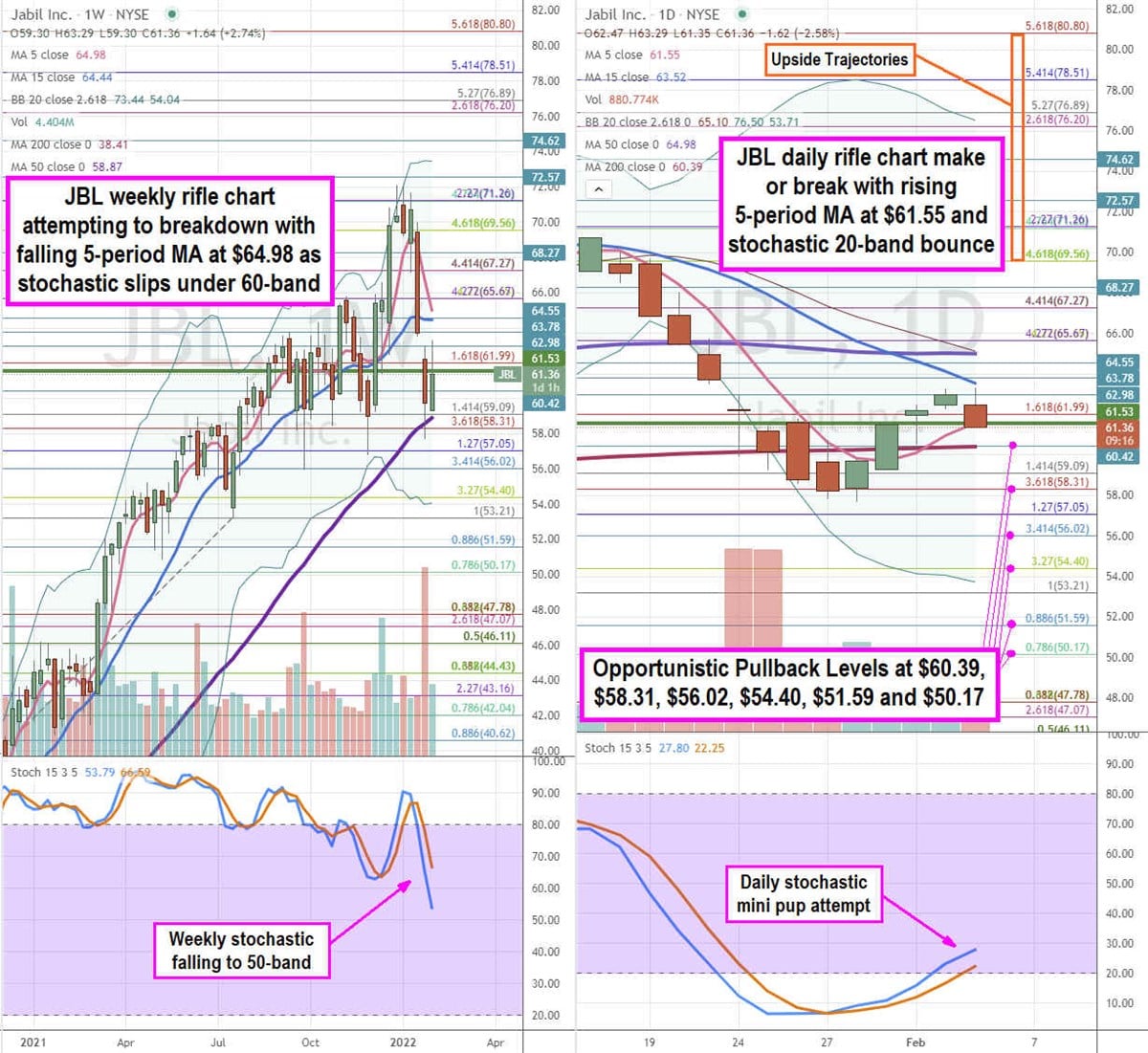

JBL Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for JBL stock. The weekly rifle chart uptrend peaked at $71.35 at the beginning of January 2022 before selling off towards the $58.31 Fibonacci (fib) level. Shares have coiled back above the weekly 50-period moving average (MA) at $58.87. The weekly rifle chart is attempting to breakdown as the 5-period MA is falling at $64.98 towards the 15-period MA at $64.44. The weekly stochastic has collapsed through the 80-band heading towards the 50-band. The weekly lower Bollinger Bands (BBs) sit at $58.87. The daily rifle chart has a make or break as the 5-period MA rises at $61.55 in a channel tightening towards the 15-period MA at $63.52. The daily stochastic bounced up through the 20-band. The daily market structure low (MSL) buy triggers on a breakout through $61.53. The daily 200period MA sits at $60.39 and 50-period MA at $61.55. Prudent investors can look for opportunistic pullback levels at the $60.39 daily 200-period MA, $58.31 fib, $56.02 fib, $54.40 fib, $51.59 fib, and the $50.17 fib level. Upside trajectories range from the $69.56 fib level up towards the $80.80 fib level.

Before you consider Jabil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jabil wasn't on the list.

While Jabil currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.