The nation’s largest bank

JPMorgan Chase & Co. NYSE: JPM stock has been leading the financials down as benchmark indexes prepare for interest rate hikes. The

U.S. Federal Reserve has made it clear that a monetary tightening policy is taking effect. Traditionally, stock markets rise during monetary expansion and low-interest rates and subsequently fall during monetary tightening and rising

interest rates. The banks and financials are one sector that benefits from rising rates but can have problems swimming

upstream in a falling market. Nonetheless, JPMorgan continues to ramp up its technology and digital capabilities as it hit record profits in fiscal 2021. The Company announced it would be increasing its expenses in 2022 by 8% to fund new investments in technology.

Investment banking revenues are expected to fall with rising rates, but the Company looks to bolster its

fintech offerings to offset this. Prudent investors seeking exposure in a rising rate environment can watch for opportunistic pullbacks in JPMorgan.

Q4 Fiscal 2021 Earnings Release

On Jan. 14, 2021, JPMorgan released its fiscal fourth-quarter 2021 results for the quarter ending December 2021. The Company reported earnings per share (EPS) profits of $3.36 versus $3.04 consensus analyst estimates, a $0.32 beat. Revenues fell (-0.3%) year-over-year (YoY) to $29.26 billion, compared to $29.78 billion. Credit costs net benefit $1.3 billion after $550 million net charge-offs. JPMorgan CEO Jamie Dimon commented, “JPMorgan Chase reported solid results across our businesses benefiting from elevated capital markets activity and a pick-up in lending activity as firmwide average loans were up 6%. The economy continues to do quite well despite headwinds related to the Omicron variant, inflation, and supply chain bottlenecks. Credit continues to be healthy with exceptionally low net charge-offs, and we remain optimistic on U.S. economic growth as business sentiment is upbeat and consumers are benefiting from job and wage growth."

Conference Call Takeaways

JPMorgan CFO Jeremy Barnum covered the financials directly off the slide presentation and the outlook moving forward, “As you’ll remember from Daniel’s comments in December, the 17% that we have talked about as a medium-term ROTCE target is not realistic for 2022. We do expect to see some tailwinds to NII, including the benefit of the latest implied and the expectation that card revolve rates will increase. But the headwinds likely exceed the tailwinds as capital markets normalize off an elevated wallet, and we continue to make additional investments as well as the impact of inflationary pressures. However, despite these potential challenges for the near-term outlook, we do continue to believe in 17% ROTCE as our central case for the medium term as rates continue to move higher and we realized business growth, driven by our investments. So, let us try to give you more detail around forward-looking drivers that could be headwinds or tailwinds. So first, the rate curve. Our central case does not require a return to a 2.5% Fed funds target rate as the current forward curve only prices in 625 basis-point hikes over the next three years. Assuming we realize the forward curve, from there, we see the outcomes as being relatively symmetric with plus or minus 175 basis points of ROTCE impact as a reasonable range relative to our central case. And of course, there are obviously any number of rate paths to get there, which could produce different outcomes over the near term. In this illustration, the downside assumes that rates stay relatively constant to current spot rates whereas upside would be driven by a combination of a steeper yield curve, more hikes together with a more favorable deposit reprice experience. And of course, what we are evaluating here is the impact of rates in isolation on NII, but for the performance of the Company as a whole, credit matters a lot. And the reason why rates are higher will have an impact on that. In markets and banking, we feel good about the share we’ve taken, and there are reasons why the beginning of a rate hiking cycle could be quite healthy for fixed income revenues in particular, at least in the sense that it might provide a partial offset to what we would otherwise expect in terms of post-COVID revenue normalization. In our central case, markets and banking normalized somewhat in 2022 relative to their respective record years in 2020 and 2021 and resume modest growth thereafter. The downside case assumes a return to 2019 trend line levels with sub-GDP growth rates, whereas the upside case assumes continued growth from current elevated levels.”

He continued, “Looking at the key drivers of that for 2022, there are a few major factors. Rates, with the market-implied suggesting approximately three hikes later this year and the reason steepening of the yield curve, we would expect to see about $2.5 billion more NII from that effect. You can see at the bottom right, we’ve shown you the third-quarter earnings at risk and an estimate of what we would expect to disclose in the 10-K, reflecting the year-end rate curve and changes in the portfolio composition.”

JPM Opportunistic Pullback Levels

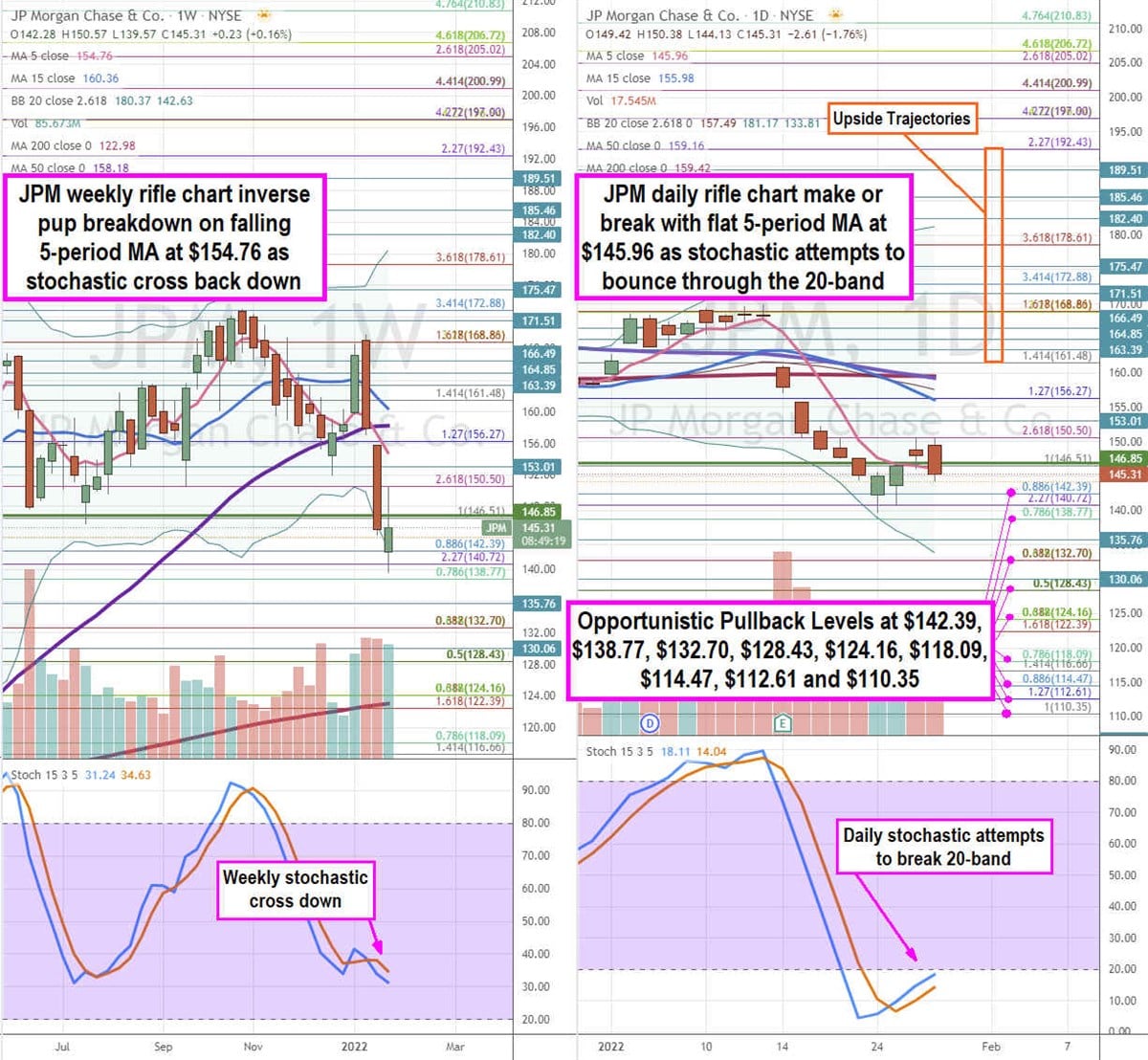

Using

the rifle charts on the weekly and daily time frames provide a precise view of the price action playing field for JPM stock. The weekly rifle chart peaked near the $172.88

Fibonacci (fib) level before falling towards the $138.77 fib area. The weekly rifle chart formed an inverse pup breakdown falling through the 50-period moving average (MA) at $158.18. The weekly 5-period MA is falling at $154.76 followed by the 15-period MA at $160.36. The weekly lower Bollinger Bands (BBs) at $142.63. The daily rifle chart has a make or break as the 5-period MA flattens at $145.96 and 15-period continues to tighten the channel at $155.98. The daily stochastic has cross up but testing the 20-band to either break or reject. The daily

market structure low (MSL) buy triggers on a breakout above $146.85 with daily upper BBs at $181.17.

Prudent investors can watch for opportunistic pullbacks at the $142.39 fib, $138.77 fib, $132.70 fib, $128.43 fib, $124.16 fib, $118.09 fib, $114.47 fib, $112.61 fib, and the $110.65 fib level. The upside trajectories range from the $161.48 fib up Before you consider JPMorgan Chase & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JPMorgan Chase & Co. wasn't on the list.

While JPMorgan Chase & Co. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.