Wearable components maker

Kopin NASDAQ: KOPN stock has been in a freefall as the

re-opening narrative has sparked a migration away from growth narratives to value. However, Kopin’s narrative is so good, that the

sell-off is providing opportunistic buying opportunities for investors that believe in the convenience, utility, and efficacy of frictionless smart glasses as an

enterprise tool to bolster productivity moving forward in the commercial, military and healthcare end-markets. The stock is linked to the performance of various smart glass makers like

Vuzix (NASDAQ: VUZI) or

Microvision NASDAQ: MVIS stock. However, Kopin has been around for over two decades as a pioneer and manufacturer and supplier of the complex smart lenses that go into the smart glasses incorporating augmented reality (AR) and virtual reality (VR). When the hype dies down and smoke clears, it becomes very clear that the next-gen technology for contactless, frictionless, smart lenses bolsters efficiency, output while providing the safety, access and convenience reserved for science fiction fodder now becoming reality beyond the hype. Prudent investors looking for a real foothold by investing in the actual technology of the smart lens provider of smart glasses can watch for opportunistic pullback opportunities in Kopin shares.

Q1 FY 2021 Earnings Release

On May 4, 2021, Kopin reported its Q1 2021 results for the quarter ending March 27, 2021. The Company reported revenues of $11.7 million, up 48% year-over-year (YoY) from Q1 2020 revenues of $7.9 million. Non-GAAP net loss was $1.8 million or (-$0.02) per-share compared to (-$0.04) per share in year-ago same period. Research and Development revenues grew 82% YoY. The Company has no long-term debt. Cash and cash equivalents were approximately $35.6 million as of March 27, 2021, quarter’s end. The Company generated $15.5 million in proceed from the at-the-market (ATM) program for 2.4 million shares, which also concluded the previously announced ATM program for $20 million.

Conference Call Takeaways

Kopin CEO, John Fan, set the tone, “We now have more than 10 programs in various stages of development, but some of them may not contribute significantly to product revenue for the next year or two. This is by far the strongest defense program portfolio in Kopin’s history. They set the stage well for the coming years. We continue to aggressively pursue additional opportunities in the defense market and expect to make some announcements regarding these opportunities in the coming months.” He continued, “Additionally, we continue to see strength in our enterprise market segments with the strong volume growth in enterprise AR and 3D automatic optical inspection systems, which are recovering nicely following a slowdown in the early days of the pandemic. The growth in these was offset by a decrease in public safety sector as municipal government budgets were affected by the pandemic.” The Company increased its defense revenue by 42% YoY in Q1 2021. The Company has over 10 defense programs in various stages of development all using the Company’s microdisplays and specialized optical systems and ruggedized assemblies. CEO Fan stated, “All defense programs are either AR or VR applications and Kopin continues to explore addition AR and VR applications in defense, industrial and consumer areas.”

KOPN Opportunistic Pullback Levels

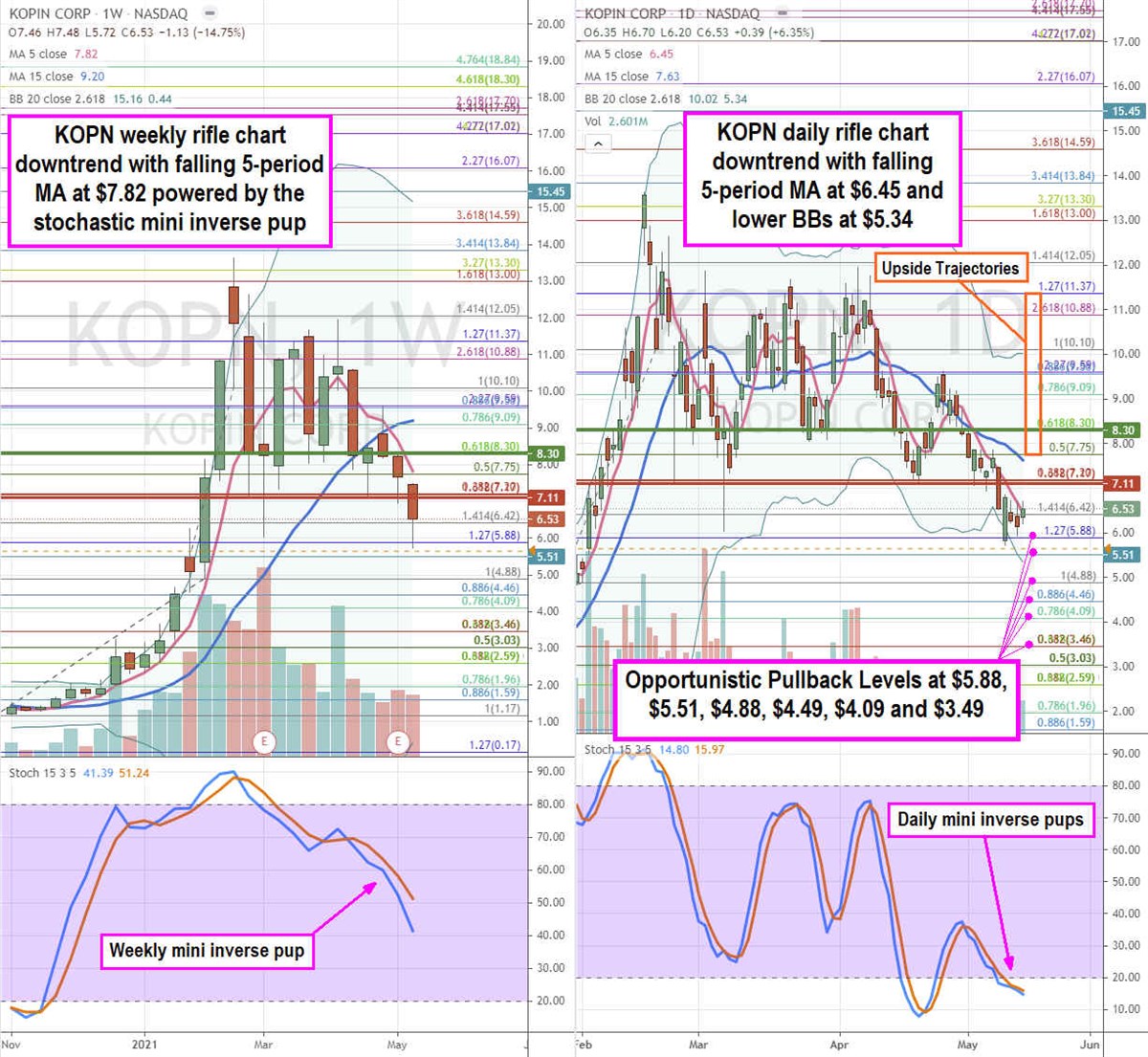

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for KOPN stock. The weekly rifle chart has a downtrend with falling 5-period moving average (MA) near the $7.75 Fibonacci (fib) level. The weekly stochastic has formed a bearish mini inverse pup falling through the 40-band. The weekly market structure high (MSH) triggered under $7.11. The daily rifle chart has a downtrend with the 5-period MA at $6.45 with lower BBs at $5.34. The daily stochastic has a stairstep mini inverse pup attempting to trigger at the 10-band. Bulls need the daily market structure low (MSL) trigger above $8.30. The narrative is enough to carry this one higher and decouple with VUZI, who happens to be just one of their customers. Prudent investors can monitor opportunistic pullback levels at the $5.88 fib, $5.51 sticky 5s level, $4.88 fib, $4.69 fib, $4.09 fib, and the $3.49 fib. Keep an eye on peer VUZI as they tend to move together and is a supplier of their smart glass micro displays. Upside trajectories range from the $7.75 fib up to the $11.35 fib level.

Before you consider Kopin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kopin wasn't on the list.

While Kopin currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.