Grocery chain operator

The Kroger Company NYSE: KR stock is trading up 4.5% in 2022 far outperforming tech stocks and the benchmark indices. The Company operates approximately 2,800 grocery store and pharmacies under two dozen banners in the 35 states and also sells fuel through over 1,600 centers. The grocery business is what’s been saving the big box stores like

Target NYSE: TGT and

Walmart NYSE: WMT and especially warehouse giant

Costco NASDAQ: COST. High

inflation has been curbing consumer discretionary spending in favor of

consumer staples as indicated by

Dollar General’s NYSE: DG earnings. While they don’t have many

discretionary items, the pure play in consumer staples is Kroger’s. They specialize in the two most essential consumer items, groceries and pharmacy. It’s like owning Target without the clothing and

electronics and

CVS NYSE: CVS without the marked up to discount down prices. They also have a thriving private label business, Our Brands, which grants them higher margins and accelerating sales growth. Kroger’s also owns a ton of

real estate. Its shares are trading at 11.5X forward earnings and sports at 2.17%

dividend yield, ideal for

value investors.

Steady Eddie Wins the Race

On Sept. 21, 2022, Kroger released its fiscal second-quarter 2022 results for the quarter ending July 2022. The Company reported a profit of $0.90 per share beating consensus analyst estimates for $0.83 per share by $0.07. Revenues rose 9.3% year-over-year (YoY) to $34.64 billion beating consensus analyst estimates for $34.44 billion. Identical sales excluding fuel grew 5.8%. Digital sales grew 8% and Our Brands identical sales rose 10.2%. The Company raised its dividend for the 16th straight quarter in addition to buying back $309 million in stock in the quarter.

Staples are More Than Stable

Kroger CEO Rodney McMullen commented, "Kroger delivered strong second-quarter results propelled by our Leading with Fresh and Accelerating with Digital strategy. We are incredibly thankful for our dedicated associates who continue to deliver a full, fresh and friendly customer experience. Our consistent performance underscores the resiliency and flexibility of our business model, which enables Kroger to thrive in many different operating environments. We are applying technology and innovation to improve freshness, grow Our Brands, and create a seamless shopping experience so our customers can get what they want, when and how they want it, with zero compromise on quality, selection and affordability.”

Conservative Guidance

Kroger’s issued conservative guidance on the safe side. The Company issued its fiscal full-year 2022 EPS to range between $3.90 to $4.05 versus $3.96 consensus analyst estimates. Kroger’s expects full-year identical sales to rise 4% to 4.5%.

Private Label is the Growth Driver

Kroger’s has evolved it’s private label brands beyond being just cheaper knockoffs. Customers are actually preferring their culinary food and natural/organic brands over national brand names. It’s private label brands saw 10.2% YoY growth at nearly double the pace of general identical grocery sales of 5.8%. They sell over 10,000 products under its private label brands including Simple Truth, Private Selection, BLOOM HAUS, Bakery Fresh Goodness, and Home Chef. They launched another private label brand Smart Way in the quarter. It’s Our Brands private label products wont 12 Editor’s Picks awards for Best New Products in 2022.

Attractive Pullback Levels

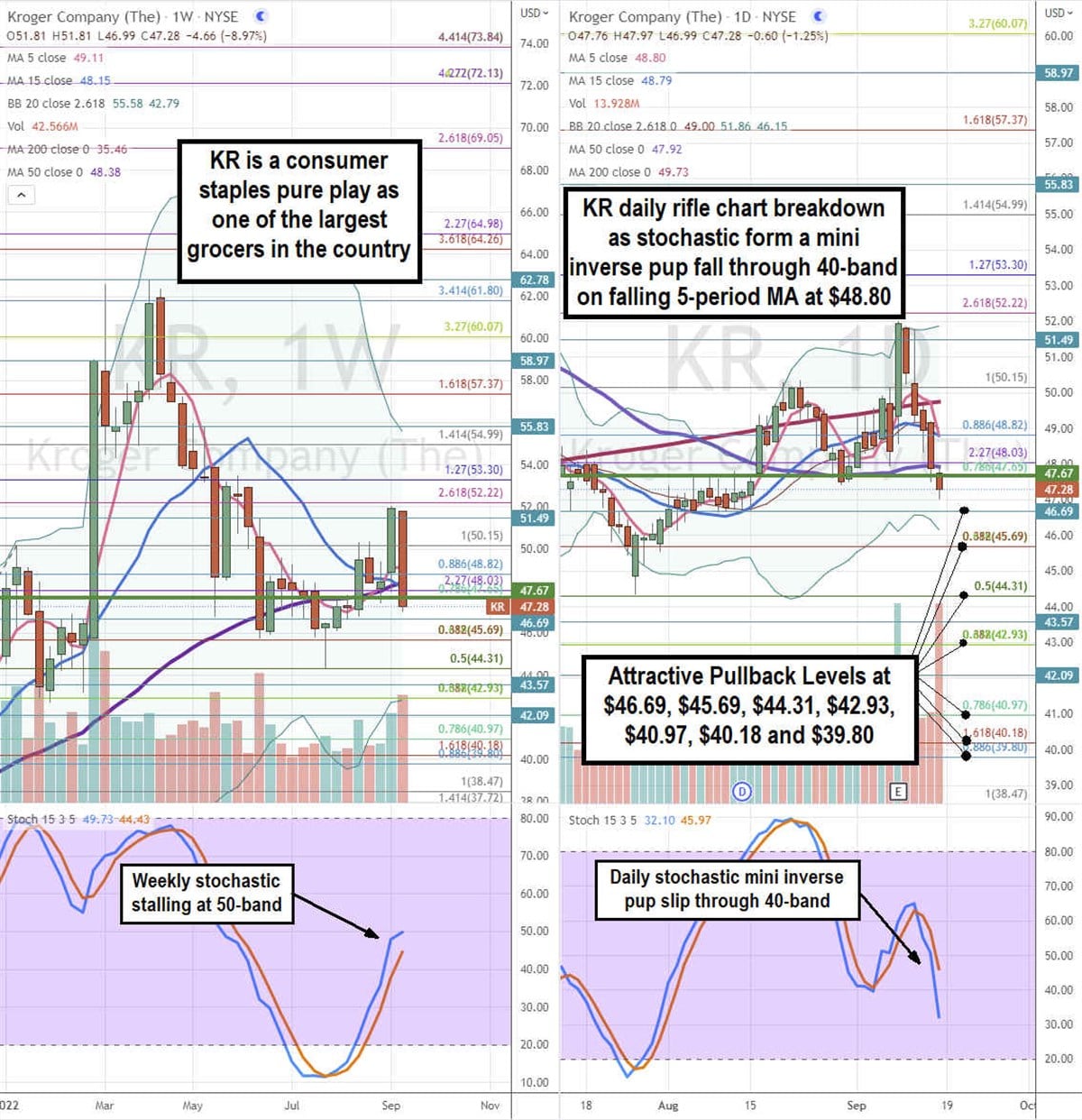

Using the rifle charts on weekly and daily charts can provide a near-term perspective of the playing field for KR stock. The weekly rifle chart peaked on its earnings spike near the $52.22 Fibonacci (fib) level. Shares collapsed quickly through the weekly 5-period moving average (MA) at $49.11, 15-period MA at $48.15, and the 50-period MA at $48.38. The rising weekly stochastic is starting to stall at the 50-band. The stock plunge fell through the weekly market structure low (MSL) buy trigger at $47.67. The daily rifle chart is attempting a breakdown as shares plummeted through the daily 200-period MA at $49.73, 5-period MA at $48.80, and the 15-period MA at $48.79. Shares fell through the 50-period MA at $47.92 towards the daily lower Bollinger Bands (BBs) at $46.15. Attractive pullback levels sit at $46.69, $45.69 fib, $44.31 fib, $42.93 fib, $40.97 fib, $40.18 fib, and the $39.80 fib level.

Before you consider Kroger, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kroger wasn't on the list.

While Kroger currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.