Shares of furniture retailer

La-Z-Boy, Inc. NYSE: LZB have been rallying off the March 2020 lows with the

S&P 500 index NYSEARCA: SPY. While their La-Z-Boy Furniture showrooms and manufacturing facilities were closed during the peak of the COVID-19 pandemic, the Company has been recovering as stay-at-home mandates get lifted. Price action has been stable as it has managed to absorb market sell-offs while inching higher on SPY rallies. The recently released Q4 fiscal 2020 earnings provide an updated lens into how the Company has managed to retain profitability during the stay-in-shelter mandates causing showrooms to close down along with manufacturing facilities. Shares are starting to accelerate again but nimble risk-tolerant investors may still find opportunistic pullback entries.

Q4 FY 2020 Earnings Release

On June 23, 2020, La-Z-Boy reported Q4 fiscal year 2020 earnings for the quarter ending April 2020. The furniture retailer beat consensus analyst estimates by $0.29 per share, coming in at $0.49 per share versus $0.20 per share. Top line revenues for the quarter came in at $367.3 million versus $384.96 million analyst estimates, down (-19.1%) year-over-year (YoY). The COVID-19 pandemic contracted same-store sales (SSS) by (-35%) versus a nine-month average SSS of up 6.4% due to the store closures and (-10%) cut in the workforce. The Company noted the effects of COVID-19 were being felt in the current quarter but operations are recovering.

Restart Narrative

The stay-at-home mandates have been a boon for online furniture retailers like Wayfair NYSE: W and Overstock NASDAQ: OSTK which don’t have the expenses of brick and mortar showrooms. The demand for comfort furniture was brisk but La-Z-Boy faced a double hindrance from having physical showrooms as well as closing down their manufacturing facilities. As of late June, La-Z-Boy Furniture Galleries have been re-opening and seeing strong early demand. The manufacturing plants have gone from zero production up to 80% of YoY production into July. Who can resist the comforts of a plush La-Z-Boy recliner to indulge in a guilty pleasure of being able to recline and lounge stress-free to take naps while watching streaming videos?

Sell-the-News Reaction Template

The general template for pandemic earnings reactions seems to be sell-the-news if the stock runs up sharply into the earnings release. However, stocks that sell-off into earnings release tend to bounce. LZB shares have been stable and avoided rallying to hard into the earnings release. This gave it more buoyancy with the bar set partially low. La-Z-Boy may also be transforming into a pandemic beneficiary even during a second wave of COVID-19. Unlike the first wave, La-Z-Boy has been re-opening their shows rooms and most important resuming nearly full production capacity to be able to accommodate the demand with ample supply of products. Having new product ready as well as clearing out inventory is the key to optimizing the restart initiative. This enables La-Z-Boy to transform into a dual narrative play with a 2nd wave novel coronavirus hedge play and acceleration on restarts.

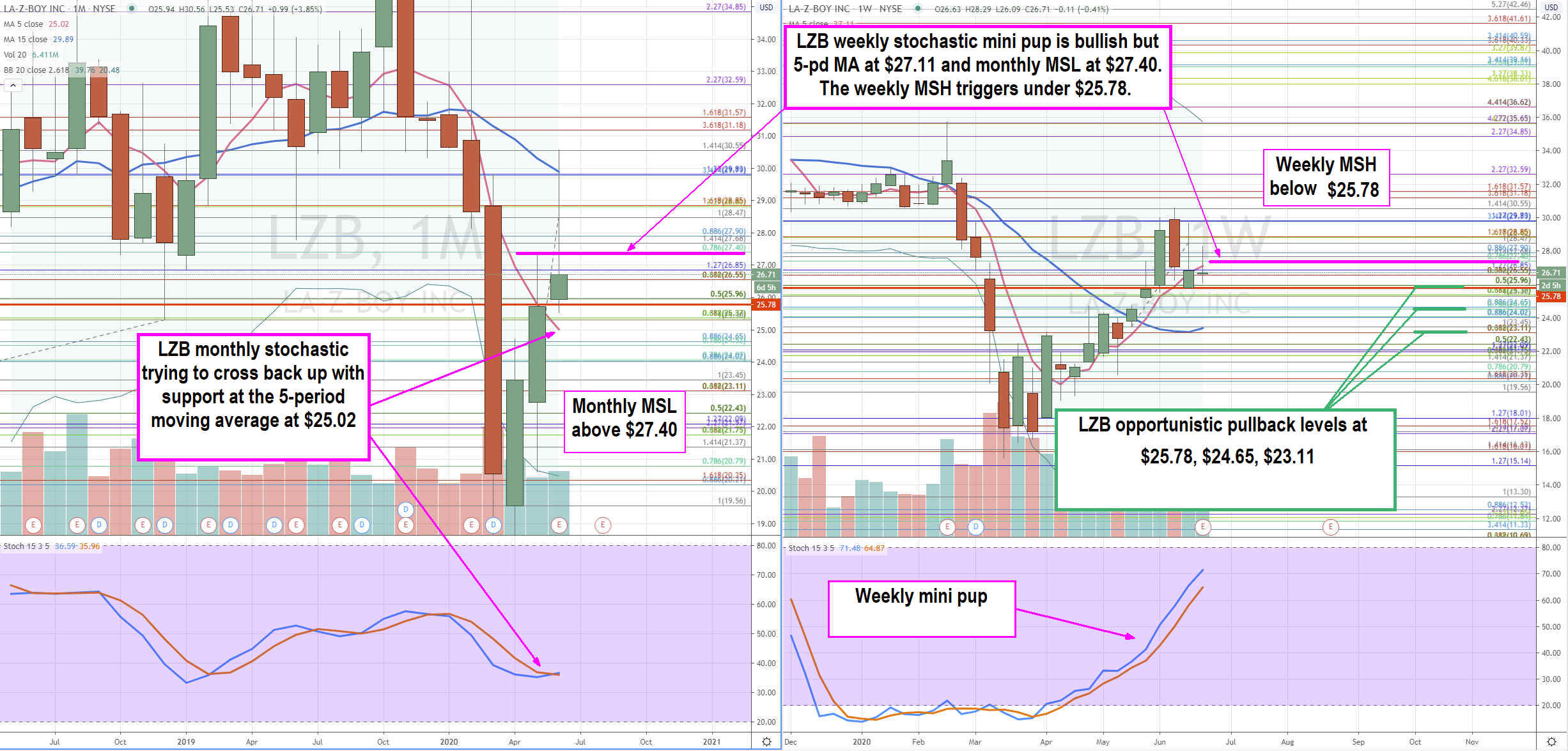

LZB Price Trajectories

Using the rifle charts on a monthly and weekly time frames provides a broader view of the landscape for LZB stock. The monthly rifle chart triggers a market structure low (MSL) above $27.40 Fibonacci (fib) level. The stochastic is trying to cross up and can do so if the monthly 5-period moving average (MA) at $25.02 into the monthly candle close. The weekly stochastic has been oscillating up with stair step mini pups but threatens a market structure high (MSH) below $25.78, which likely tests on the daily inverse pup. This can provide opportunistic pullback levels for risk-tolerant investors and nimble traders at the $25.78 weekly MSH trigger, $24.65 fib and sticky 5’s zone, and $23.11 fib. Shares trade thin so it’s best to scale in on pullbacks or on a break trigger to improve average pricing. The weekly upper Bollinger Bands project upside potential towards the $31.57 fib, $32.59 gatekeeper fib and the $35.65 fib level. Nimble traders can play the various in-between fibs for reversions and breakouts.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.