Barrick Gold Today

$19.36 +0.30 (+1.55%) As of 12:52 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $15.11

▼

$21.35 - Dividend Yield

- 2.07%

- P/E Ratio

- 15.71

- Price Target

- $24.05

Leading gold mining company Barrick Gold Co. NYSE: GOLD stock is trading down 1.66% despite gold prices rising 15.4% year-to-date (YTD). While it's easy to assume gold mining stocks should move in lockstep with gold prices, that's not usually the case. While it's true that higher gold prices would result in higher revenues for gold miners since they would be collecting more for their gold, there are other factors like operational efficiency, interest rates, hedging, and diversification that can dampen the impact of rising gold prices. However, Barrick Gold is widely considered to be a best-of-breed as one of the world’s largest gold producers.

Barrick Gold operates in the basic materials sector, competing with other miners, including Newmont Co. NYSE: NEM, Kinross Gold Co. NYSE: KGC, and Rio Tinto Group NYSE: RIO.

Barrick Gold Mines More than Just Gold

While Barrick Gold is known as a gold miner and producer, it also mines and sells other materials, including silver and copper. The company has ownership stakes in gold mines in Canada, Argentina, the Dominican Republic, Mali, Tanzania, the Ivory Coast, the Democratic Republic of Congo, and the United States. Barrick Gold operates 13 gold mines and three copper mines with projects throughout 18 countries, including copper mine interests in Saudi Arabia, Zambia, and Chile. The company expects to increase gold production by 40% as it grows from 5 million gold equivalent ounces (GEOs) to 7 million by 2030.

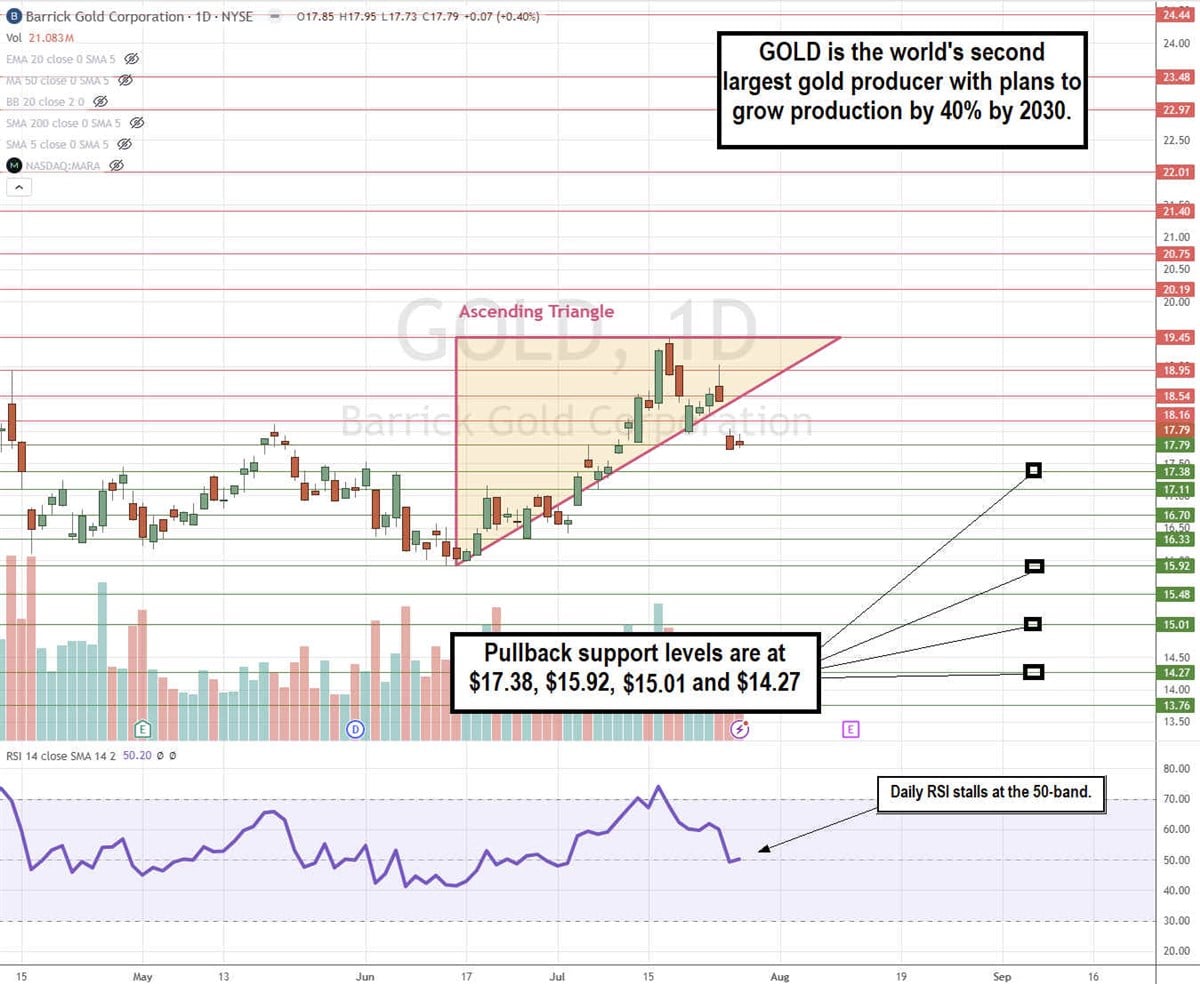

GOLD May Be Breaking Down From an Ascending Triangle Pattern

The daily candlestick chart for GOLD illustrates an ascending triangle breakdown pattern. The pattern was formed by the flat-top upper trendline resistance at $19.45, converging with the rising lower trendline off the $15.92 low. The breakdown is forming under the lower trendline at $18.54. The daily relative strength index (RSI) has fallen to the 50-band. Pullback support levels are at $17.38, $15.92, $15.01, and $14.27.

Solid First-Quarter Results Bodes Well for 2024

Barrick Gold reported Q1 2024 EPS of 19 cents, beating the consensus estimates by 4 cents. Revenues grew 3.9% YoY to $2.75 billion, beating $2.74 billion consensus estimates. Net earnings were $295 million. Barrick sold gold for an average realized price of $2,075 per ounce in the quarter, which was up from $1,902 per ounce in the year-ago period. Gold prices have steadily risen since then.

Gold Production Fell YoY Due to Maintenance Delays

Barrick produced 940,000 ounces of gold in Q2, which was less than the 952,000 ounces produced in the year-ago period. Higher costs and lower production levels reflected the delayed ramp-up at Pueblo Viejo, where the reconstruction of the conveyor was completed. Planned maintenance in the Nevada gold mines and mine sequencing at other sites contributed to the lower production. However, the company expects costs to come in lower while production ramps back up for the rest of 2024.

Kibali Gold Mine Update

On July 2, 2024, Barrick Gold confirmed that Kibali continues to be Africa's largest and most automated gold mine due to its three hydropower stations. Its backup solar power plant and battery storage system are expected to go online in 2025, taking the renewable component of its energy mix up to 85%. Kibali continues to deliver growth, and further investment in technology and capacity positions it to sustain its 750,000-ounce annual production schedule beyond its current 10-year horizon to 15 years and beyond.

Barrick Gold Continues to Invest in Mali

On July 9, 2024, Barrick stated that the long-term viability of the Loulo-Gounkoto gold mining complex was a top priority to ensure the Malian mining industry’s sustainability. Barrick has been a substantial contributor to the country’s economy. Barrick has invested over $10 billion in the past 29 years and over $1 billion in the past year alone.

Barrick Provides Q2 Gold and Copper Production Update

On July 16, 2024, Barrick Gold reported preliminary Q2 production results. Barrick produced 948,000 ounces of gold and 43,000 metric tons of copper. This improved over Q1 2024’s production of 940,000 ounces of gold and 40,000 metric tons of copper.

Barrick Gold MarketRank™ Stock Analysis

- Overall MarketRank™

- 74th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 24.5% Upside

- Short Interest Level

- N/A

- Dividend Strength

- Moderate

- Environmental Score

- -6.13

- News Sentiment

- 0.78

- Insider Trading

- N/A

- Proj. Earnings Growth

- 5.44%

See Full AnalysisThe company stated that it remains on track to achieve its full-year 2024 guidance for gold and copper output of 3.9 million to 4.3 million ounces of gold and 180,000 to 210,000 metric tons of copper. Production will progressively increase per quarter with a higher weight in the second half of the year. Barrick forecasted Q2 sustaining costs of gold would rise 1% to 3% from $1,474 per ounce in the previous quarter, but that will drop in the second half as production increases.

Barrick Gold analyst ratings and price targets are at MarketBeat. There are 14 Wall Street analyst ratings on GOLD stock, comprised of 10 Buys, three Holds, and one Sell, with a 24.7% upside to the consensus average price target of $22.20.

Before you consider Rio Tinto Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rio Tinto Group wasn't on the list.

While Rio Tinto Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.