Most investors are familiar with the popular exchange-traded-funds (ETFs) of the major benchmark indexes like the

S&P 500 index NYSEARCA: SPY,

Dow Jones NYSEARCA: DIA, and the

Nasdaq NYSEARCA: QQQ. The advent of ETFs has enabled investors to trade equity indexes, multiple asset classes, whole

sectors and

industries, and themes like regular stock. The ability to buy and sell is only limited by liquidity and one’s capital. The ETF universe has ballooned to over 8,000 symbols. However, most of these ETFs don’t provide great liquidity as they trade well under 10 million shares a day. Many obscure ETFs literally trade as thin as OTC or Pink Sheet stocks on very little volume, liquidity and wide bid/ask spreads that you could drive a truck through. Wall Street’s theme is that when you got a good thing going, why not leverage it? This bred a new form of ETF that attempts to double or triple the performance of the underlying index. Unfortunately, investors tend to misunderstand what leveraged ETFs are designed for and make the mistake of investing in them long-term. Here’s why leveraged ETFs are good for trading but not for investing.

What’s a Leveraged ETF?

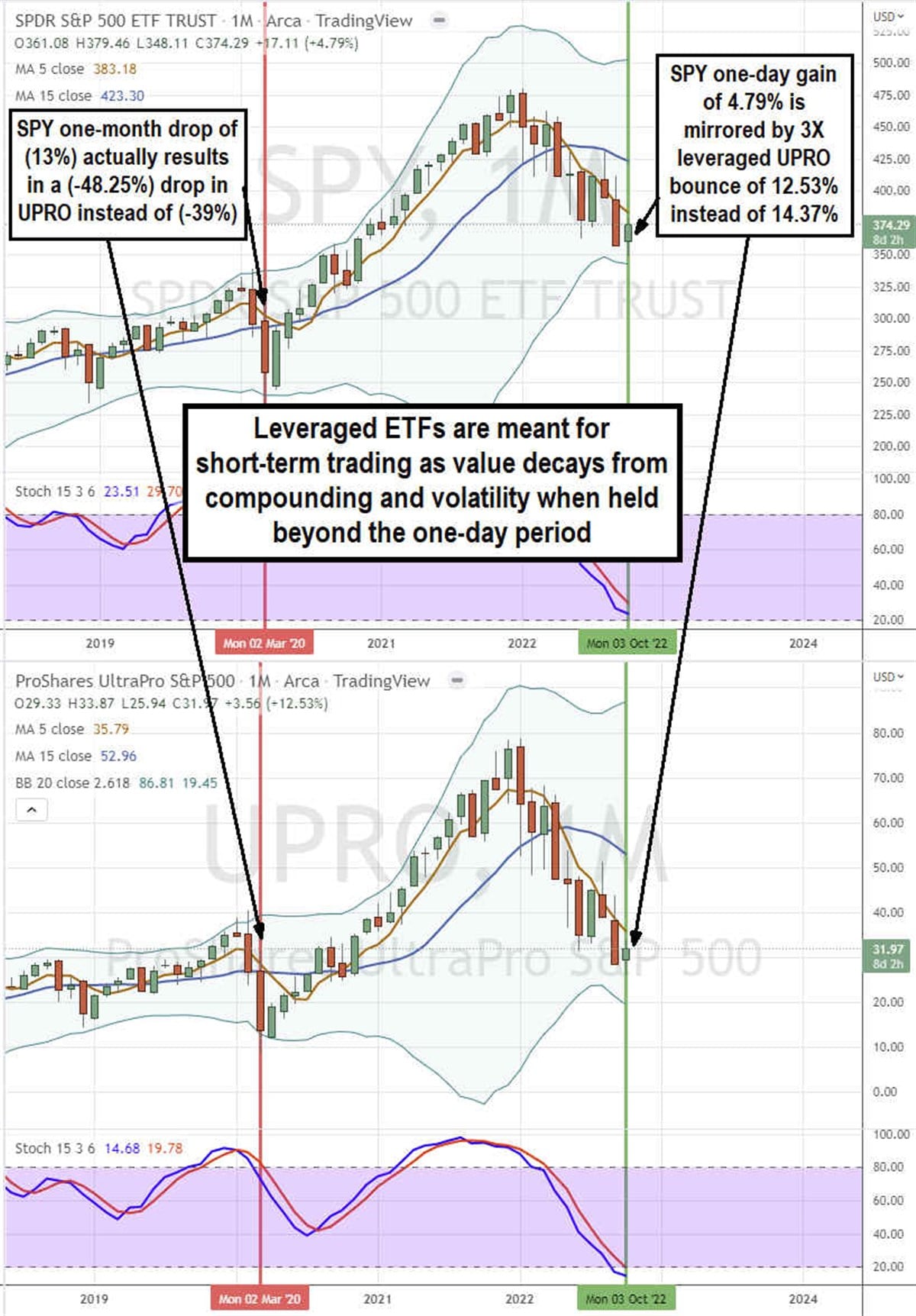

A benchmark ETF is designed to mirror or track the performance of the underlying index. For example, if the S&P 500 index is up 10% for the year, then the SPY ETF should also be up 10% for the year. However, a leveraged ETF is only designed to mirror a multiple of the one-day performance of the underlying benchmark index. The UltraPro S&P 500 ETF NYSEARCA: UPRO is a 3X or triple-leveraged ETF of the S&P 500 index. This ETF should mirror 3X the one-day performance of the S&P 500. If the SPY is up 1% on the day, then the UPRO should be up 3% for the day. It enables traders to reap the same results of the underlying index gains or losses with less capital or attain greater returns with the same capital.

Whats is Wrong with Holding Leverage ETFs Long-Term?

The inherent structural problem with leveraged ETFs, especially the triple leveraged ETFs, is they’re only designed to be held short-term as they only mirror the single-day performance of the underlying asset. To maintain a consistent leverage ratio (2X or 3X), they’re rebalanced nightly. Any gaps up or down in the underlying index can complicate matters. The compounding effect can work against the holder during periods of volatility.

Overly Simplified Example

Let’s take an example of three days of market fluctuations for +10%, -10%, and +20% for the S&P 500 compared to the 2X S&P 500 ETF NYSEARCA: SSO. For simplicity sake, let’s assume the S&P 500 was at 1,000 and rose 10% on day 1. That would mean the S&P 500 closed at 1,100. The SSO would have moved 20% from $50 to $60. On day 2 the S&P 500 fell (-10%) or (-110 points) to 990. The SSO ETF would mirror the 2X one-day performance for a (-20%) of (-$12) drop from $60 to $48. On day 3 the S&P 500 rose 20% or (220 points) to 1,210. The SSO would rise 40% or $19.20 to $67.20. Based on just three days of trading performance, the S&P 500 started at 1,000 and ended the three-day period at 1,210 gaining 21%. The SSO ETF mirrored each one-day performance separately starting the week at $50 and ended the week at $67.20 for a 34.4% gain instead of 2X the S&P 500 gain for 42%. The compounding and volatility resulted in a (decayed) three-day performance of the SSO ETF of 34.4% instead of the (mistaken) implied expectation of 42%. Expenses and fees along with larger leverage speed up the decay even faster.

What are Leveraged ETFs Best For?

Since leveraged ETFs mirror a single day’s performance, they are best used for trading intraday. They can be used directionally with the added leverage to magnify gains (or losses). Smaller capital traders may opt to trade them since the cheaper prices require less capital in order to get the same percentage movement of the original index. Leveraged ETFs can also be used as a hedge against positions. For example, if the market starts to collapse, you might choose to short a triple-leveraged SPY 500 ETF to offset the losses in your long portfolio. Remember that the longer you hold a leveraged ETF, the more slippage and decay you’ll experience.

Before you consider ProShares UltraPro S&P 500, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProShares UltraPro S&P 500 wasn't on the list.

While ProShares UltraPro S&P 500 currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn how options trading can help you navigate market volatility, manage risk, and maximize returns with MarketBeat's "Unlock the Potential in Options Trading." Click the link below to have this special report delivered to your inbox.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.