If results from Ralph Lauren NYSE: RL and PVH Corp. NYSE: PVH can be used as a guide, Levi Strauss NYSE: LEVI is about to report a solid quarter and send its shares moving higher. While these apparel manufacturers are vastly different in their styles, they share some traits that have proven to be a winning combination. Those include a well-known brand with global appeal, a lean into DTC channels and a specific focus on eCommerce.

This combination is winning for apparel makers as well as shoe manufacturers like Nike NYSE: NKE, consumer product companies like Williams-Sonoma NYSE: WSM and even big box retailers like Dicks’ Sporting Goods NASDAQ: DKS. The takeaway for investors is that Levi Strauss is set up for reversal and pays a healthy 2.6% dividend yield.

What The Analysts Are Expecting From Levi’s

The analysts are expecting mixed results from Levi’s that have it set up to outperform and possibly surprise with YOY EPS growth. As it is, the analysts expect sequential and YOY revenue growth in the range of 1.25%, consistent with results from Ralph Lauren and PVH, but the EPS outlook is much different. While results from PVH Corp. were mixed relative to the analysts' consensus it and Ralph Lauren were able to produce YOY growth and outperform expectations. This suggests that Levi’s results will be at least better than the consensus target predicts and possibly much better. Levi’s also posted solid results last quarter and gave a bullish outlook.

"In 2022, we delivered strong, profitable growth as well as significant market share expansion, demonstrating the enduring strength of our brands, the diversity of our business and our team’s focused execution of our strategic plan," CEO Chip Bergh commented in the FQ4 report. “Our high-margin DTC business is delivering exceptional results and our diversification efforts provide additional growth drivers for sustainable long-term growth.”

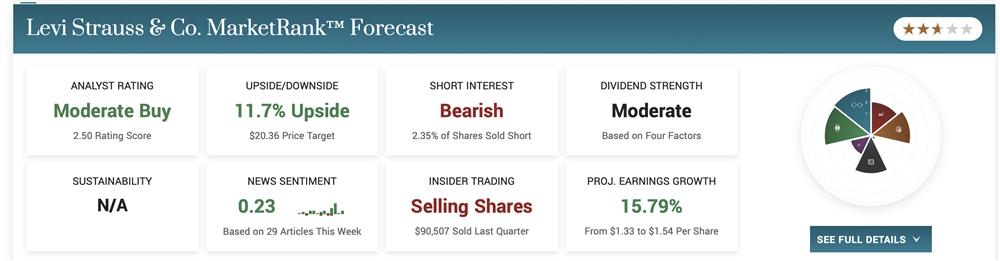

The analysts already favor Levi compared to Ralph Lauren and PVH Corp. They have the stock rated at Moderate Buy compared to strong Holds for the others, including a series of upgrades and price target increases following RL’s and PVH’s CQ1 reports. Assuming Levi’s can outperform the consensus, sentiment should improve. As it is, the analysts are leading these stocks higher with price target increases. The consensus for RL and PVH has the stock trading at fair value, but the most recent targets are well above the current price action.

Levi Strauss Offers Value And Yield For Income Investors

Levi Strauss is a relatively high-yielding stock with a payout near 2.6%. This is consistent with Ralph Lauren’s 2.6% payout, which suggests value. Levi Strauss trades at only 13X its earnings, while Ralph Lauren trades closer to 14.5X. That’s only a 1.5X earnings difference but could be worth 15% to investors if there is a multiple expansion. Even so, 2.6% is 100 basis points better than the broad market.

The chart sets up another opportunity as Levi Strauss has lagged behind its competitors in the post-pandemic world. Ralph Lauren and PVH Corp. are moving higher after completing reversals; if Levi follows suit, it could see a multiple expansion on top of an earnings-driven rally.

Before you consider Levi Strauss & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Levi Strauss & Co. wasn't on the list.

While Levi Strauss & Co. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.