Levi Strauss & Co. Today

LEVI

Levi Strauss & Co.

$14.62 +0.51 (+3.61%) As of 04/17/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $12.17

▼

$24.34 - Dividend Yield

- 3.56%

- P/E Ratio

- 28.11

- Price Target

- $19.18

Iconic American apparel manufacturer Levi Strauss and Co. NYSE: LEVI disappointed investors after lowering their guidance on their fiscal third-quarter of 2024 earnings report. While shares initially sold off 8% on the warning from the declining headline metrics, there were many positives in the report that were overshadowed by the initial sell-off reaction.

Levi's is a global American brand in the consumer discretionary sector best known for their rugged denim blue jeans. They have expanded their brand portfolio to appeal to a wider audience, including athleisure and boating fans. This also opens them up to more competition from competitors like The Gap Inc. NYSE: GPS, Birkenstock Holding plc NYSE: BIRK, Gildan Activewear Inc. NYSE: GIL and Lululemon Athletica Inc. NASDAQ: LULU. Interest rate cuts also spur demand for Levi's products as consumer disposable income increases, which can also stimulate more borrowing.

The Glass Is Half Empty on Headline Numbers

Levi Strauss reported a 2-cent EPS beat over consensus estimates earnings of 33 cents. Revenues were lackluster, rising 0.4% YoY to $1.52 billion, falling short of the $1.55 consensus analyst estimates. Net revenues fell 1% in the Americas. Asia net revenues were flat YoY on a reported basis. Dockers saw a 15% plunge in revenues as reported and 13% on a constant currency basis. Wholesale revenue declined 6% YoY on a reported basis and 5% in constant currency. Constant currency backs out the FX or currency translation impacts, which is a more accurate indicator.

The Positives for the Quarter Outnumber the Negatives

Levi Strauss & Co. Stock Forecast Today

12-Month Stock Price Forecast:$19.1831.21% UpsideModerate BuyBased on 12 Analyst Ratings | Current Price | $14.62 |

|---|

| High Forecast | $25.00 |

|---|

| Average Forecast | $19.18 |

|---|

| Low Forecast | $14.00 |

|---|

Levi Strauss & Co. Stock Forecast DetailsWhile revenues were flat on a reported basis, there were 160 bps of currency headwinds, which would have equated to revenues rising 2% YoY. On the bright side, the Levi's brand saw sales grow 5% YoY globally, the highest revenue growth in two years and a significant acceleration from the first half of 2024. Levi Strauss generated its highest gross margin at 60%, up 440 bps YoY, driven by lower product costs, brand mix, and favorable channels.

The Americas suffered a 1% sales decline primarily due to exiting the Denizen business. Backing that transaction out would have resulted in a 2% YoY revenue climb. Europe was a bright spot as net revenues climbed 6% on a reported basis and 7% in constant currency. It had positive growth in both the DTC and wholesale channels.

Levi Strauss Trims Inventories and Reaches Record Gross Margin

Levi Strauss generated a record gross margin of 60% for the first time. This was driven by the growth in the direct-to-consumer (DTC) channel, which rose 12% YoY in the U.S. and 9% YoY in Europe. DTC has a higher gross margin since Levi doesn't have to deal with a middleman. The DTC channel rose to 44% of total revenues. The athleisure trend continues to be a bright spot as its Beyond Yoga brand experienced a 19.3% YoY sales increase in the quarter. Total inventories decreased by 7% YoY, which is another big positive that added to the gross margin.

Dockers Is a Weak Link, But It May Be Sold

The weakness in Dockers sales has prompted Levi to consider a “strategic review," aka divesting the unit. Dockers was the big blemish on the report, tripping Levi’s revenue growth in the Americas. Selling Dockers would kill two birds with one stone by shedding its weakest brand and injecting new cash onto the balance sheet.

Levi Issues Lower Guidance Tipping the Scale Lower

Levi Strauss lowered its full-year 2024 revenue guidance while adjusting EPS estimates to a tighter range. The company expects adjusted EPS at the mid-point of its $1.17 to $1.27 prior guidance, which is lower than the $1.25 consensus estimates. Full-year 2024 revenue was lowered to $6.24 billion versus $6.32 billion consensus analyst estimates.

CEO Points Out the Three Areas of Softness

Levi Strauss CEO Michelle Gass was formerly CEO of Kohl’s Co. NYSE: KSS, where she was credited for bolstering its athleisure category during the pandemic. She brought the experience in athleisure as illustrated by the growth of its Beyond Yoga brand. Gass acknowledged a tough macroeconomic backdrop exacerbating headwinds. The company has been trying to push the fashion of denim to a younger audience and saw success with its Beyonce campaign, resulting in triple-digit growth in women's dresses and skirts. The Levi women’s business grew 11% YoY.

Gass pointed out that three areas didn't meet the company's expectations, Dockers, Mexico and China, which the company is already implementing plans to address the headwinds. While Dockers is under strategic review, it remains a global leader in the khaki category. China only comprises 2% of overall total revenue, which makes it relatively insignificant in the near-term but long-term for growth. Levi Strauss replaced its China director with a 15-year veteran with a strong track record of performance in Asia.

Levi Strauss Launches a Massive New Marketing Campaign Titled “Reimagined”

Their new marketing campaign, titled Reimagined on a massive scale, will continue through 2025. Gass commented, "The campaign features core products like 501 '90s, original Truckers and Essential T’s and pays homage to classic Levi’s ads through a modern reinterpretation focused on women and icons.”

Gass concluded, “We’ll be activating the campaign across more than 3,000 direct-to-consumer touch points and throughout our e-commerce channels around the world. We’re proud to see the celebration of two global icons come to life and look forward to connecting in new ways with our fans globally.”

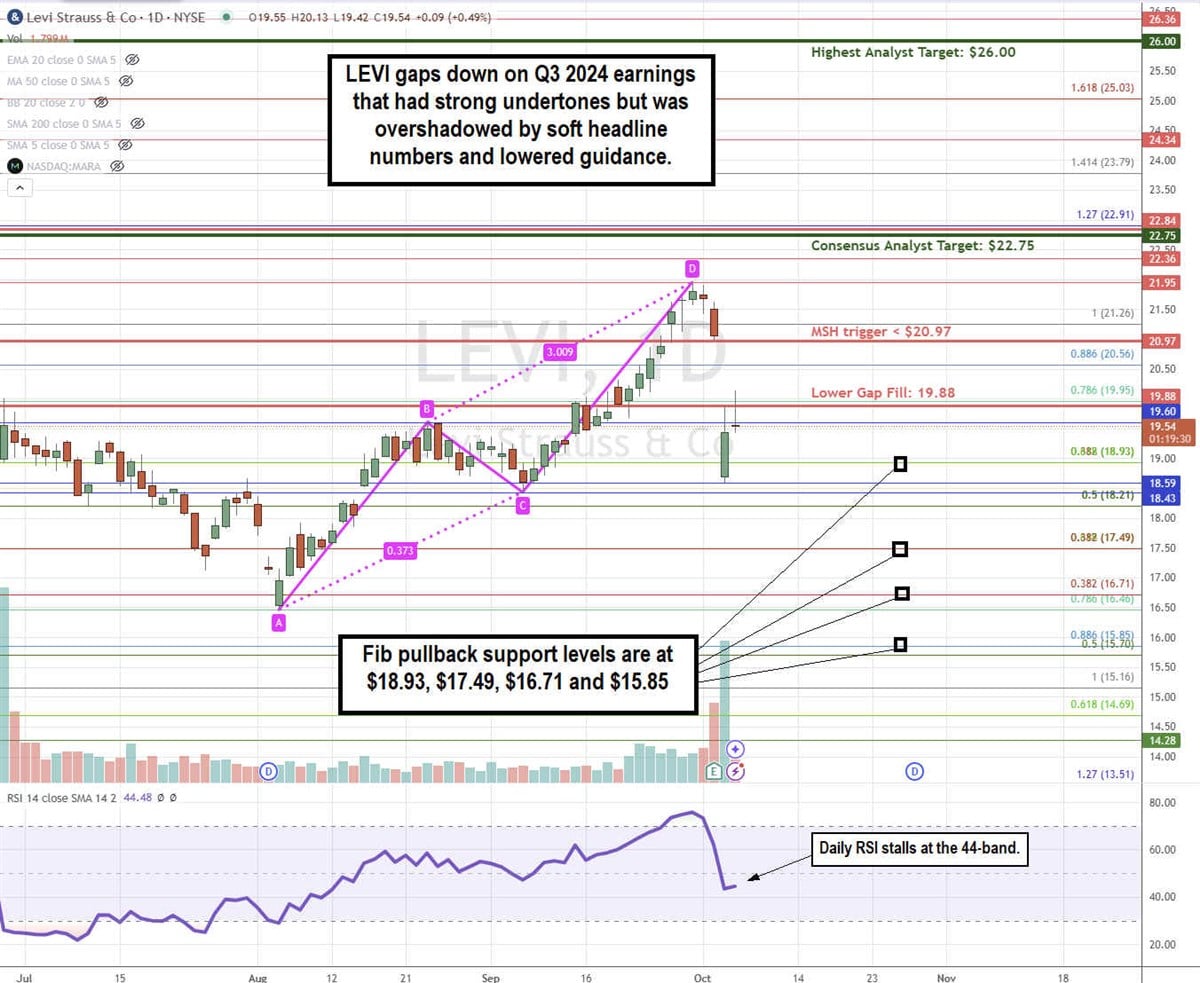

LEVI Triggers an ABCD Reversal Pattern

An ABCD pattern is a harmonic reversal pattern comprised of two higher peaks and one higher low. The pattern resembles a rising lightning bolt. The reversal is often triggered by a market structure high (MSL) sell trigger.

LEVI stock formed its B peak at $19.54, pulling back to C point at $18.43 before surging to the highest high at $21.95. The market structure high (MSH) triggered the breakdown under $20.97, which also happens to be the upper price gap fill level. The lower price gap fill resistance is at $19.88. The daily relative strength index (RSI) peaked above the 70-band heading into the earnings report and fell to the 44-band in the aftermath reaction. Fibonacci (Fib) pullback support levels are at $18.93, $17.49, $16.71, and $15.85.

Levi Strauss's average consensus price target is $22.75, and its highest analyst price target sits at $26.00. It has five analysts' Buy ratings and five Hold ratings. The stock trades at 15.72x forward earnings.

Actionable Options Strategies: Bullish investors can pick up LEVI stock on pullbacks using cash-secured puts at the fib pullback support levels to buy the dip and write covered calls to execute a wheel strategy for income in addition to the 2.65% annual dividend yield.

Before you consider Levi Strauss & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Levi Strauss & Co. wasn't on the list.

While Levi Strauss & Co. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report