Telehealth aggregator

LifeMD (NASDAQ: LFMS) stock been pulling back from it’s $33.02 year-to-day (YTD) highs. The acceleration of

Covid-19 vaccinations have caused selling in the telemedicine companies that were

pandemic. winners like

Teladoc Health NYSE: TDOC. LifeMD formerly known as Conversion Labs, operates multiple subscription-based direct-to-consumer (DTC) platforms for treatments ranging from for erectile dysfunction (ED), mental health, insomnia, and hair loss to primary care and concierge care. They will soon be launching tele-dermatology services. These maladies tend to be more private and the convenience factor of

remote appointments has been a recipe for success. While the return to normal is inevitable, telehealth will inevitably be a part of the “new” normal as the pandemic accelerated the mainstream acceptance and migration to all things digital. Prudent investors seeking exposure with a fast-growing telehealth company, can watch shares of LifeMD for opportunistic pullback levels

Q4 FY2020 Earnings Release

On Jan. 19, 2021, LifeMD released its preliminary fiscal fourth-quarter 2020 results for the quarter ending December 2020. The Company expects Q4 revenues to come in around $13.4 million, up 265% year-over-year (YoY). Full-year 2020 revenues are expected to be $38 million, up 205% YoY. CEO Justin Schreiber stated “We ended the year hitting a monthly record of $5.1 million, up 321% YoY for December. Given our extensive telehealth platform buildout in 2019, we were prepared when the breakout of the COVID-19 pandemic suddenly accelerated the consumer shift from traditional healthcare to telemedicine.” Annual recurring revenue (ARR) generated by subscriptions hit $26 million for 2020, up 525%. ARR increased by over $3 million sequentially from November to December. The Company has completely embraced a subscription-based model with provides improved visibility and lowered overall cost of customer acquisition. CEO Schrieber summed it up, “Looking ahead in 2021, we expect our momentum to continue to build, driven by our expanding professional team and growing suite of telehealth brands. Convenience, affordability, and health security have become increasingly important to our patients… We also believe we’re still very much in the early stage of our growth as a leading direct-to-consumer telemedicine business, so we expect 2021 to be our biggest year yet.”

LifeMD Brands

The Company has four key brands utilizing its proprietary Veritas MD platform. The platform connects its 50-state network of doctors, patients, and pharmacy. There are four brands: Rex MD for men (ED, hair loss, depression, skincare, mental health, and insomnia), Shapiro MD (hair loss treatments for men and women), Nava MD (teledermatology for women) and LifeMD (primary and concierge care). Nava MD launched in Q1 2021 and Life MD is expected to launch in 1H 2021. Nava and Life MD brands should help drive revenue growth regardless of in-person outpatient visits. The Company has the ability to leverage a growing base of customers with its various brands generating a true network effect. Prudent investors will be able to scale in positions at a discount to the highs at opportunistic pullback levels.

LFMD Opportunistic Pullback Levels

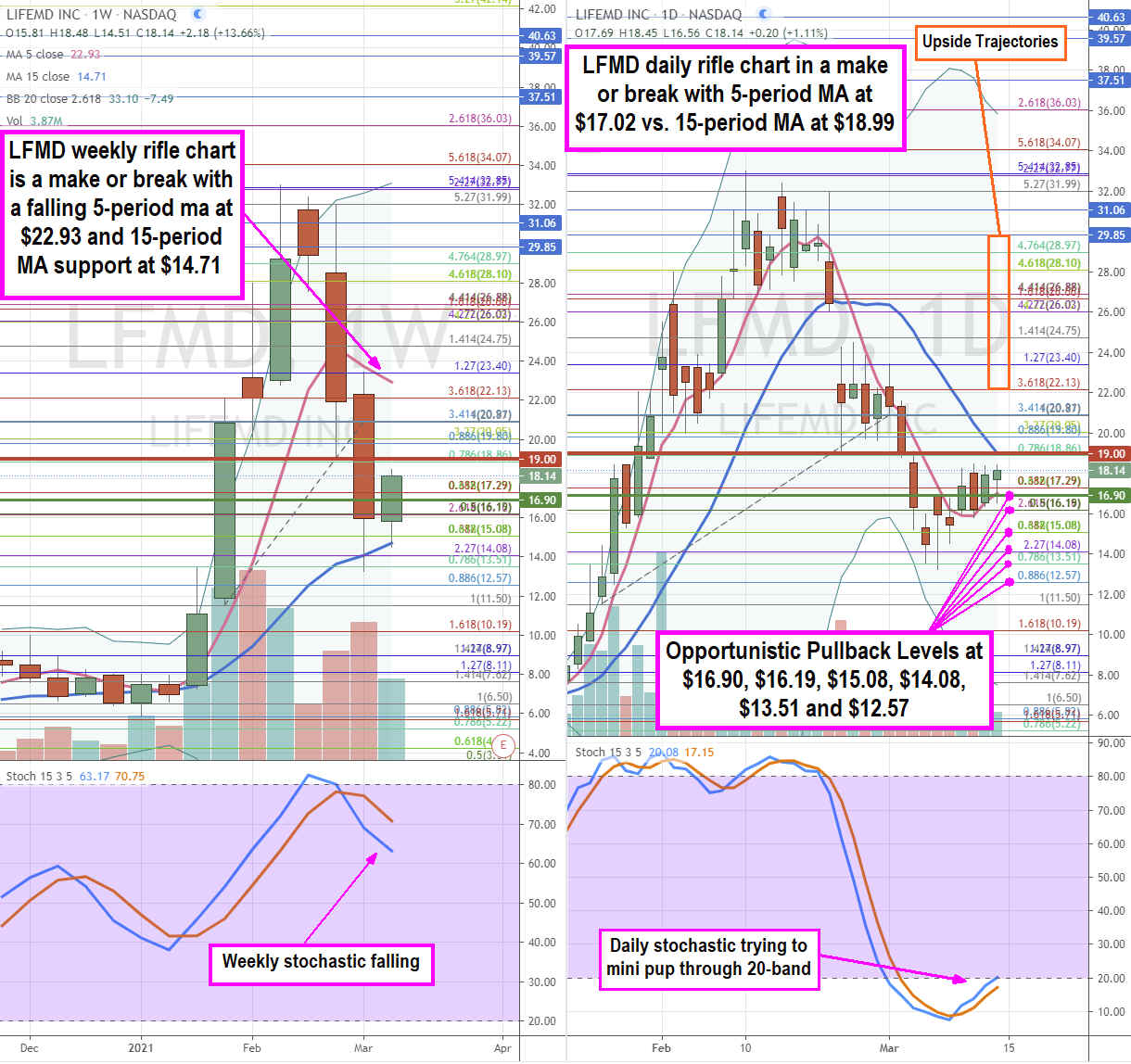

Using the rifle charts on the weekly and daily time frames provides a near-term view of the landscape for LFMD stock. The weekly rifle chart peaked out at the $32.85 Fibonacci (fib) level in early February 2021 and has been selling off ever since. The weekly 5-period moving average (MA) has been sloping down at $22.93 as the weekly 15-period MA was able to hold support at $14.71. The weekly stochastic crossed down. This sets up a weekly make or break that will either result in a breakdown if the weekly 5-period MA crosses over the 15-period MA down driven by the falling weekly stochastic oscillation towards the 20-band. The bullish case would be a pup breakout as shares rise back up through the weekly 5-period MA powered by a weekly stochastic cross-up. The daily rifle chart downtrend has stalled as the daily 5-period MA is rising at $17.02 powered by the daily stochastic cross up and mini pup attempt through the 20-band. The daily market structure low (MSL) buy triggered above $16.90. However, the weekly market structure high (MSH) sell triggered under $19.00. The daily rifle chart has a make or break as well, but it’s the inverse version of the weekly rifle chart make or break since the daily has a stalled downtrend versus the weekly with a stalled uptrend. Prudent investors can monitor for opportunistic pullback entry levels at the $16.90 daily MSL trigger, $16.19 fib, $15.08 fib, $14.08 fib, $13.51 fib, and the $12.51 fib. Keep an eye on peer telemedicine stock TDOC as they move together. Upside trajectories range from the $22.13 fib on up to $29.85 with best-case upside at the daily upper BBS near the $36.03 fib.

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.