Computer peripherals maker Logitech NASDAQ: LOGI stock has collapsed from its highs of $140.17 to lows of $71.11 before staging a bounce attempt. The well-known maker of video, computer, and gaming accessories has been running on all cylinders due to the surge in demand stemming from COVID-19, which continues years after the peak. Logitech crushed earnings and raised its forward guidance for its fiscal full-year 2022. However, the Company has been impacted by higher logistics costs and delays from supply chain disruption in components. However, their wholly-owned production facilities and active supply chain management have enabled them to remain competitive. The Company was ranked number 12 worldwide in the Computer Peripherals and Office Electronics Industry for ESG, as they label their products with the amount of carbon created during production through the end of the life cycle. The Company is also recycling plastics to the turn of 65% of its mouse and keyboard products. Prudent investors looking for exposure in the growing gaming and video collaboration segment can look for opportunistic pullbacks in shares of Logitech.

Q3 Fiscal 2022 Earnings Release

On Jan. 25, 2022, Logitech released its third-quarter fiscal 2021 results for the quarter ending December 2021. The Company reported an earnings-per-share (EPS) profit of $1.55 excluding non-recurring items versus consensus analyst estimates for a profit of $1.06, a $0.49 beat. Revenues rose 2.1% year-over-year (YoY) to $1.63 billion, beating consensus analyst estimates for $1.45 billion. Logitech CEO Bracken Darrell commented, “Our Q3 results reflect the strength of our operational capabilities, innovation engine, and the choices we made to position ourselves in line with the long-term trends affecting work, play, and creating.

Raised Guidance

Logitech raised its fiscal full-year 2022 revenues to come in between $4.88 to $5.51 billion versus $5.32 billion consensus analyst estimates. Non-GAAP operating income is expected to come in between $850 million to $900 million, where previous guidance flat top-line growth and $800 million to $850 million in non-GAAP operating income.

CEO Commentary

CEO Bracken reiterated that the Company targets good markets in fast-growing categories to gain the leadership position through its innovation engine. The Company has successfully positioned itself early in the most powerful secular trends of video everywhere and gaming. He commented, “ In creativity & productivity, we hit our biggest quarter ever, driven by another strong performance in mice and keyboards. Hybrid work is driving and even accelerating demand for these products. We are the market leaders in these categories and we're innovating as a leader should, developing upgrade opportunities that offer more value and have higher price points, unlocking new dimensions of advantage that cater to today's consumers, like sustainability and lifestyle, and always staying ahead of what's happening in the category.” The Company meets the needs of ergonomic mice and keyboards with its MX Master and MX keys product offerings and the recently announced M650 wireless mouse for left-handers. CEO Bracken also stressed that gaming has grown from a fringe hobby to a worldwide phenomenon with over three billion gamers around the globe, and Logitech is there to enhance the gaming experience. For example, the G435 gaming headset is designed for both competitive and casual gamers. Its video collaboration sales rose 24% growth sequentially. Video is the de facto tool that replaces in-person meetings and non-video conference calls. He concluded, “Our mission is to develop video collaboration tools that can make remote participants feel like they can participate equally or even better than those in the room. This year has been another year when operations have been tested for many companies globally. Our operations team continued their strong execution in the face of ongoing industry-wide supply chain challenges.”

LOGI Opportunistic Pullback Price Levels

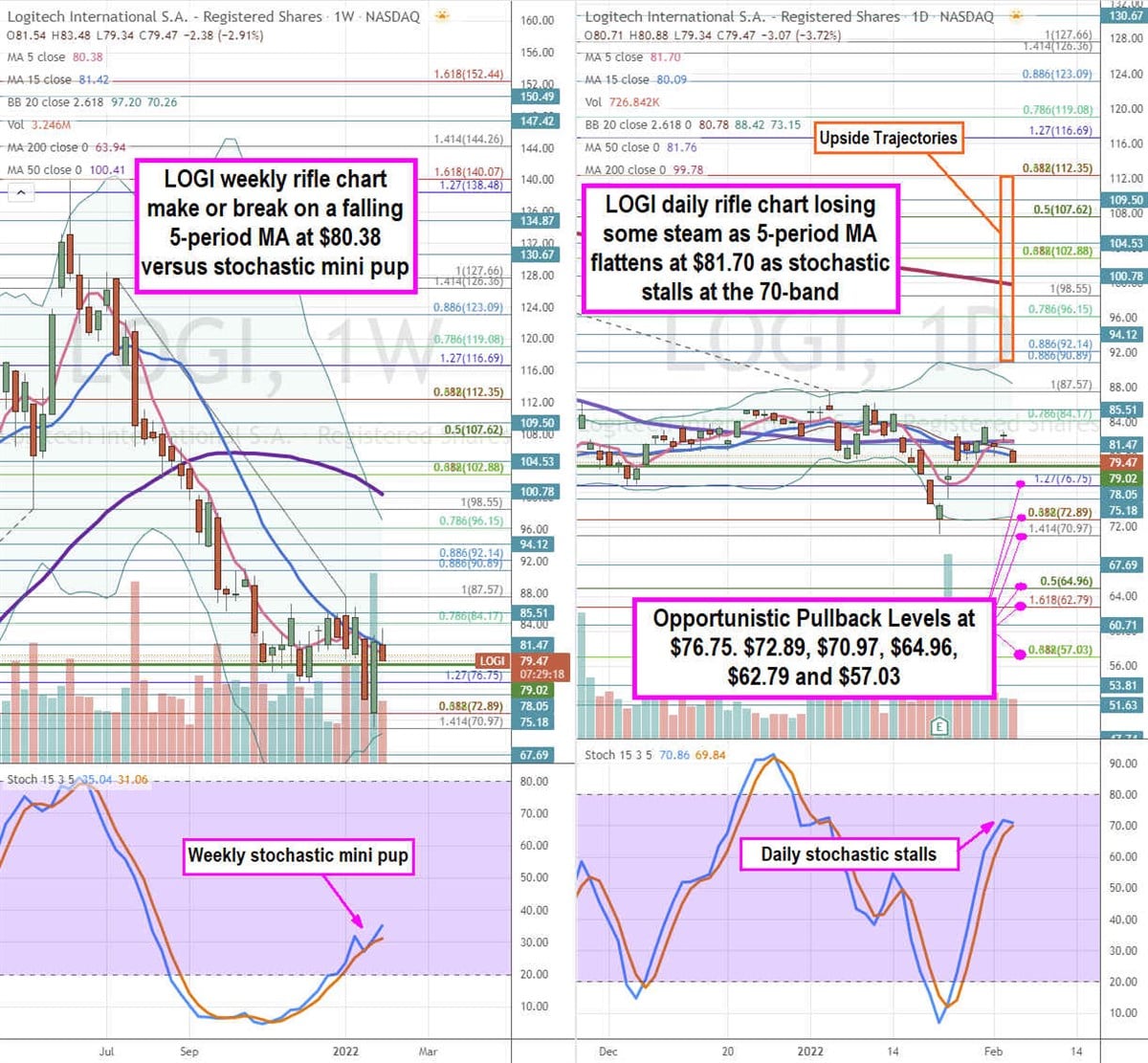

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for LOGI stock. The weekly rifle chart peaked at the $140.07 Fibonacci (fib) level before descending on its journey down towards the $70.97 fib. The weekly rifle chart formed an inverse pup breakdown with a falling 5-period moving average (MA) at $80.38 followed by the 15-period MA at $81.43. The weekly stochastic formed a stair-step mini pup towards the 40-band. The weekly lower Bollinger Bands (BBs) sit at $70.26. The weekly rifle chart is chopping flat with a 5-period MA at $81.70 nearly overlapping with the 50-period MA at $81.76 and 15-period MA at $80.09. The daily BBs are compressing with the upper BBs falling at $88.42 and lower BBs rising at $73.15. The daily market structure low (MSL) buy triggers above $79.02. Prudent investors can watch for opportunistic pullback levels at the $76.75 fib, $72.89 fib, $70.97 fib, $64.96 fib, $62.79 fib, and the $57.03. Upside trajectories range from the $90.89 fib up towards the $112.35 fib level.

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.