Hard-surface flooring retailer

Lumber Liquidators NYSE: LL stock has been a benefactor from spike in lumber pricing bolstered by the

housing boom. The demand for single-family homes continues to far outstrip supply causing homeowners to

renovate existing homes. The

pandemic spurred the migration out of cities into the suburbs as work-learn-play and engage from home trends continue to remain strong even during the

re-opening phase. The elastic office supporting

work-from-home is part of the “new normal” in a post-pandemic world. Despite

soaring lumber prices, the do-it-yourself (DIY) and home improvement trend should continue to be strong throughout 2021 with low-interest rates and a limited supply of single-family homes. The lumber shortage is adding an extra $36,000 to the cost of a new home, this is pushing customers to select higher-margin alternatives like vinyl. Prudent investors looking to capitalize on this trend can watch shares of Lumber Liquidators for opportunistic pullback levels to consider scaling into a position.

Q4 2020 Earnings Release

On March 2, 2021, Lumber Liquidators released Q4 Fiscal 2020 results for the quarter ending in December 2020. The Company reported earnings per share (EPS) of $1.06 excluding non-recurring items, beating consensus analyst estimates of $0.50, by $0.56. Revenues grew 11.1% year-over-year (YoY) to $304.2 million, beating analyst estimates for $296.51 million. Comparable store sales rose 10.5% YoY credited to strong customer demand from home improvement projects. Due to uncertainty from COVID effects, the Company didn’t provide any forward guidance.

Conference Call Takeaways

Lumber Liquidators CEO Charles Tyson set the tone, “For the fourth quarter, our web sales increased more than 90% versus 2019. We are pleased with the new customer growth. Our investment in digital marketing is delivering. And we are encouraged to see so many customers want to engage online for large ticket purchases.” The Company launched its new digital platform in December 2020 with features like displaying flooring in digital room scenes, floor finder, picture it, free flooring samples and promotion of installation services. “During the fourth quarter, we began testing a new in-store portal for installations that will increase efficiency for our store associates and reduce turnaround time for our customers when quoting new jobs… We remain focused on transitioning from a transactional sales approach to building longer-term relationships and credibility with Pros.” CEO Tyson noted that vinyl is benefitting from the expanded assortment and sees room to grow, “As a high touch, high-surface flooring retailer, we also emphasized selling a complete solution to our customers, adding the necessary higher-margin attachments, such as moldings and other accessories.”

Targeting Pros

The Company plans to continue targeting pros with specialized pro reps. Lumber Liquidators will also focus on targeted television advertising like HGTV to attract new audiences driving them to LLflooring.com for conversion. Stores will also undergo “broad scale” rebranding in 2021. CEO Tyson summed it up, “Residential investment, existing home sales and rising home prices spurred by low interest rates should continue to provide tailwinds.” Prudent investors can patiently monitor shares for opportunistic pullbacks as LL shares indicate a breakdown to lower prices.

LL Opportunistic Pullback Levels

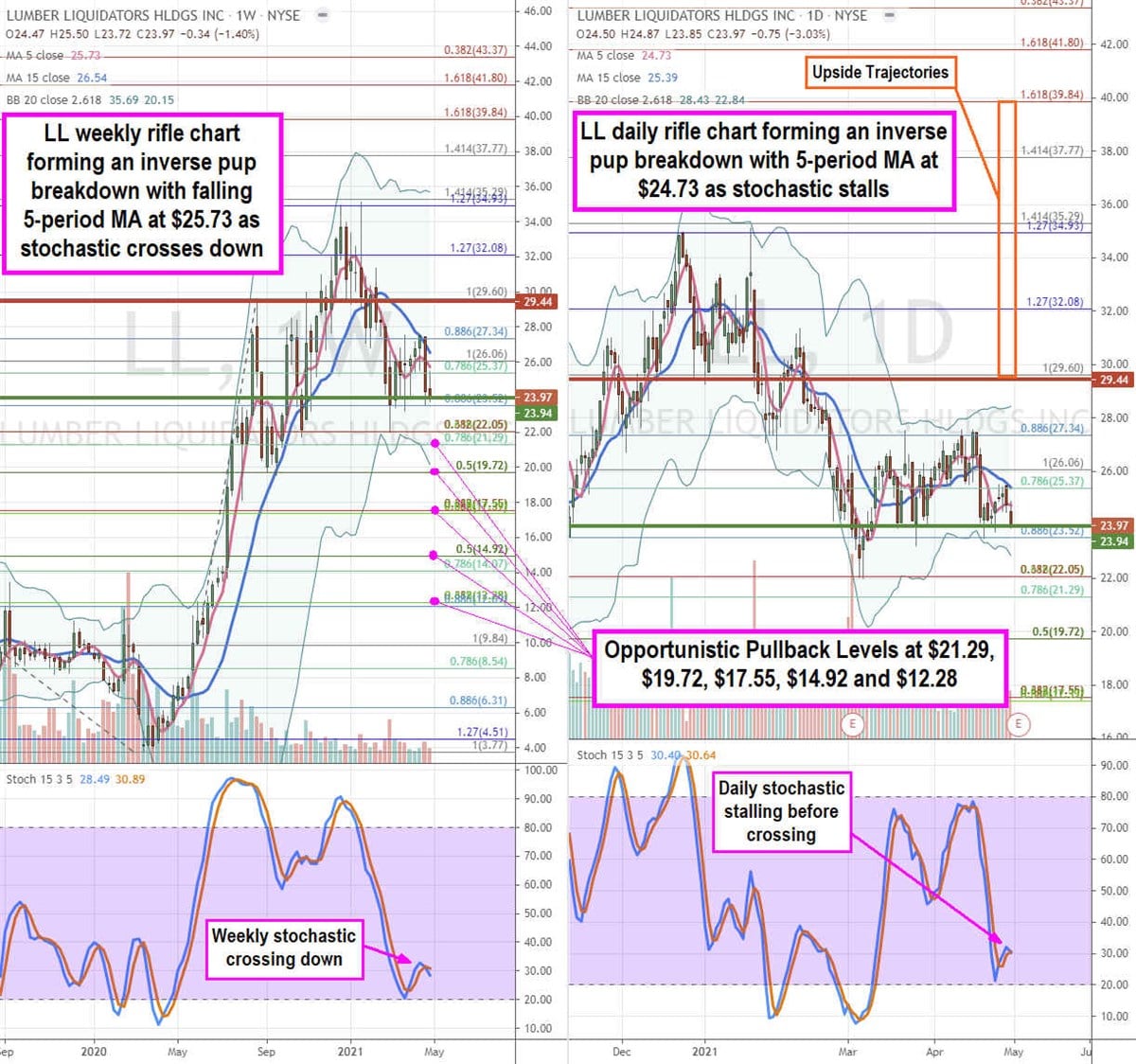

Using the rifle charts on the weekly and daily time frames provides a precision view of the near-term playing field for LL shares. The weekly rifle chart formed a bearish inverse pup breakdown with a falling 5-period moving average (MA) at $25.73 and 15-period MA at $26.54. Shares have deflected breakdown attempts at the $23.52 Fibonacci (fib) level. The weekly market structure high (MSH) sell triggered under $29.44. The daily rifle chart is desperately trying to hold above the market structure low (MSL) trigger at $23.94. A stochastic cross down with trigger an inverse pup breakdown towards the daily lower Bollinger Bands (BBs) at $22.84. The dual weekly and daily inverse pups are bearish; therefore, prudent investors need to administer patience and wait for opportunistic pullback levels at the $21.29 fib, $19.72 fib, $17.55 fib, $14.92 fib, and the $12.28 fib. The upside trajectories range from the $29.60 fib up towards the $39.84 fib level.

Before you consider LL Flooring, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LL Flooring wasn't on the list.

While LL Flooring currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.