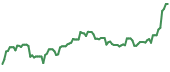

Lumen Technologies NYSE: LUMN is known for its legacy telecommunications business. However, recently, Lumen’s stock price has skyrocketed over 150%. The catalyst? A surge in demand for high-capacity fiber optic networks that are crucial for powering the artificial intelligence (AI) boom. However, this excitement is tempered by a stark reality: Lumen carries a significant debt load, raising questions about whether the AI-driven growth spurt can indeed turn its fortunes around.

Glimmers of Hope Despite Financial Headwinds

LUMN

Lumen Technologies

$5.68 -0.16 (-2.74%) (As of 09/9/2024 ET)

- Price Target

- $4.02

Lumen's earnings report for the second quarter of 2024 presents a mixed perspective for investors. Revenue reached $3.268 billion, slightly exceeding Lumen’s analyst community’s expectations. More importantly, the company raised its full-year guidance for Adjusted EBITDA, now projected between $3.9 billion and $4.0 billion, and free cash flow, expected to reach $1.0 billion to $1.2 billion. These upward revisions are primarily attributed to the burgeoning demand for AI infrastructure, signaling a potential lifeline for the debt-laden company.

However, a closer look at the financials reveals a more complex picture. Lumen reported a negative free cash flow of $(156) million for the quarter, underscoring its challenges in generating cash to service its debt. While this was an improvement from the negative $(896) million free cash flow reported in the same period last year, it remains a point of concern for investors.

While Lumen's press release highlights the excitement surrounding its AI-driven deals, the company's second-quarter 2024 filing (10Q) reveals a more complex picture of its overall performance. A detailed look at Lumen’s SEC filings exposes challenges within some business units.

The business segment, which includes various sales channels for enterprise and wholesale customers, reported a revenue decrease of $331 million for the three months ending June 30, 2024, compared to the same period in 2023. A significant portion of this decline ($164 million) can be attributed to the divestiture of Europe, the Middle East, and Africa (EMEA) business and the sale of certain content delivery network (CDN) contracts in the fourth quarter of 2023.

However, even excluding these divestitures, declines persist in areas like traditional VPN and Ethernet services within the "Nurture" product category and legacy voice and private line services in the "Harvest" category. These ongoing declines raise concerns about the company's ability to stabilize its legacy business segments and offset revenue losses.

The 10Q filing also allows for a deeper examination of Lumen's profitability beyond the top-line figures presented in the press release. The company's consolidated statement of operations shows that for the six months ending June 30, 2024, interest expense totaled $664 million, a 16% increase compared to the same period in 2023. This substantial interest burden, primarily stemming from the company's considerable debt load, continues to weigh heavily on Lumen's bottom line, casting a shadow over its ability to convert top-line growth into meaningful profits.

Despite the excitement surrounding Lumen's AI-driven growth, a look at the company's debt situation emphasizes the need for continued caution. A debt-to-equity ratio of 36.89 highlights the significant leverage Lumen carries, amplifying the company's risk profile for investors. While the current and quick ratios stand at 1.03, suggesting adequate liquidity to cover short-term obligations, the company's long-term debt burden remains a serious consideration. Lumen's ability to successfully manage this debt while simultaneously investing in growth initiatives like AI infrastructure will be crucial for its long-term success and will likely continue to be a key focus for investors.

The $5 Billion AI Deal: A Game-Changer or a Drop in the Bucket?

Central to Lumen's potential turnaround is a massive $5 billion deal to provide fiber network infrastructure to major cloud and tech companies. The most significant partnership is with Microsoft NASDAQ: MSFT to support its expanding data centers, but Lumen indicates that other prominent players are also involved. The company has not disclosed the exact timeline for deploying this infrastructure or the breakdown between upfront revenue and long-term contracts.

This deal holds immense promise, potentially generating billions in revenue and bolstering Lumen's cash flow in the coming years. However, crucial questions remain unanswered. The proportion of upfront cash versus long-term contracted revenue will significantly impact Lumen's ability to address its immediate debt burden. Additionally, investors must assess whether this influx of AI-related business is sustainable or simply a short-term boost in a rapidly evolving market sector.

The success of this deal is crucial for Lumen to make a significant dent in its debt and improve its credit profile. While the company has not provided specific details on its debt reduction strategy, it's reasonable to assume that a portion of the proceeds from the AI deal will be allocated toward deleveraging. However, the magnitude of Lumen's debt and rising interest rates suggests that even with this influx of cash, it will likely take several years of consistent execution to improve its financial health in a meaningful way.

Investor Sentiment: A Cautious Embrace

Lumen's recent stock performance suggests investors are optimistic about its potential to capitalize on the AI boom. Lumen’s analyst community has been upgrading its stance and stock price target, further indicating their growing confidence. However, even bullish analysts like Citigroup NYSE: C acknowledge the risks, with their revised price target still implying potential downside from the current stock price.

The significant volatility in Lumen's stock price highlights the speculative nature of the current rally. While the AI deal presents a compelling narrative, investors must weigh this against the company's historical performance and ability to execute its plans despite fierce competition and a rapidly changing technology sector.

Proceed with Informed Caution

Lumen's Q2 2024 earnings report provides a complex situation for investors to digest. The company undoubtedly benefits from its strategic positioning in the AI infrastructure space, but it's too early to declare a triumphant turnaround. The $5 billion deal offers a potential path to financial stability, but the road ahead remains filled with challenges.

Investors considering Lumen must adopt a data-driven approach, diligently scrutinizing any upcoming SEC reports for a comprehensive understanding of Lumen’s financial metrics. Analyzing segment performance, profitability trends, and cash flow generation will be crucial to better understanding Lumen's ability to service its debt and achieve sustainable growth. While the allure of the AI boom is undeniable, investors must temper their enthusiasm with a healthy dose of caution and a keen eye focused on potential risks.

Before you consider Lumen Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumen Technologies wasn't on the list.

While Lumen Technologies currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report