Optical and photonic products maker

Lumentum NASDAQ: LITE stock took a hard tumble recently falling (-30%) off its 2021 highs and presenting an opportunistic buying opportunity. The makers of optical and

network communications products and commercial laser technology spun-off by the iconic former high flier momentum stock JDS Uniphase in 2015. The Company’s photonics products are essential for the

5G rollout and adoption as higher bandwidth requirements can only be accomplished through the evolution in photonics, light-based, products.

Optics manipulates and modulates light as it transfers data through

fiber shaping up the infrastructure of the internet. Lumentum shifted its strategy from providing optical transmitters to supplying the underlying optical components including high-speed source lasers and receivers photodiodes used optical transceivers, which is a crowded marketplace. By pursuing higher-margin products including ROAMs, VCSELs, laser

chips and EMLs, the Company is pursuing a stronger path towards growth including a major footprint in the 3D sensing LiDAR segment. Prudent investors looking for a discounted entry into a pure 5G components play, can watch shares for opportunistic pullbacks for exposure.

Q3 Fiscal 2021 Earnings Release

On May 12, 2021, Lumentum reported its fiscal Q3 2021 results for the quarter ending Mar 2021. The Company reported earnings-per-share (EPS) of $1.40 matching consensus analyst estimates for $1.40. Revenues rose 4.1% year-over-year (YoY) to $419.5 million, missing analyst estimates for $434.02 million. The Company achieved Non-GAAP gross operating margin of 27.9%. Lumentum CEO, Alan Lowe, stated, “The strong year on year margin improvements in our third-quarter results highlight a product portfolio increasingly rich in new and differentiated products that are aligned with multi-year favorable market trends and impact of continuous improvement in our operations.” He continued, “In an abundance of caution, we deferred $14.8 million of revenue due to delays in 5G deployments in China, which decreased our reported revenue accordingly.”

Lowered Q4 Fiscal 2021 Guidance

Lumentum lowered its Q4 fiscal 2021 EPS range to $0.92 to $1.14 versus the $1.26 consensus analyst estimates. Revenues are expected to range between $360 million to $400 million versus $414.37 analyst estimates. The lowered outlook stems for a decline in 3D sensing and slower 5G deployment.

Conference Call Takeaways

CEO Lowe set the tone, “Our third quarter results highlight a product portfolio increasingly rich in new and differentiated products and aligned with favorable long-term multiyear market trends. Revenue from key new product lines that position us well for long-term growth were each up by double-digit percentages year-on-year. These include indium phosphide-based coherent components and modules, next-generation contentionless MxN ROADMs, high-speed EMLs and 3D sensing lasers.” He continued, “The transition to digital and virtual approaches in all aspects of work and life is driving staggering amounts of data in the world’s networks and cloud data centers. The proliferation of 5G wireless will remove bandwidth bottlenecks at the edge of the network and drive even more bandwidth in the core networks and cloud data centers.” CEO Lowe went on to detail how we are in the early stages of computer and machine vision revolutions as he expects 3D sensing and LiDAR capabilities to expand into applications in many new markets. This also includes their application in augmented and virtual reality applications for both industrial and commercial uses for facial recognition and biometric security to automatic and delivery applications.

Tailwinds

While 5G deployment shortfalls based out of China was the main cause of the earnings and guidance shortfall, it’s a matter of when not if. There is no question of the growing bandwidth demand that will continue. Lumentum’s own market-leading customers have expressed growing end market demand for its next-gen products, however, near-term headwinds with telecom and 5G components remain stunted for calendar year 2021. CEO Lowe feels the 5G components market will reaccelerate mid-way through its fiscal 2022, which should be early calendar year 2022. He summed it up, “Laser-based material processing is critical to the manufacturing of the devices that enable digital transformation and transition to 5G wireless and electronic vehicles and energy storage. These multi-year trends, combined with our products and technology leadership positions, bode well for us over the long-term.”

LITE Opportunistic Pullback Levels

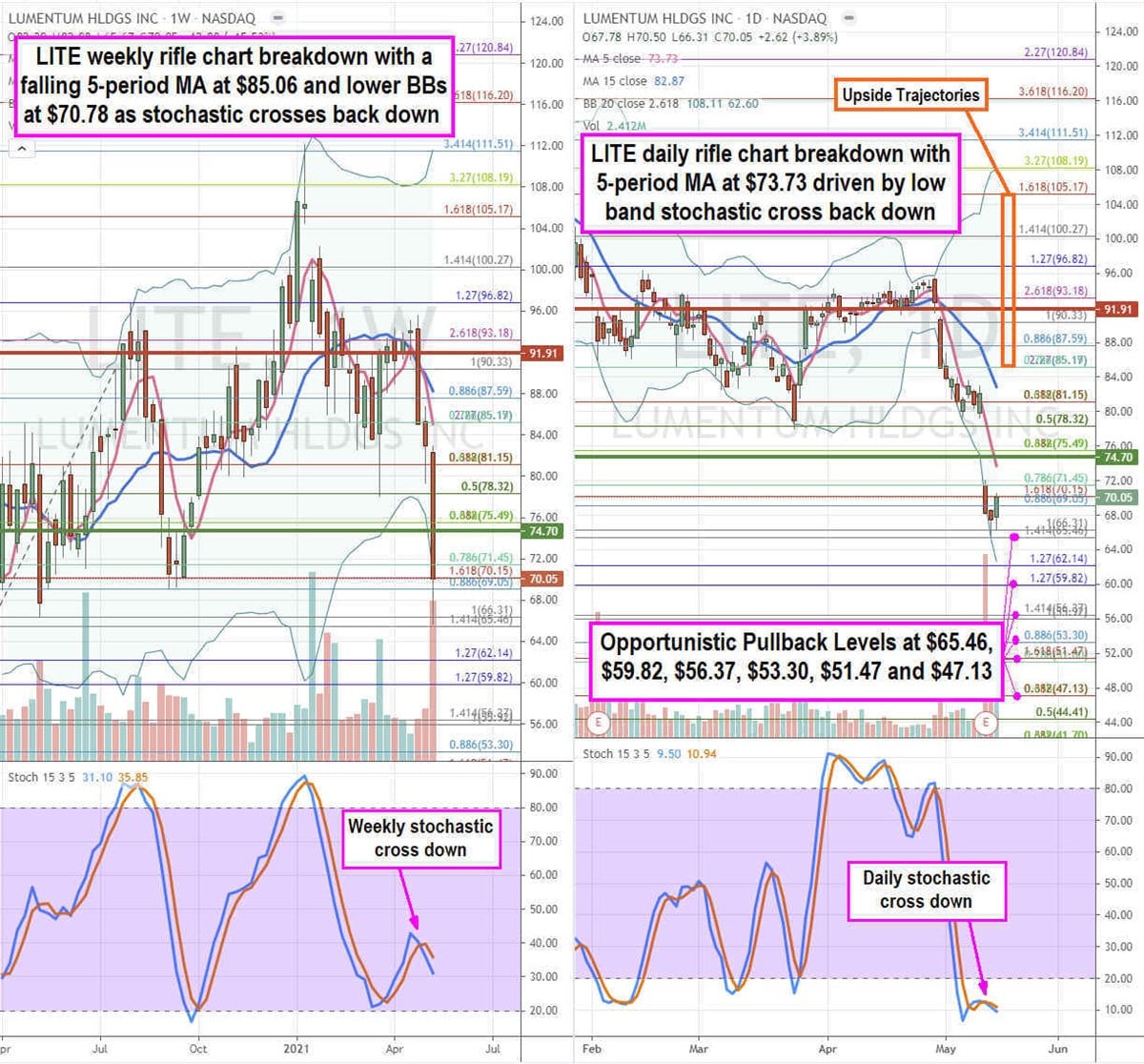

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for LITE stock. The weekly rifle chart broke down with a vicious inverse pup with a falling 5-period moving average (MA) at the $85.19 Fibonacci (fib) level. Shares fell under its weekly lower Bollinger Bands (BBs) at $70.78 on its Q3 2021 earnings reaction. The weekly formed a market structure high (MSH) sell trigger on the breakdown through $91.91. Shares also fell below its market structure low (MSL) buy trigger at $74.70 which compounded the panic stop-loss selling. The daily rifle chart has a downtrend with a falling 5-period MA at $73.73 and lower BBs at $62.60. The daily stochastic formed a low-band mini inverse pup indicating a capitulation sell-off awaits. Risk-tolerant prudent investors can used this downdraft to monitor for opportunistic pullback levels at the $65.46 fib, $59.82 fib, $56.37 fib, $53.30 fib, $51.47 fib, and the $47.13 fib. Upside trajectories range from the $85.19 fib up to the $105.17 fib level.

Before you consider Lumentum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumentum wasn't on the list.

While Lumentum currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.