Rideshare operator

Lyft, Inc. (NASDAQ: LYFT) shares have been recovering on the coattails of rival

Uber Technologies, Inc. (NASDAQ: UBER) and the

S&P 500 index (NYSEARCA: SPY) . The COVID-19 pandemic exposed Lyft as a one-trick pony as national stay-in-shelter mandates caused ride volumes to drop by more than 70% for the same period year-over-year (YoY). The Company could do little but cut capex and spending until isolation restrictions get lifted. Meanwhile, competitor Uber partially offset ride share volume declines with strong growth in its Uber Eats food delivery platform as well as cutting almost a quarter of its global workforce. Merger rumors with food delivery platform

GrubHub (NASDAQ: GRUB) have inserted a value premium in Uber shares in the hopes of growing benefits of scale through consolidation in the food delivery platforms. This inadvertently boosted shares of Lyft purely in sympathy with Uber as a rideshare peer. Investors in Lyft may want to consider unwinding positions in during the market melt-up before reality sets back into the shares.

Lyft’s Q2 Business Trends Update

On June 2nd, Lyft provided a business trends update for Q2 2020 trying to paint a robust recovery narrative using selective metrics and sophomoric apples and orange percentage comparisons. Rather than compare year-over-year (YoY) financial comparisons, Lyft opted to compare April to May 2020 improvements with various double- and triple-digit growth rates which carry no substance without the actual booking numbers, which Lyft doesn’t reveal. For example, the “non-material” bike and scooter business Lyft normally clumped together with the rideshare numbers was highlighted in the Q2 update stating bike rides on the Lyft platform increased 118% in May 2020 versus April 2020. What does that mean? Does that mean 20 bike rides to 42 bike rides in May? Bike ride revenues are normally so insignificant, Lyft doesn’t report them separately during “normal” times. Again, month to month comparisons from April to May, when isolation mandates were heaviest and started to ease were reported to have increased 73% in Austin, 31% in Las Vegas, 40% in New York, 49% in Salt Lake City, 64% in Miami and other select cities. Lyft stated rides on the platform grew 26% from April to May 2020, but still down (-70%) YoY. Aside from the headline impact, the overall narrative is still bearish.

Path to Profitability Model Unravels

Lyft’s so-called path to profitability has been coined numerous times by the Company throughout press releases and statements. Lyft’s game plan pre-COVID-19 was raises prices for riders and cut incentives for drivers, cut costs and raise prices. This only works with robust demand to provide price elasticity and an ample (over)supply of drivers. The fact that the U.S. rideshare industry is a duopoly makes this attempt very risky due to lack of stickiness with Lyft’s network that can push drivers and riders on over to Uber’s network. The COVID-19 pandemic completely wiped out the demand as riders were mandated to stay home and drivers (supply) also stayed off the roads for safety reasons. The best Lyft could do was cut costs and preserve cash until isolation mandates are loosened for economies to restart.

Uber Rules the Restart

The restart has begun, and Lyft is trying to paint a robust recovery narrative. However, Uber’s driver network has been more active throughout the pandemic with Uber Eats and is ready to hit the ground running with rideshare as regions restart their economies. Uber is providing surge incentives to drivers in the same areas where Lyft is not. Drivers will naturally migrate to Uber’s network when bonuses are presented over Lyft. More drivers mean less wait times to meet demand which attracts more rider demand. In essence, Uber is taking the liquidity (drivers and riders) from Lyft as they misguidedly pursue their “path to profitability” strategy. The aftermath of the COVID-19 pandemic will reveal market share growth for Uber and shrinkage for Lyft. However, what happens if Lyft reaches profitability? Simple, markets can apply a price-earnings (P/E) ratio to properly value the shares like any transport company. Since Lyft has stated it will seek no other business outside of multi-modal transportation, it has boxed itself as a transport play (a dispatcher) and not a “technology company” as Uber states itself to be. The transportation sector boasts a price-sales (P/S) ratio from 0.50 to 4.5X if you are a world-class profitable railroad. If Lyft attains a P/E ratio, shares will inevitably be priced closer to industry metrics (17X P/E), which is something Lyft shareholders may regret. As they say, “be careful what you wish for, because you just might get it…”.

Price Trajectory Levels

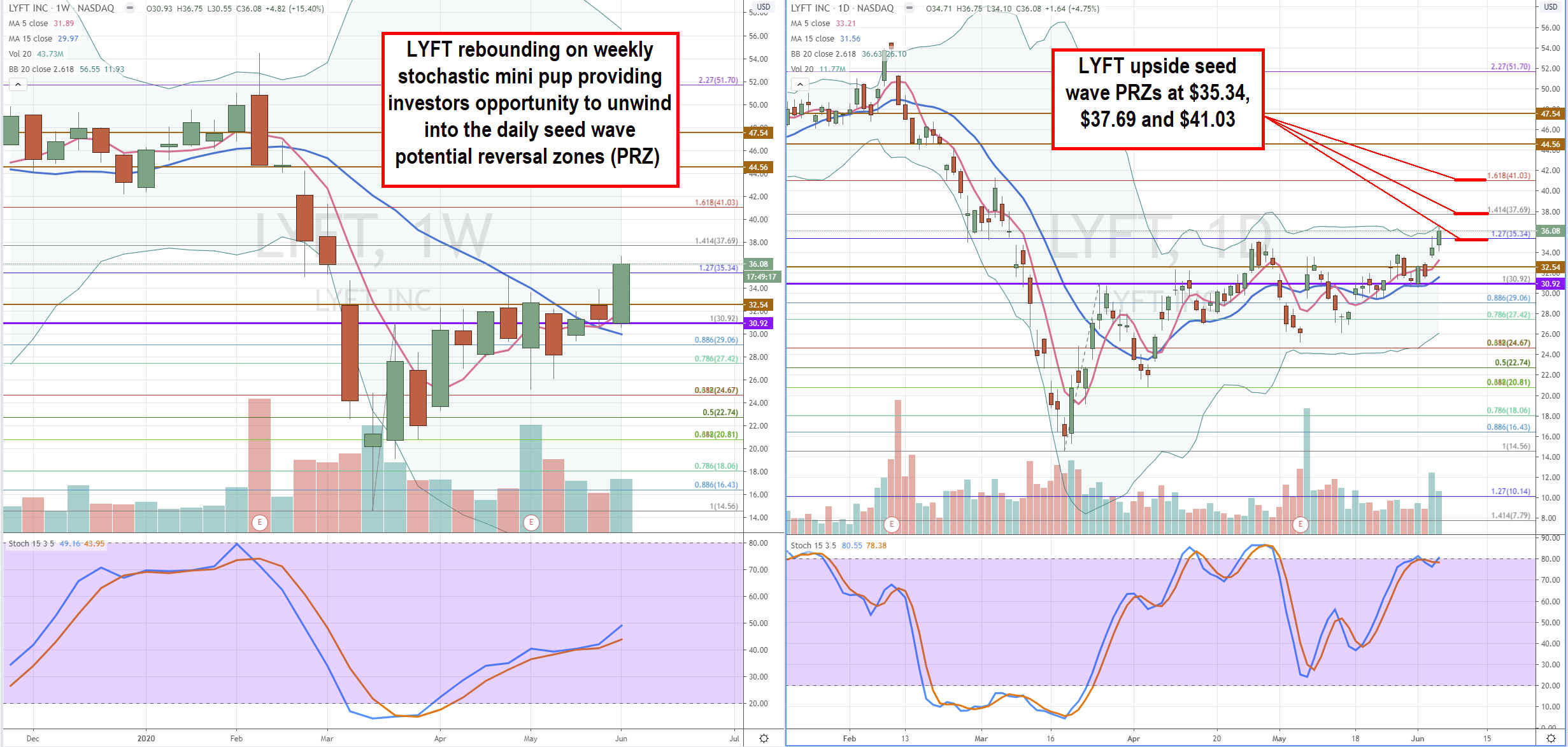

Using the rifle charts on the wider weekly and daily time frames to lay out the playing field is suitable for swing traders and investors. LYFT formed a weekly market structure low (MSL) buy trigger above $30.92 and triggering a daily seed wave pattern that forecasts three price targets also referred to as potential reversal zones (PRZs) which are at $35.34, $38.69 and $41.03. These are the 1.27, 1.414 and 1.618 Fibonacci (fib) levels. Nimble traders can play reversions off these levels while investors should be aware of these trajectory levels for opportunities to trim into.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.