Cryptocurrency mining company

Marathon Patent Group NASDAQ: MARA stock has exploded in the past few months thanks to the surge in

Bitcoin (BTC) values. While there are a number of thinly traded blockchain ETFs, Bitcoin has yet to have an SEC approved tracking ETF. Mining rig component makers like

Advanced Micro Devices NYSE: AMD and

NVIDIA NASDAQ: NVDA are seeing a surge as their

graphic processor cards power them. Until then, investors may look to find alternative derivatives to ride the Bitcoin momentum. It’s very much like how junior gold mining stocks tend to move with large price moves in gold, Marathon would be the junior gold miner. Instead of mining gold, it’s mining cryptocurrencies, notably Bitcoin. The markets would have to establish this narrative. Marathon has the potential to become one of the largest publicly traded crypto miners by the end of 2021. For high risk-tolerant investors that seek a potential liquid derivative of Bitcoin, Marathon Patent may be the vehicle to play it. Watch for opportunistic pullback opportunities during the decoupled periods for speculative exposure.

Bitcoin Mining

Marathon Patent operates a proprietary data center in Montana with capacity of 105 Megawatts. The Company plans to have 23,500 Antminer Bitmain S-19 Pro Bitcoin Miners in production in 1H 2021. On Dec. 28, 2020, the Company entered a purchase agreement for 70,000 S-19 ASIC Miners from Bitmain for $170 million. The initial batch of 7,000 miners will arrive in July 2021 with the final shipment by December 2021 to bring total miners to 103,000. In the December 2020 Investor Presentation, the Company anticipates a fleet of 33,560 miners projected to produce 2 BTC/day with revenues of $500,000 per month (based on an $18,000 Bitcoin price) to ramp up to producing 15 to20 BTC/Day at a 2.7% Hashrate generating $11.7 million per month by the end of December 2021. This coming from the December 2020 investor presentation assuming Bitcoin trading price of $18,000. It has risen through $30,000 during the first-week of 2021.

Q3 2020 Earnings Release

On Nov. 12, 2020, Marathon Patent released its third-quarter earnings report for the quarter ending in September 2020. The Company saw total revenues of $825,184 with operating losses of (-$2 million) or (-$0.12) EPS. CEO Merrick Okamoto stated, “With only 2,600 miners in operation in September when Bitcoin was trading at $10,000, the company generated $650,000 in Bitcoin revenue, our largest quarterly Bitcoin revenue in history. By the end of the second quarter in 2021, we will have 23,560 miners deployed which equate to a greater than 1100% increase in mining capacity. At current Bitcoin prices, our deployment of new miners has the potential to produce more than an 11 fold increase in our monthly revenue as compared to our September 2020 revenue production.”

Transforming into Bitcoin Derivative

This is the part that relies on the stock price action correlating with the price of Bitcoin on a consistent basis. The analogy would be like junior gold miners moving with the price of gold. Ultimately, if the markets view Mara as a top miner, then shares would correlate even closer with Bitcoin to eventually become a derivative of Bitcoin price action.

Regulatory Risks

Governments and Central Banks are weary of cryptocurrencies for a multitude of reasons. While U.S. banks are tightly regulated to track funds and prevent money laundering, the decentralized nature of Bitcoin and cryptocurrencies is a nightmare to combat criminal activities. The U.S. Treasury Secretary Steve Mnuchin is rumored to be attempting to rollout new regulation for crypto exchanges in 2021. However, there is hope that his replacement Janet Yellen will have a more “friendlier” stance on cryptocurrencies as she has been receptive to the digital asset.

How High Can Bitcoin Rise?

This is the million-dollar question. Bitcoin prices jumped 40% in December 2020. Some analysts peg the upside as high as $400,000 while others call it another bubble in the making. The main underlying factor is the ever dwindling supply since only 21 million Bitcoins will ever exist. The scarcity as prices rise alone can drive FOMO demand higher especially as institutions are stepping into the game after companies like PayPal NASDAQ: PYPL and MicroStrategy NASDAQ: MSTR lead the way loading up on Bitcoin investment. The approval of a Bitcoin tracking ETF will undoubtedly surge prices higher. The lack of pattern day trading (PDT) rule restriction and 24/7 around the clock trading enables Robinhood traders full access. As for fundamentals, there are none. It was originally created as a store of value, but that argument only works when prices remain stable. When Bitcoin collapsed over (-80%) after peaking around $20,000 in December 2017 to $3000s by Nov. 2018, it was hardly a “store of value” for those who chased it. This is uncharted territory, literally. It could be a worldwide game of musical chairs driven by scarcity. High-risk speculators seeking exposure should monitor opportunistic pullback levels on Marathon Patent for entries.

MARA Opportunistic Pullback Levels

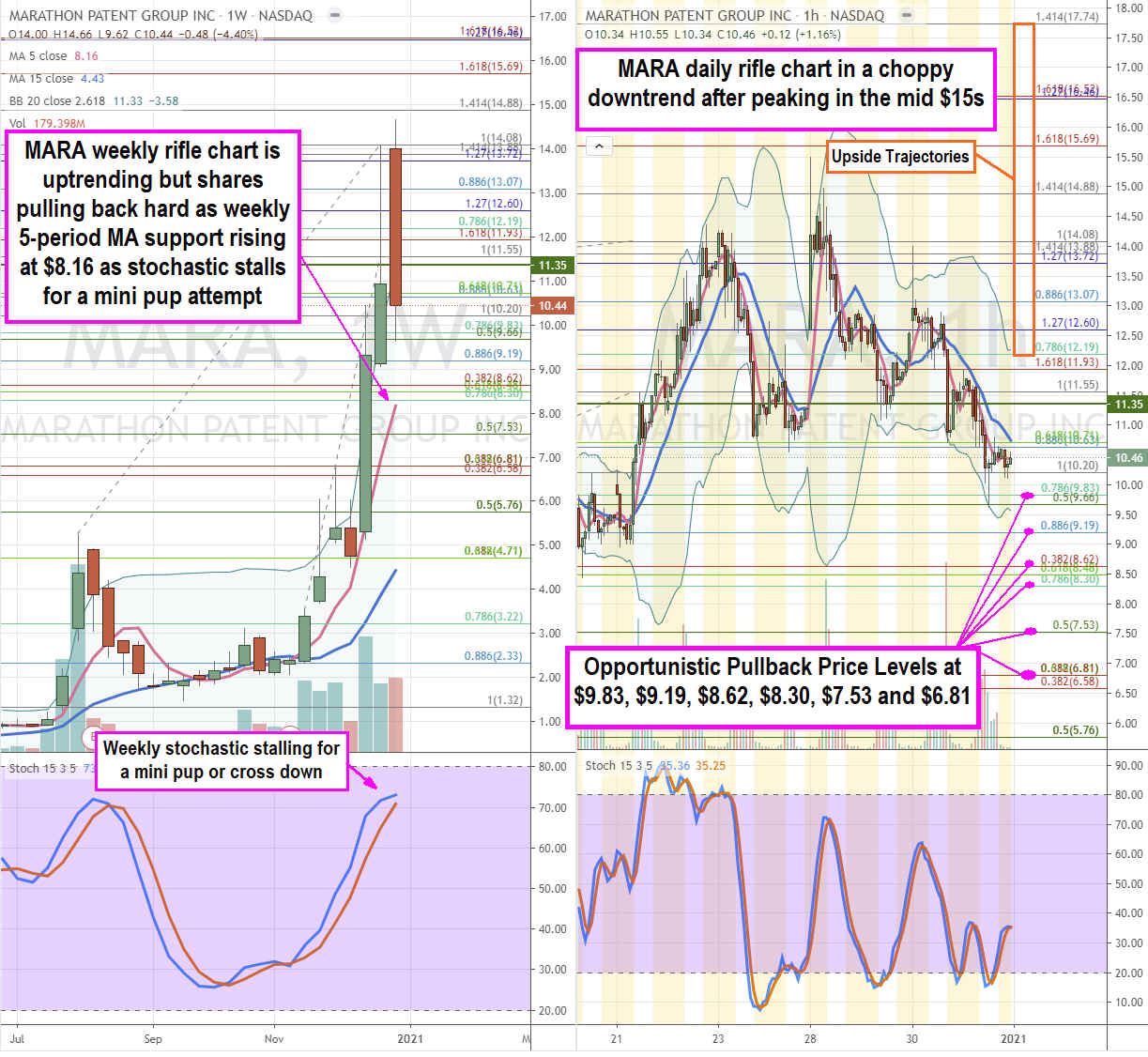

Using the rifle charts on the weekly and daily time frames enables a more precise near-term view of the price action playing field for MARA stock. Keep in mind that MARA correlation to Bitcoin has diverged after peaking in the $15s. Whether correlation with Bitcoin remains consistent is the wildcard but should improve as more miner rigs go online. The weekly rifle chart is uptrending but pulling back hard after peaking. The weekly 5-period moving average (MA) is rising at $8.16. The weekly stochastic is stalling for either a mini pup breakout or cross down for channel tightening selling towards the weekly 15-period MA. The daily rifle chart has been down trending with daily stochastic divergence tops. The daily market structure low (MSL) trigger is above $11.35. The daily lower Bollinger Bands (BBs) sit near the $9.66 Fibonacci (fib) level. Due to the volatility, it’s important to control size allocations and scale in and out of positions. The cheaper the price levels, the less risk incurred but that’s also relative to sizing and holding period. The opportunistic pullback levels are at the $9.86 fib, $9.19 fib, $8.62 fib, $8.30 fib, $7.53 fib and the $6.81 fib. The upside trajectories range from the $12.19 fib up to the $17.74 fib. This stock is only suitable for nimble seasoned traders and high-risk tolerant investors.

Before you consider MARA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MARA wasn't on the list.

While MARA currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.