Because AI is so data-centric, based on big data, data mining and the algorithmically-produced insights that come from it, it is no surprise to see stock market-oriented businesses such as Marketbeat leaning into the technology. The stock market is all about data and generates it in terabytes. Marketbeat is embedding AI into the platform infrastructure to help investors cope with the data flow while performing their due diligence.

After all, due diligence is what Marketbeat is all about—digging deep into the ins and outs of publicly traded companies to help investors with their decision-making process. The tools won’t tell you what or when to buy; they will help aggregate the terabytes of data generated about the stock market and provide information investors can use.

Marketbeat AI-powered insights

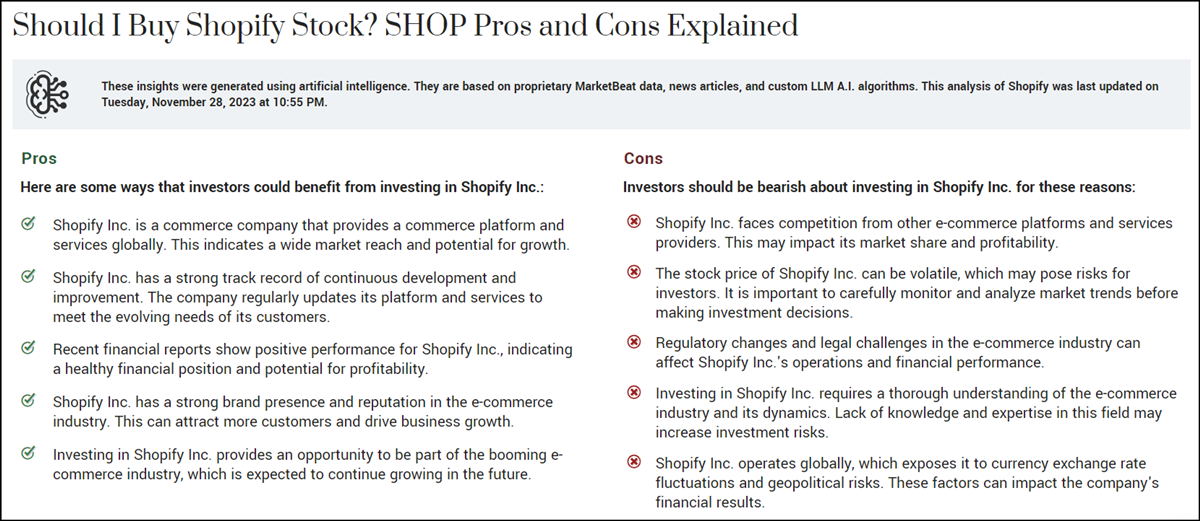

The first AI-powered tool provided by Marketbeat.com is called Pros and Cons. The custom LLM AI algorithms sift through Marketbeat.com’s proprietary data and news articles to generate insight for investors. The tool lists insights as Pros and Cons that investors can use as a launch pad for additional research.

For example, Shopify’s NYSE: SHOP AI insights list its global presence as a pro and a con. The pro-argument is that globalization indicates a broad reach and a pathway to growth offset by negatives such as currency translation and regulatory hurdles. Other pros are its position in eCommerce, consistent performance and brand recognition. The takeaway for investors is that Shopify is a solid play on eCommerce that comes with risks. Investors willing to take on the risk will want to keep track of consumer trends and competition, which includes Amazon.

The insights for Microsoft NASDAQ: MSFT are equally intriguing. The tool suggests that Microsoft has a strong presence in tech, multiple revenue streams to support its financial health, and a strong growth potential due to recent developments (AI).

Microsoft is also trading at a price point favorable to investors, and the analysts' sentiment backs that up. Microsoft has a consensus target that is trending steadily higher and a high-end target worth 20%. Cons to investing in Microsoft include competition, a volatile market for tech and regulatory hurdles in international markets.

Marketbeat is still in the early stages of rolling out its AI tools, so platform users can expect to see new developments over the coming quarters. Until then, the Pros and Cons are listed for the top 1000 publicly traded companies and shown about midway down each stock page. Eventually, the Pros and Cons will be listed for sector pages too.

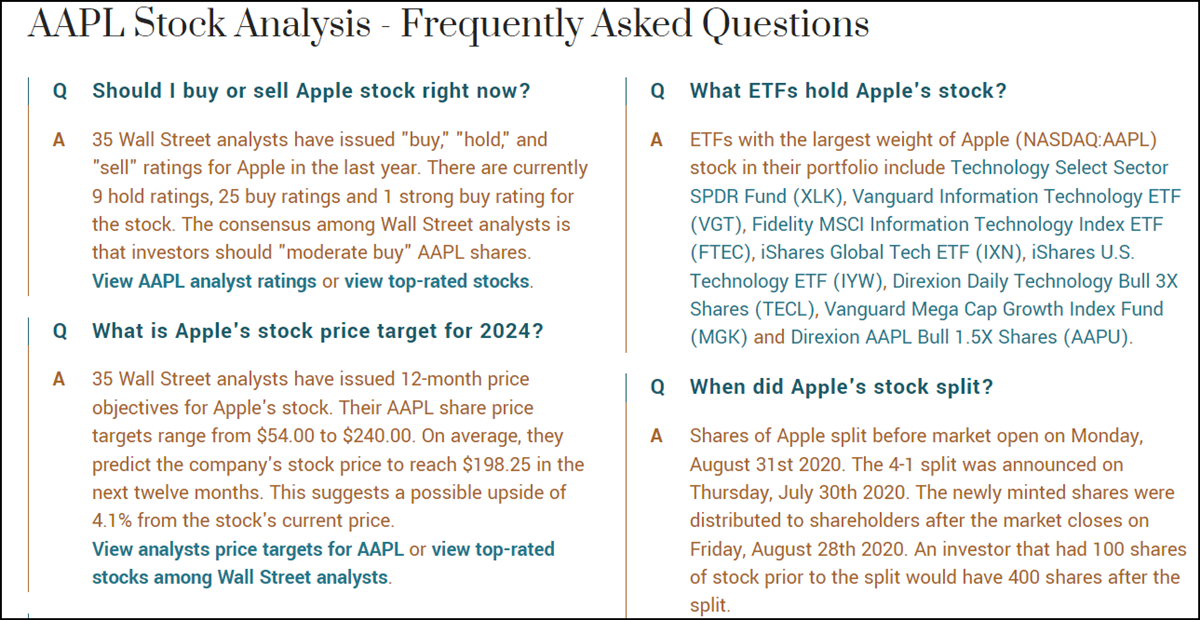

Another useful tool that compliments the AI insights is the Frequently Asked Questions for each stock. These are the run-of-the-mill questions found on other sights, but proprietary data from the Marketbeat.com platform that is aggregated and displayed in a Q&A format. This is where investors can find an in-depth snapshot into a company’s health, outlook and market sentiment.

Pros and Cons of the AI Pros and Cons

Pros of the AI tools center around new investors. Seasoned investors will already know much of what the tool is listing. New investors or investors looking at new stock may find the insights more than sufficient to make the next move in their decision process.

The depth and quality of the knowledge will improve over time but should not be overlooked now. The trick with investing is to keep track of market activity daily to know what “normal” is like so the abnormal days (buying or selling opportunities) are easier to recognize. The AI tools constantly aggregate new information and can provide an early warning to sell or signal to buy for savvy investors.

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.