Semiconductor developer

Marvell Technologies NASDAQ: MRVL stock been uptrending to multi-year highs after recovering off

pandemic lows made in March 2020. The Company is hitting on all cylinders as nearly every segment is showing growth, even the legacy

storage segment. The most robust growth is expected to continue in 5G, networking, cloud, and automotive. While the

automotive sector has recently announced issues with the

chip shortage having material impacts on earnings in 2021, the markets view it as a sign of robust demand for chip makers outstripping supply. The recent downdraft in the semiconductor sector can provide prudent investors with opportunistic pullback levels to consider taking exposure in Marvell.

Q3 FY 2021 Earnings Release

On Dec. 3, 2020, Marvel released its fiscal third-quarter 2021 results for the quarter ending October 2020. The Company reported an earnings-per-share (EPS) profit of $0.25 excluding non-recurring items meeting consensus analyst estimates of $0.25. Revenues rose 13.3% year-over-year (YoY) to $750.1 million beating analyst estimates of $751.01 million. The Company provided in-line guidance for Q4 2020 expecting EPS between $0.25 to $0.33 versus $0.28 consensus analyst estimates. Revenues for Q4 are expected to come in between $745.75 million to $824.50 million versus $785.40 million analyst expectations. The Company noted strength in networking, cloud and 5G. Networking revenues rose 35% YoY. Supply chain constraints are keeping the Company conservative on its forecasts.

Conference Call Takeaways

Marvell CEO, Matt Murphy discussed a major win, “One of these OEMs also selected our next-generation 5-nanometer OCTEON processors to replace their current x86 Solutions across their entire enterprise router platforms.” Referring to beating out semiconductor behemoth Intel NASDAQ: INTC . CEO Murphy also highlighted the synergies of its Inphi acquisition, “Marvell’s leadership in embedded processors for 5G infrastructure will better position Inphi to participate in the optical conductivity opportunity. In cloud, Inphi’s electro optics platform is critical to data center architecture, and they have established a direct relationship with the industry’s largest cloud infrastructure providers.” The supply chain issues were detailed, “The rapid recovery this year in the semiconductor industry appears to be stressing significant portions of the supply chain. These supply challenges are currently limiting our ability to fully satisfy the increasing demand for some of our networking products.” China is the highest area of growth for the Company, especially in 5G. However, outside of China, the momentum is expected to accelerate the fastest in the U.S. and Japan, “Our 5G customer base continues to expand, and the second regional customer has selected Marvell’s industry-leading OCTEON fusion-based NAND processors to power all their 5G base stations.”

Growth Drivers

Marvell is well-positioned in the strongest growth segments in semiconductors. The 5G rollout is still in the early stages and its chips are key components for the development on next-gen Radio Access Network (RAN). OCTEON fusion processors are the leading silicone platform for 5G-based band and radio processing. Cloud computing continues to accelerate as more and more companies and end users are migrating to the cloud. The notion of downloading a standalone program taking up resources on your system is dissipating as applications move to the cloud. Rather than tying up resources and slowing your system done, the cloud enables technology providers to do all the heavy legwork and push just the information you need quickly and conveniently. When’s the last time you purchased a spreadsheet or word processing program? Microsoft NASDAQ: MSFT Office is a subscription-based cloud product just as Google NASDAQ: GOOG Docs, Adobe NASDAQ: ADBE Acrobat and PhotoShop and so on and on. The Company has guided very conservatively due to supply constraints. The bar was set low. Prudent investors can monitor opportunistic pullback levels to consider building positions as the underlying growth drivers will continue to accelerate.

MRVL Opportunistic Pullback Levels

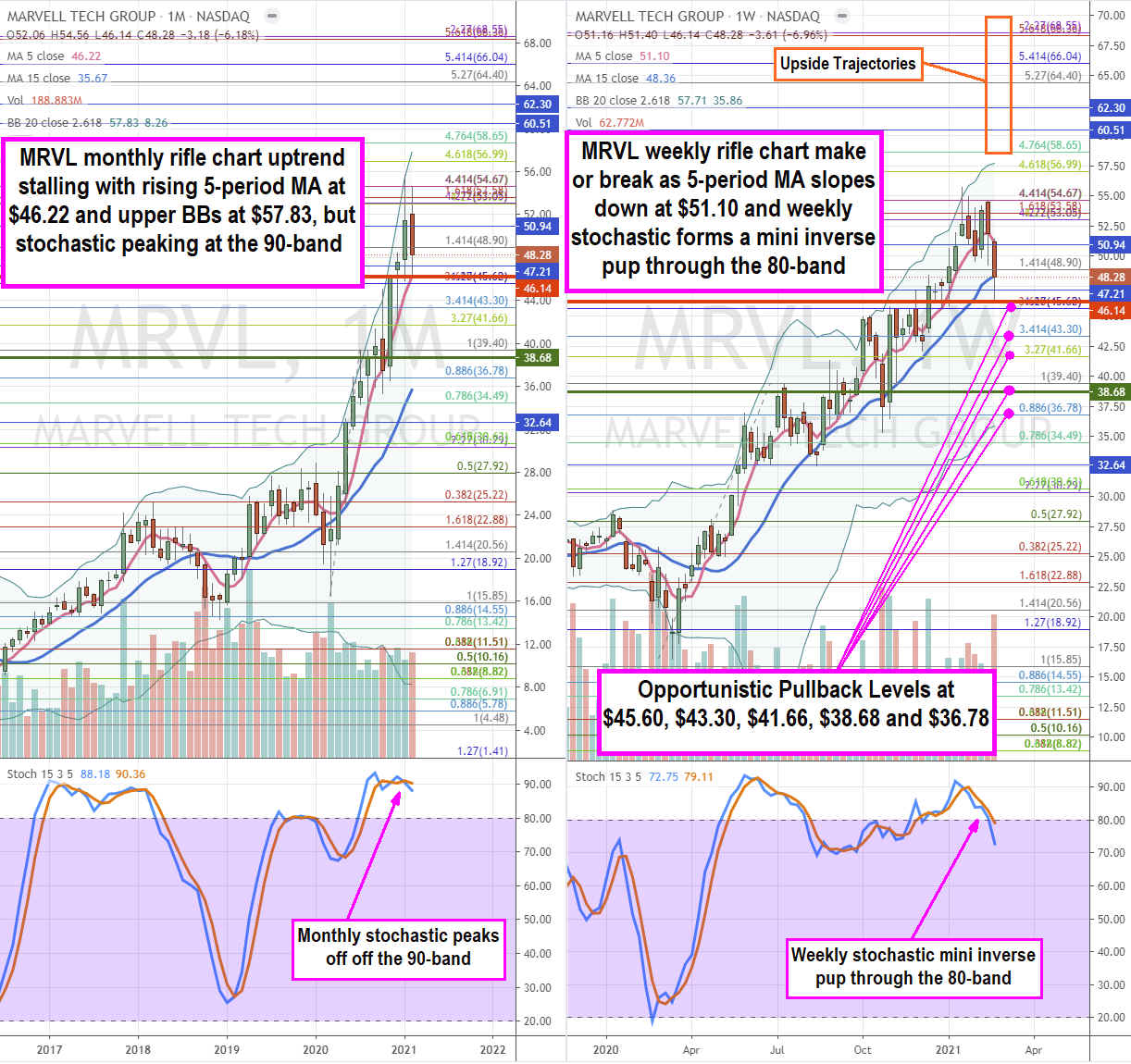

Using the rifle charts on the monthly and weekly time frames provides a broader view of the playing field for MRVL shares. The monthly rifle chart uptrend has a rising 5-period moving average (MA) support at $46.22 with upper Bollinger Bands (BBs) at $57.83. The monthly 15-period MA is rising at $35.67. The monthly stochastic has peaked at the 90-band, but still could form a pretzel mini pup, but will need the weekly stochastic to cross back up. The monthly market structure high (MSH) triggers under $46.14. The daily monthly market structure low (MSL) triggered above $38.68. The weekly rifle chart uptrend is stalled as the 5-period MA slopes down at the $50.94 Fibonacci (fib) leveland 15-period MA at $48.36. The weekly stochastic formed a mini inverse pup through the 80-band setting up a make or break that can turn into a pup breakout or mini inverse pup breakdown. Prudent investors can watch for opportunistic pullback levels at the $45.60 fib, $43.30 fib, $41.66 fib, $38.68 fib, and the $36.78 fib. The upside trajectories range from the $58.65 fib up towards the $70.00 level.

Before you consider Marvell Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marvell Technology wasn't on the list.

While Marvell Technology currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.