Geospatial satellite network operator

Maxar Technologies (NYSE: MAXR) shares have staged an impressive breakout on its Q2 2020 earnings results. The turnaround story has legs and shares are basing for the next breakout higher. The stock fell as low as $7.50 during the pandemic market plunge that sent the benchmark

S&P 500 index (NYSEARCA: SPY) down by (-34%) before bottoming in March 2020. As an overlooked pureplay on the red-hot space-theme, risk-tolerant investors may want to monitor Maxar Technologies for opportunistic pullbacks ahead of its next leg breakout especially in light of

Virgin Galactic (NYSE: SPCE) stock shortfall. Maxar has real revenues and increasing contracts with many the U.S. government agencies as it prepares to launch its next-gen World Legion Satellites in H1 2021.

Q2 FY 2020 Earnings Release

On Aug. 5, 2020, Maxar released its second-quarter fiscal 2020 results for the quarter ending June 2020. The Company reported earnings of $0.05 per share versus consensus analyst estimates of $0.32 per share, missing estimates by (-$0.27) per share. Revenues rose to $439 million up from $412 million year-over-year (YoY) beating analyst estimates by $28 million. Net income was $306 million but that included an after-tax gain on the sale of MDA Business for $304 million net $25 million in taxes which closed on April 8, 2020. The Company purchased the remaining 50% ownership in 3D-data provider Vricon on July 1, 2020, by exercising call options. Maxtor ended the quarter with $500 million in liquidity and swapped out $150 million of 2023 notes with 2027 bonds. Revenue guidance for 2020 was raised from flat to mid-single digit and adjusted EBITDA in the range of $415 million to $445 million, up $40 million higher since previous quarter.

Takeaways

Maxtor CEO Don Jablonsky stated, “Demand has remained resilient in the current environment as our customers continues to rely on us for important national security and commercial missions.” The Company repaid $511 million of the Term B Loan facility thanks to closing the MDA transaction. Revenues increased by $15 million in the Earth Intelligence segment and 3 million in the Space Infrastructure (SI) segment. Total order backlog rose to $1.9 billion primarily due to new awards in the SI segment.

World Legion Satellites

Maxar plans to launch its next generation World Legion Satellites consisting of six new satellites in the first half of 2021. This will triple its 30cm and multispectral imagery enabling up to 15 revisits per day improving near-real time geometric accuracy for new use cases for satellite imagery for detection of change on Earth’s surface. The Company is prioritizing sales and marketing efforts to leverage the additional capacity and integrating the Vricon acquisition with unique 3D capabilities. The synergy of Vricon and its upcoming World Legion constellation is expected to drive growth over the next several years. While shares seem lofty after rising nearly 40% in reaction to Q2 2020 earnings, opportunistic pullbacks should present itself prior to forming another breakout on this improving turnaround story.

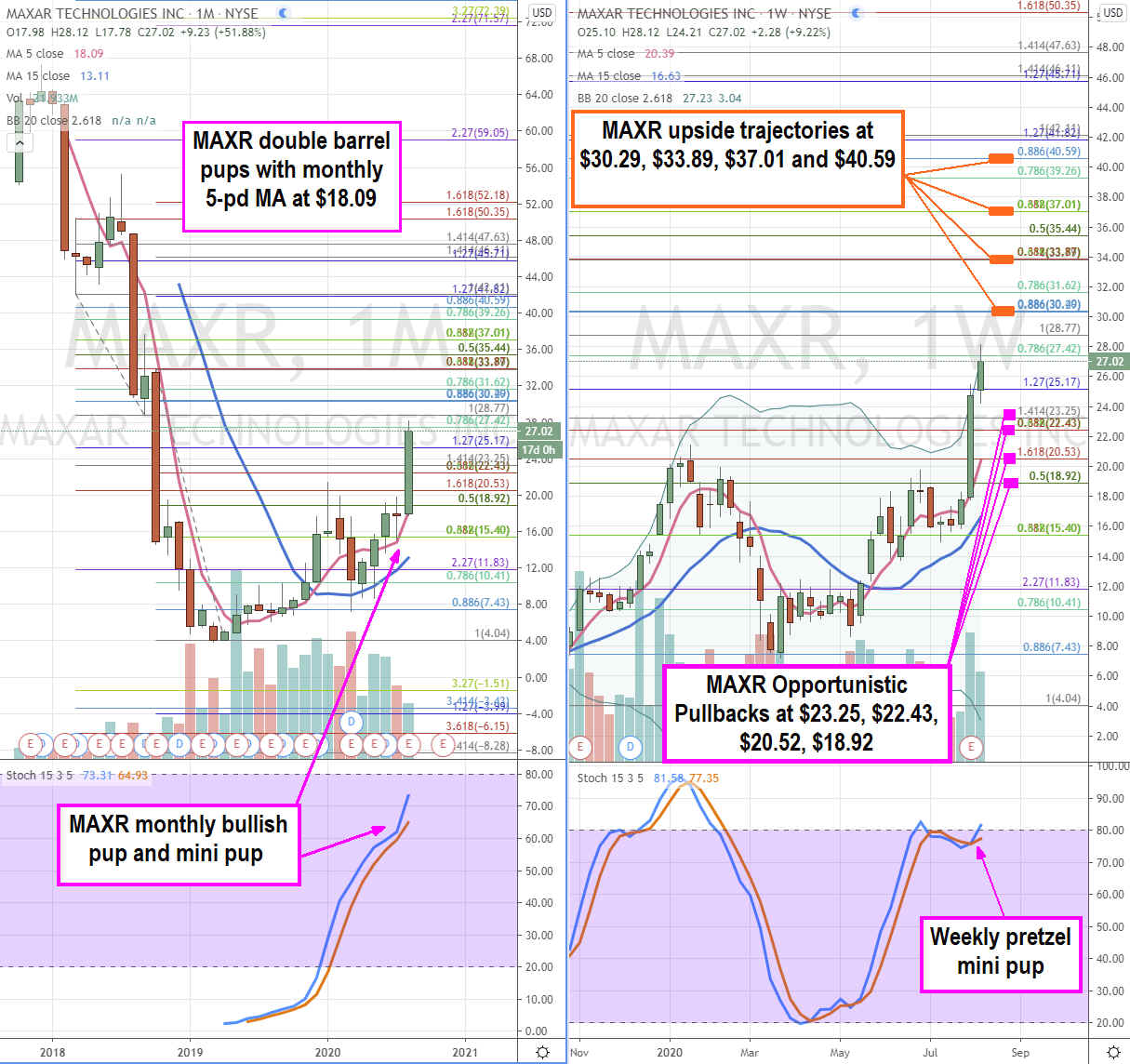

MAXR Price Trajectories

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for MAXR stock. The monthly rifle chart triggered a market structure low (MSL) buy above $9.05. The weekly rifle chart triggered its MSL buy above $11.58. The monthly rifle chart formed an impressive double barrel pup breakout consisting of the monthly pup breakout and stochastic mini pup. With mini pups, the 5-period moving average (MA) is the key support which is currently at $18.09. The weekly rifle chart tested its upper Bollinger Bands (BBs) at $27.23, which indicates near-term targets have been hit on the pup breakout. The rifle chart uses a 2.618 standard deviation rather than the conventional 2.0 to accommodate extensive moves. Usually, the reversion back down off the upper BBs tends to pullback to the 5-period MA for that time frame, which would be on the $20.53 Fibonacci (fib) level. This sets up opportunistic pullback levels at the $23.25 fib, $22.43 fib, $20.53 weekly 5-period MA/fib and $18.92 fib near the monthly 5-period MA. The upside trajectories for the next leg up sit at $30.29, $33.89, $37.01 and $40.59. Unlike many of the momentum floaters, these upside trajectories are not new to shares of MAXR as its traded as high $67.30 in 2018.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.