It’s not like there was much uncertainty about whether or not McDonalds (NYSE: MCD) would be an inflation and recession-proof stock, but yesterday’s earnings report pretty much confirmed it. The home of the Big Mac came in a little light on revenue but topped analyst expectations for its bottom line earnings. Global comparable sales increased 9.7%, reflecting positive comparable sales across all segments, with the US alone increasing 3.7%. Further afield there was a double-digit bounce seen in sales across international operated markets. “Strategic menu price increases” were credited with carrying profits above expectations, and the results were enough to send shares up close to 3% on the day.

Considering the benchmark S&P 500 index finished down more than 1%, it’s clear Wall Street is a fan of the numbers. CEO Chris Kempczinski struck a mostly bullish tone with the report, saying "the McDonald's System continues to demonstrate strength and resiliency. Our second quarter performance reflects outstanding execution against our Accelerating the Arches strategy. By focusing on our customers and crew, enabled by a rapidly growing digital capability, we delivered global comparable sales growth of nearly 10%. Nonetheless, the operating environment across the competitive landscape remains challenging. While we are planning for a wide range of scenarios, I am confident that our plans and people position McDonald's to weather this environment better than others."

Fortress Stock

The headwinds he was referring to must be acknowledged by anyone thinking about getting involved. It is true that competition remains robust and that economic concerns are likely to continue impacting the fast-food chain. In Q2 currency impacts and slower sales in China due to COVID lockdowns helped drive the disappointing revenue report despite broadly stronger international sales. Consolidated revenues decreased 3% from the prior year, with a 6% impact of currency impacts blamed for the decline. But on the whole, these are relatively light concerns compared to what some of the other mega caps are dealing with right now.

Strategas Research Partners CEO Jason Trennert made the point earlier this week that while the broader equity market is likely going lower, with speculative stocks leading the way, so-called well-established companies, or what he calls “fortress stocks”, should be able to succeed in this market. He counts McDonalds as one of them. Elsewhere on Wall Street, Morgan Stanley analyst John Glass lowered his price target on McDonalds stock to $285 from $287. This was a fairly minor adjustment all things considered as he still maintained the Overweight rating on the shares. This fresh price target is pointing to an upside of at least 10% from where shares closed on Tuesday, and were they to hit it they’d be at fresh all time highs.

Beating The Competition

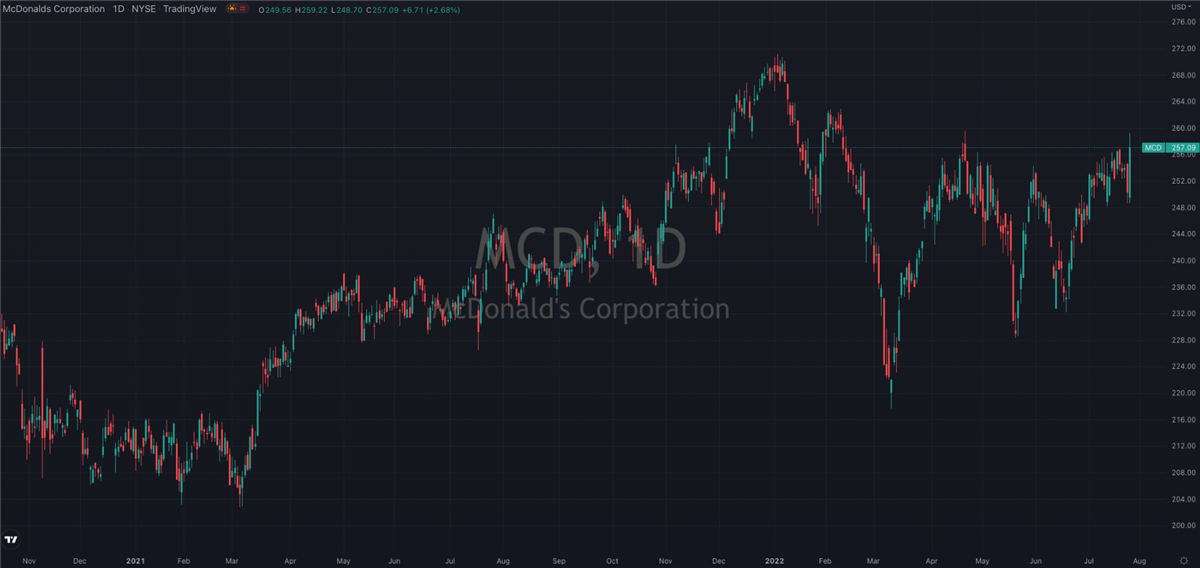

In a wider industry move, Glass and the team reduced their second half and 2023 estimates across much of their restaurant and foodservice distributors coverage ahead of Q2 earnings reporting to reflect expected softening sales as consumers face rising pressures. Out of that bunch though, McDonalds is easily one of the strongest and best performing. Its shares are up a full 18% from the lows of March, versus the 6% lighter that the S&P 500 index is over the same time period.

Looking at some other

well known names in the fast food space only cements McDonalds position as an industry, and effectively market, leader right now.

Chipotle (NYSE: CMG) shares are close to 2022 lows, while the likes of

Shake Shack (NYSE: SHAK) are only marginally above the levels they hit during the worst of the pandemic driven sell-off in 2020. This is going to be a summer and a year where investors have to be

more picky than ever with stocks they choose to add to their portfolio. Increasing sales, better than expected earnings and outperforming competitors are three good characteristics to start that search with. On all three fronts, McDonalds is delivering right now.

Before you consider McDonald's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and McDonald's wasn't on the list.

While McDonald's currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.