Microsoft NASDAQ: MSFT, the blue-chip tech juggernaut, recently hit an all-time high when the stock hit $370.10 on Friday. With a market capitalization soaring to an impressive $2.75 trillion, Microsoft is positioned as one of the most valuable companies globally, trailing only slightly behind Apple, which boasts a valuation of $2.9 trillion.

This surge in market value over the years has certainly not gone unnoticed, making Microsoft a focal point for investors seeking stability and growth in their portfolios. The stock has garnered significant attention and adoration from investors, earning a reputation as a beloved choice in the market. Microsoft has also consistently received top ratings from analysts, making it a darling among investment professionals.

So, as this adored tech stock achieves new heights, let’s take a closer look at its recent earnings and growing influence and impact on the market, as it holds a significant weighting of many popular sector and market ETFs.

Earnings topped Wall St. estimates

Microsoft exceeded expectations in its latest earnings report on October 24th, 2023, reporting earnings per share of $2.99, surpassing the consensus estimate of $2.65 by $0.34. The company generated $56.52 billion in revenue for the quarter, beating the consensus estimate of $54.52 billion and reflecting a 12.8% year-over-year increase.

Notably, the Intelligent Cloud segment, including Azure, reported a 19% revenue increase, with Azure-specific growth at 29%, surpassing expectations.

Azure OpenAI Service attracts 18,000 customers, and 3% of Azure's quarter growth is attributed to AI. The Productivity unit's $18.59 billion revenue exceeded expectations, and the Teams app reached 320 million monthly users. The More Personal Computing segment contributed $13.67 billion, up 3%, surpassing the $12.85 billion consensus.

Analysts love the stock

It should come as no surprise that analysts love the stock, considering the company's ability to consistently perform, grow, innovate, and provide a return to its shareholders. As a result, MSFT is on the Top-Rated list, and one of the most followed stocks online.

Based on thirty-eight analyst ratings, the stock has a consensus rating of Moderate Buy and a consensus price target of $384,34, predicting almost 4% upside. Notably, out of all ratings, thirty-four analysts have rated the stock as a Buy and four as a Hold.

Following the company’s earnings release and comments, The Goldman Sachs Group, on October 25, boosted its target for MSFT from $400 to $450, calling for an almost 32% upside on the date of the price update.

Microsofts growing influence on the market

As Microsoft reaches remarkable market cap heights, second only to Apple, it assumes substantial and growing responsibility within the U.S. market.

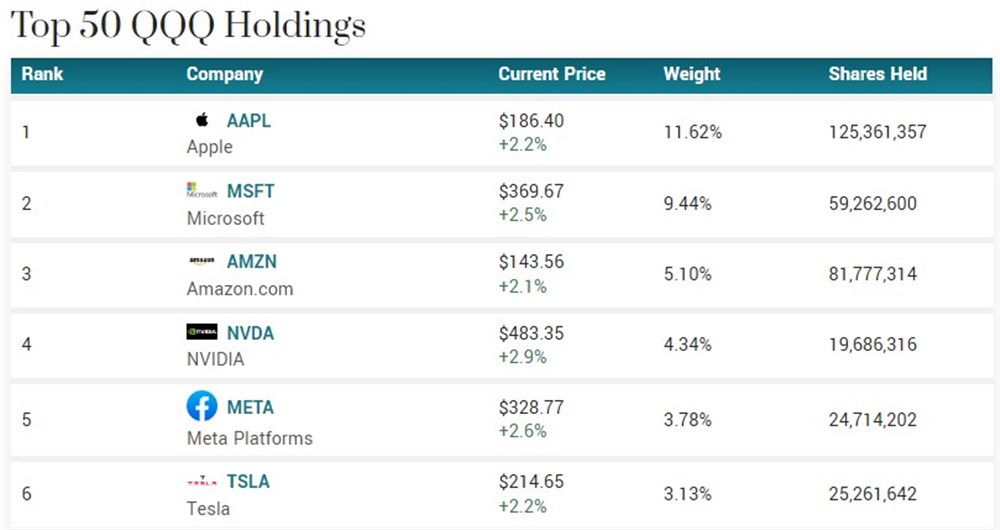

MSFT is now a prominent holding in key ETFs, such as the technology-focused Invesco QQQ NASDAQ: QQQ with nearly 10% weighting and the SPDR S&P 500 ETF NYSE: SPY with a significant 6.53% stake. Observe the image above to grasp the considerable influence of Microsoft and Apple on the entire sector, evident from the concentrated and outlier holding of their stocks within the ETF.

As a result, fluctuations in Microsoft's share price impact not only its investors but also shareholders of the diverse ETFs in which the stock plays a pivotal role.

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.