Microsoft Today

$522.04 +1.20 (+0.23%) As of 08/8/2025 04:00 PM Eastern

- 52-Week Range

- $344.79

▼

$555.45 - Dividend Yield

- 0.64%

- P/E Ratio

- 38.27

- Price Target

- $609.86

Microsoft Corporation NASDAQ: MSFT delivered an earnings report that can be considered a blowout, even for a mega-cap company with high expectations. Microsoft beat on revenue and earnings and reiterated its guidance for data center spending for the remainder of the 2025 calendar year.

Analysts have taken notice.

The Microsoft analyst forecasts on MarketBeat show that nearly two dozen analysts have either reiterated or raised their price target for MSFT stock. Many of the new targets are above the consensus price of $609.86, which is a 15% gain from the stock’s price on August 6.

Why Buying the Best Still Matters

August is a tricky month for investors. Apart from a few names like NVIDIA, the major technology stocks have already reported. The economy continues to give off conflicting signals, and Congress is out on recess, which generally leads to a less active market.

This is a good reminder of why buying the best matters. In the tech sector, that means Microsoft. The company’s stock has been up about 2.8% since the earnings report, but that’s down from the 5% gain it had before a slight pullback this week.

Earnings Drive Stock Price Growth

Earnings reports provide a snapshot of a company’s performance. However, the headline numbers are lagging indicators. In other words, they tell what’s happened in the past. What a company has to say about the current and future quarters can drive up a stock price.

For a mega-cap company like Microsoft, that usually comes down to its earnings outlook. Analysts project Microsoft to post 12.3% earnings growth in the next 12 months. That compares favorably to another mega-cap hyperscaler, Meta Platforms Inc. NASDAQ: META, which analysts project to post 13.15% earnings growth.

That aligns with the company’s guidance for “double-digit earnings growth on a constant currency basis.” However, it also means that analysts are slightly more bullish about earnings expectations for Microsoft, which largely explains the outlook for 15% stock price growth.

Leading the AI Revolution

Microsoft Stock Forecast Today

12-Month Stock Price Forecast:$609.8616.82% UpsideModerate BuyBased on 32 Analyst Ratings | Current Price | $522.04 |

|---|

| High Forecast | $675.00 |

|---|

| Average Forecast | $609.86 |

|---|

| Low Forecast | $475.00 |

|---|

Microsoft Stock Forecast DetailsMicrosoft emphasized that its projected future growth will be driven by continued investment in AI and cloud infrastructure, improving operating leverage, and disciplined expense management.

That aligns with Dan Ives' sentiment. The Wedbush analyst continues to be bullish on the tech sector, specifically the Magnificent Seven stocks that will lead the AI revolution.

Ives and his team believe that the market is not fully appreciating the amount of spending that will be needed over the next three years. Wedbush lists Microsoft, Meta Platforms, NVIDIA, Tesla, and Palantir as its top five tech stocks for the second half of 2025.

That bullish outlook comes with a price target of $625, up from $600. However, Wedbush isn’t the most bullish on MSFT stock. That would be Brent Thill from Jefferies Financial Group. The analyst raised his price target for Microsoft to $675 from $600.

A Cautious Chart That Still Has Momentum

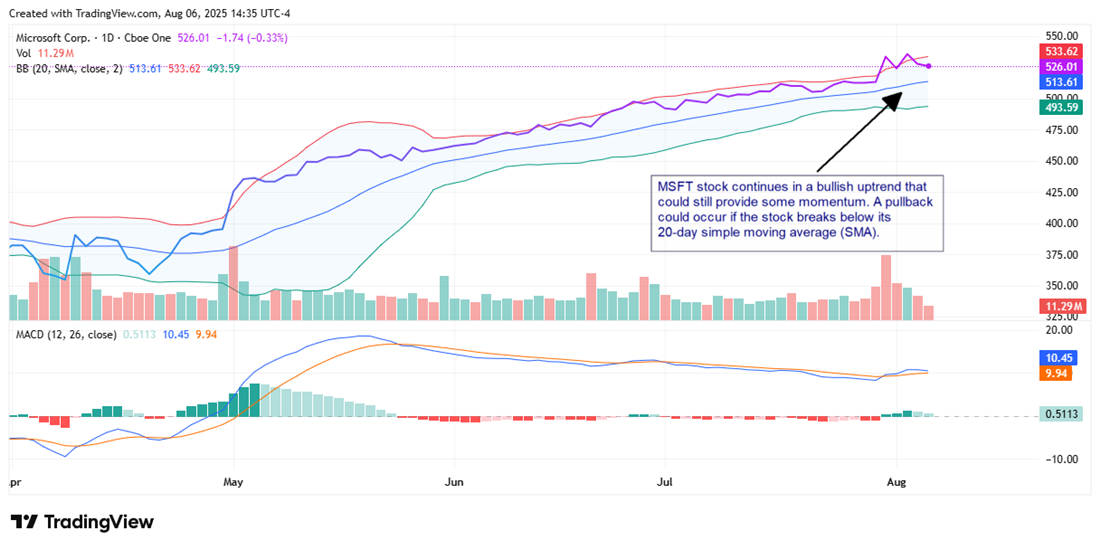

MSFT stock continues to be in a sustained uptrend.

The 20-day simple moving average (SMA), currently around $513.61, is serving as a reliable short-term support level. Price action remains above the 20-day SMA and within the upper range of the Bollinger Bands, signaling strength and proximity to potential overbought conditions.

The MACD (Moving Average Convergence Divergence) shows a slight bullish crossover, with the MACD line (10.45) above the signal line (9.94), suggesting upward momentum could continue. However, there may be limited strength behind the move.

One reason is the relative strength indicator (RSI), which, at 64, suggests that MSFT is approaching overbought territory. However, there may still be room for modest upside before a possible pullback or consolidation.

Another potential short-term concern is lighter volume after the post-earnings surge. That’s not a bearish signal but could signal that momentum is slowing.

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.