The Covid-19 pandemic hasn’t stopped Americans from moving, and that’s benefited

Skyline Champion NYSE: SKY. The Michigan-based company specializes in various categories of manufactured homes, including the currently popular “tiny homes.”

Its product lines also include modular homes, accessory dwelling units (think a guest cottage in the back yard), park-model recreational vehicles, and other modular buildings.

The stock is up 41.76% year-to-date.

The company’s U.S. brands include Skyline Homes, Athens Park Model RVs, Genesis Homes, Champion Home Builders, Dutch Housing, Homes of Merit, Excel Homes, Redman Homes, New Era, Shore Park, Titan Homes and Silvercrest.

It also owns Moduline and SRI Homes in Canada.

Demand for manufactured and modular housing is growing worldwide. North America accounts for two-fifths of the global market.

According to a November 2020 report from Allied Market Research, the worldwide manufactured housing market was valued at $27.18 billion in 2019. That’s expected to grow to $38.84 billion by 2027, a compound annual growth rate of 6.5%.

Stock Gapped Up On Earnings

Skyline Champion is certainly taking part in that growth.

The stock gapped up 12.81% on February 2, following its fiscal third-quarter earnings release.

Earnings were up 19% year-over-year to $0.38 per share. Revenue increased 10% to $377.6 million.

In March, the company acquired ScotBilt Homes, a Georgia-based producer of manufactured homes.

In a statement announcing the deal, Skyline Champion CEO Mark Yost said the company expected the transaction to “generate solid returns with meaningful shareholder value creation from day one.”

In the February earnings call, Yost emphasized that the company had continued to invest in production automation for its factories. It also purchased two idled manufacturing facilities in North Carolina, one of the company’s most robust markets.

Attracting Younger Buyers

The also company announced some good news about its buyers during the earnings call.

Yost said the company is attracting younger purchasers, along with buyers who understand more about manufactured and modular homes in the buying process.

“We're definitely seeing a slightly different demographic of buyers, more millennials buying today,” he said. “We are seeing a more educated buyer, starting to move into our sector, that's looking for kind of an attainable home.”

The company said the number of U.S. factory-built homes sold grew 6.2% to 5,343. The average selling price per U.S. home sold increased 4%, to $63,000.

One headwind could be the high price of lumber, which soared in 2020 and 2021.

Yost addressed that in the earnings call, saying that continued strong demand should help offset high commodity prices, but he expects “a highly inflationary environment for the remainder of the year. Homebuilding demand is up and the supply chain in aggregate throughout the entire year will be challenged to keep up with demand. So I don't expect much relief on the inflationary side, throughout the majority of the year.”

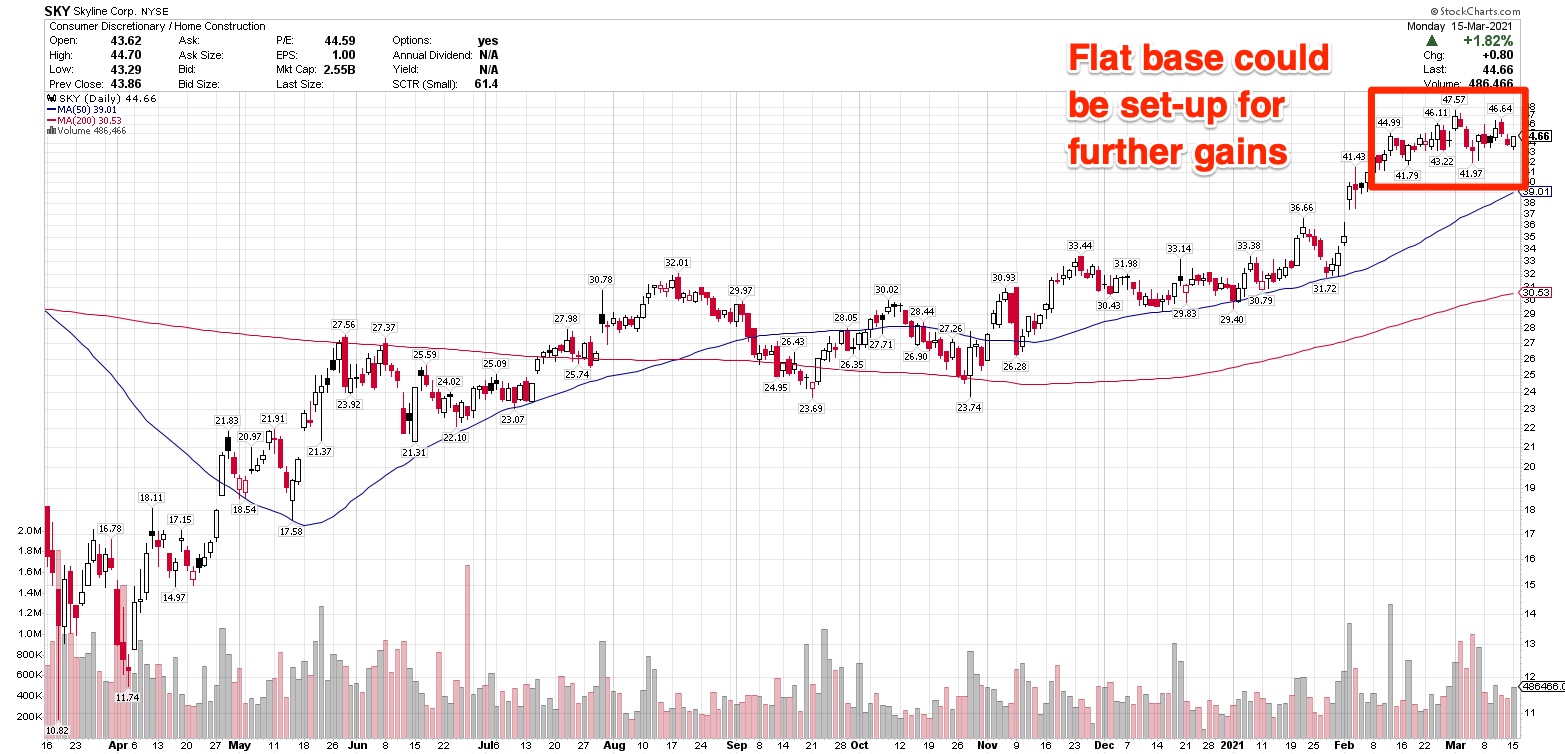

Forming A Flat Base

The stock is trading at new highs. It pulled back following the news of the ScotBilt acquisition, but continues to trend along its 10-day moving average.

It’s been trading in a tight price range for the past several weeks, forming a flat base. That’s a potentially constructive consolidation, as it indicates that institutional owners are holding shares. A flat base can often set the stage for a further price increase.

However, investors should be aware that the stock may be getting a bit extended after nearly a year of trending higher. It didnt’t experienced the explosive growth in 2020 that many techs did, but its one-year return is an impressive 139.21%.

The stock’s market capitalization is $2.53 billion, placing it on the lower end of mid-cap territory.

As such, don’t expect to see the kind of massive institutional ownership you’ll find in a larger stock, but the number of mutual funds owning shares grew in each of the past six quarters. For retail investors, that institutional conviction often signals more price appreciation ahead.

Before you consider Skyline Champion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skyline Champion wasn't on the list.

While Skyline Champion currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report