Monster Beverage

NASDAQ: MNST, formerly known as Hansen’s Natural, is one of the best-performing stocks of the century. Sixteen years ago, shares of the energy drink maker were worth a split-adjusted 10 cents. Now, shares change hands at close to $70 a piece. Monster has increased its revenue by at least 9% every year since 2001 and earnings have gone up each year since 2008.

This track record is incredible, but obviously Monster is not going to 600-700x over the next 15-20 years. But the company’s history indicates that it knows where to find growth and with a reasonable valuation, its intriguing at current levels.

While growth in the US market is beginning to stagnate, Monster should still be able to eke out gains in the coming years domestically. It is the international markets that can make the 2020s another decade of high growth for Monster.

Let’s start by taking a look at Monster’s fundamentals.

Fundamentals

Monster is clearly no stranger to growth and that continued in Q1 2020. Net sales increased by 12.3% yoy to $1.06 billion and net income increased 6.6% yoy to $2.78 million.

Shares trade at around 32x TTM earnings, a reasonable value for a growing company like Monster.

The pandemic has provided a couple of obstacles for Monster.

Manufacturing operations in China were adversely affected by lockdowns in the country. This caused a decrease in Q1 volume in China. But that quickly turned around, with shipments showing an uptick by late March. A potential second-wave could introduce fresh concerns, but Monster should be better prepared if that happens. And Monster’s balance sheet should allow it to weather any short-term disruption, as it has over $900 million in cash and short-term investments to go along with no debt.

In addition to manufacturing, sales have also been hindered by the pandemic. The convenience and gas channels are Monster’s largest on-premise sellers. Foot traffic has been down in these shops, causing a drag on revenue. Fortunately, this decrease seems short-term in nature and Monster’s e-commerce, club store, and grocery businesses have held up nicely.

While its namesake “Monster Energy Drink” is by far its best seller, Monster has dozens of other drinks. These other drinks can be the growth drivers of the future for Monster. In Q1 2020, the company launched several products in the US, including Reign Inferno Thermogenic Fuel, a line of Java Monster 300, and a line of Monster Hydro Super Sport.

In March 2020, Monster launched a Dragon Tea Lemon Tea drink in Brazil. This launch is one small part of a potentially massive international expansion.

International Expansion

In Q1 2020, international sales were $356.8 million, up more than 25% yoy. Foreign revenue accounted for 33.6% of Monster’s total sales, up from 30% in Q1 2019.

The company sees high growth potential in China and India, the two most populated countries in the world. But Monster is also making headway seemingly everywhere else around the world:

- In Japan, Q1 sales increased by 61.7% yoy. In Korea, by 40.6%.

- In Latin America, Q1 sales increased by 29.1% yoy.

- Monster is gaining market share in the Czech Republic, France, Great Britain, Italy, Norway, Poland, Republic of Ireland, South Africa, Spain, and Sweden.

These results would have been even better, but a weaker dollar caused a slight drag on the results.

Nevertheless, Monster has a lot of momentum abroad. As stated earlier, international already comprises over a third of Monster’s sales; a high international growth rate combined with stable or slowly growing domestic sales can lead to high company-wide growth.

Entry Point

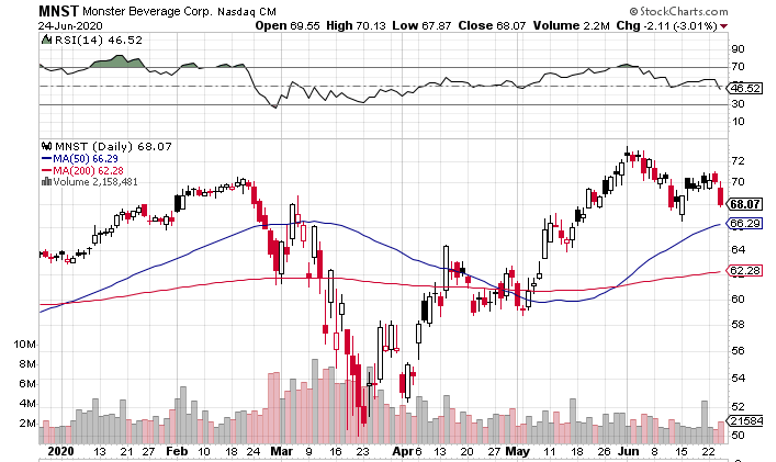

Monster took a deep dive in the early stages of the pandemic, moving from $70 a share to $50 a share in less than a month. It hasn’t exactly had a V-shaped recovery. But over the subsequent two and a half months, it broke above $70, and set a new all-time high.

Monster has been in a pullback since the beginning of June. Volume has been light as shares have retreated towards the 50-day moving average.

You have two potential entry points:

- You can buy if it gets a bit closer to the 50-day moving average. This would mean getting in around $66-66.50. That number is also interesting because it’s a retest of the mid-May breakout point of a two-and-a-half-month base.

- Alternatively, you can wait for the stock to set a new high. Ideally, the stock would move up to the low $70s and consolidate for a few days before breaking out above the old high of $73.43. This way, it wouldn’t be too extended or overbought on the breakout.

Monster is definitely a stock to keep an eye on over the next few trading sessions. It’s hard to pass up an opportunity to buy such a strong and reasonably valued company if it offers a nice entry point.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.